Know your passive income before it arrives

Dividend tracking app to analyze passive income streams in one powerful dashboard. Get complete visibility of future cash flows and confidently plan your path to financial independence.

How to predict dividend yields without a glass ball?

Dividend investing should be predictable. But most tools leave you in the dark. Brokers don't show accurate future projections, spreadsheets become outdated with every market change...and tracking multiple income streams? Nearly impossible with most investment apps that can't handle anything beyond basic stock dividends.

You need a solution that brings all your income streams together. A tool that tracks every revenue source, shows your past performance, and provides accurate forecasts of your future income - turning uncertainty into a clear path to financial freedom.

Complete dividend portfolio tracker

Track dividends & passive income

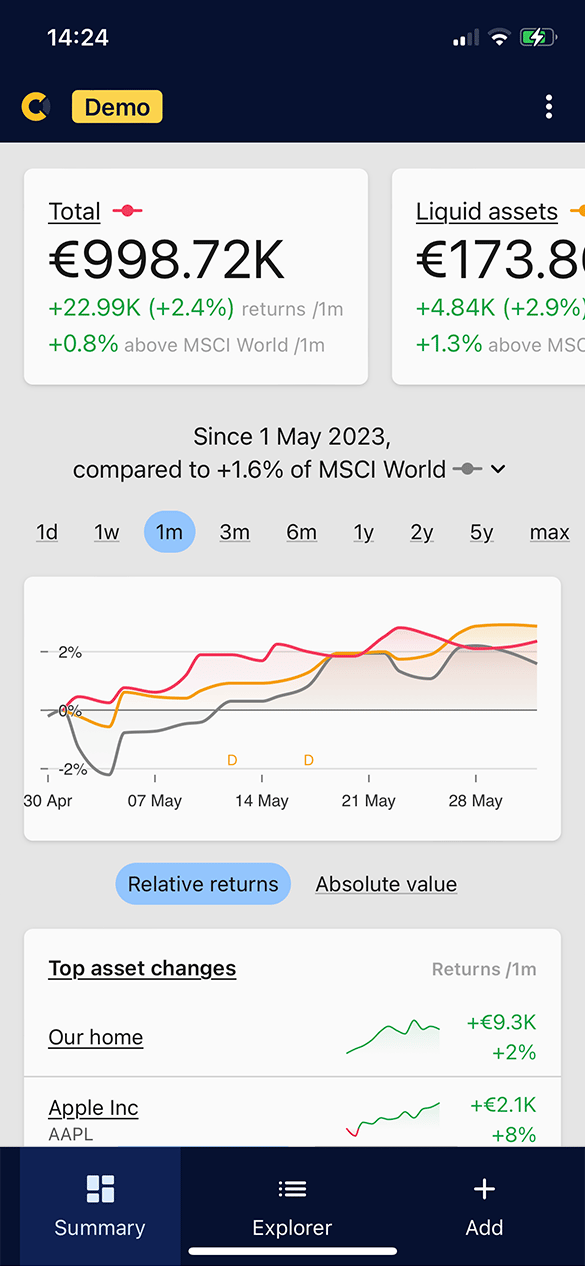

Capitally is the complete portfolio tracking app that shows you exactly what's coming - whether it's next month's dividends, rental income, or annual interest. Get complete picture of your passive income strategy. Find out which assets are your true income champions. Forecast future performance for any timeframe, and visualize your journey to financial freedom better than ever before.

- Track dividends along with withheld tax

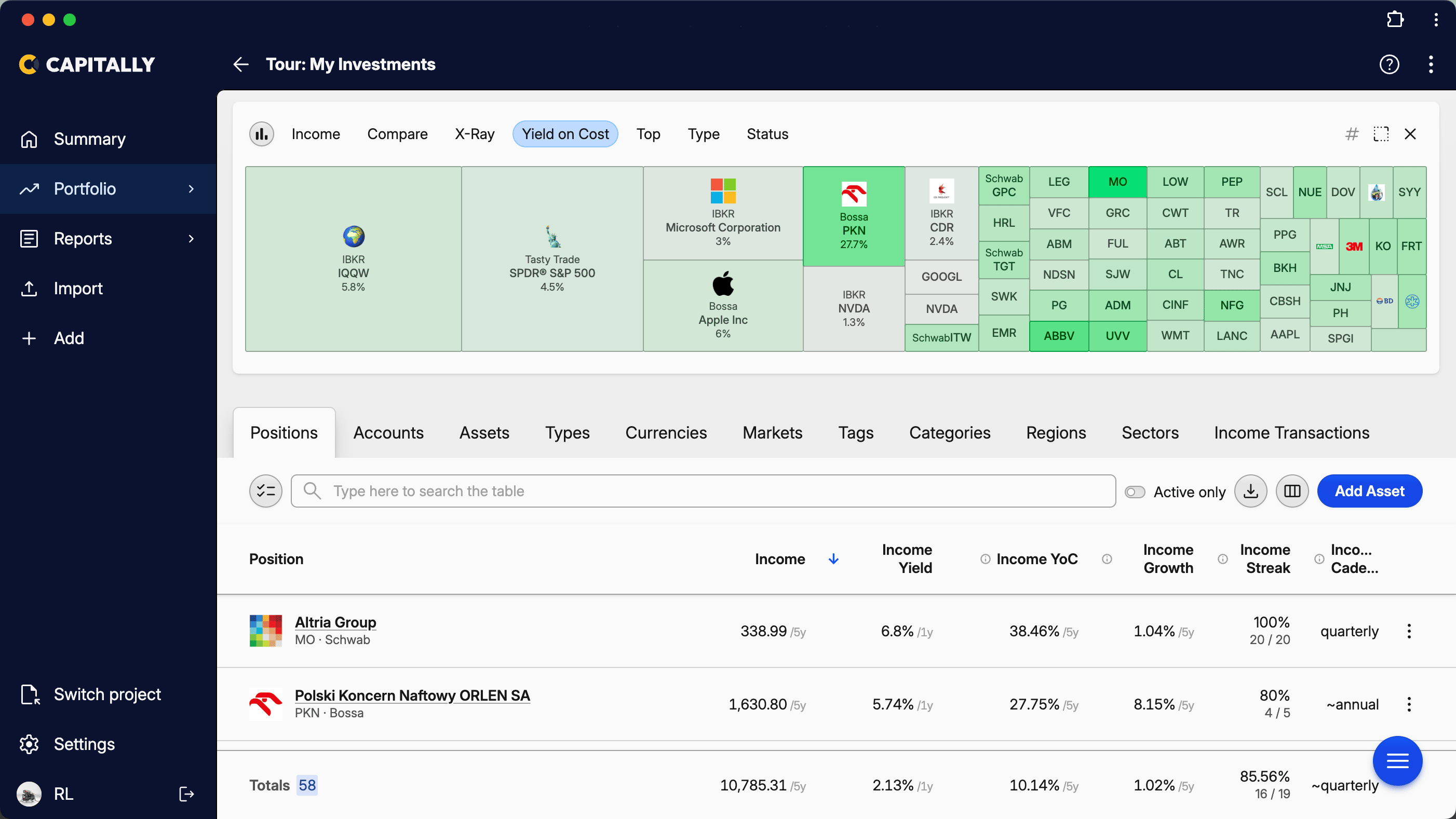

Import exact dividends from your broker, including real withholding tax data. No more manual calculations or checking statements - your actual tax withholdings are preserved exactly as reported.- Make it your dividend portfolio calculatorFind your top money-generating assets by comparing crucial metrics: Dividend Yield, Yield on Cost, and Dividend Growth Rate.

- Measure the exact compounding effect of DRIPTrack both DRIP and dividend paid in stock with precision, calculating exact compounding effects and visualizing your growing income.

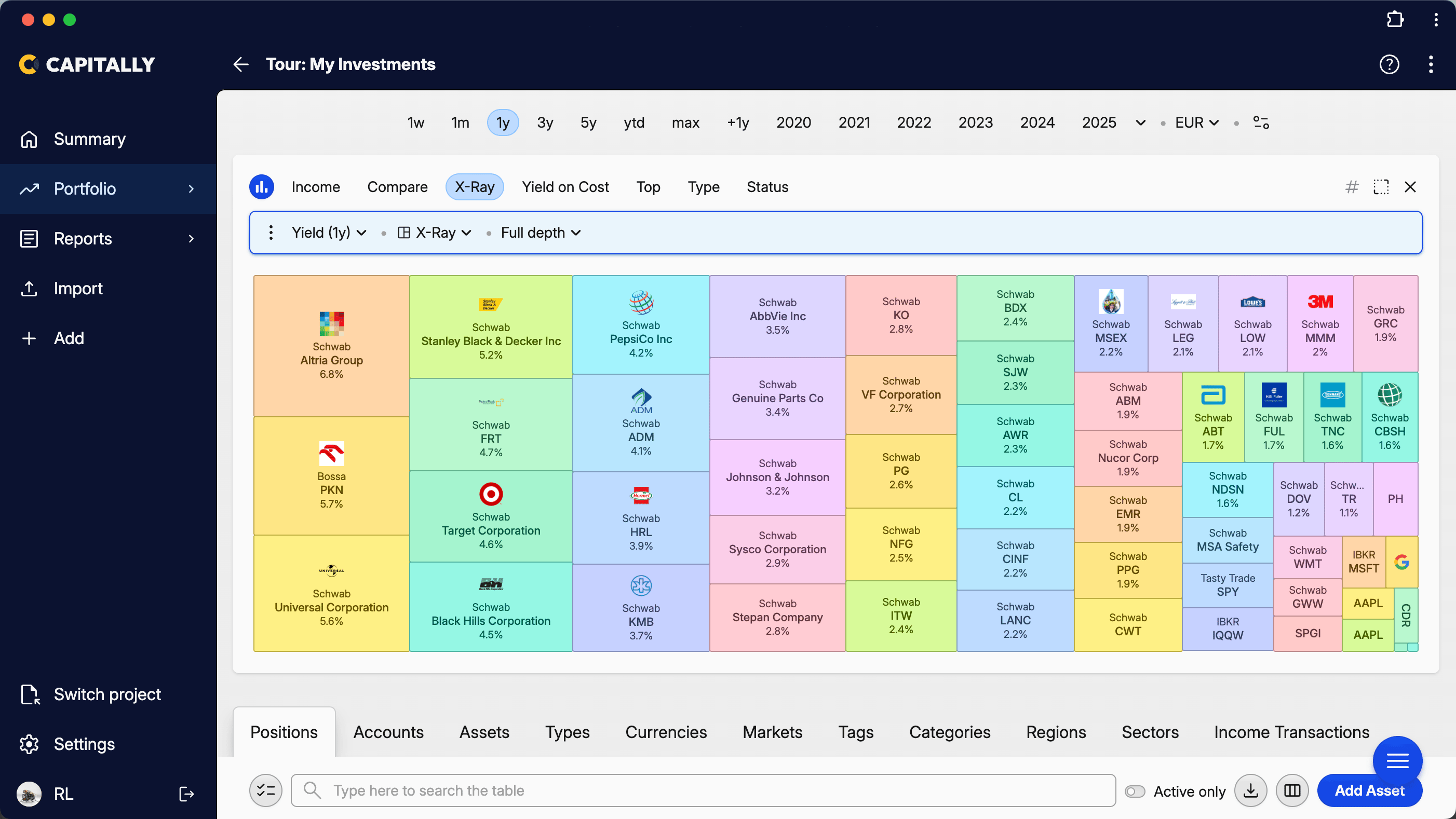

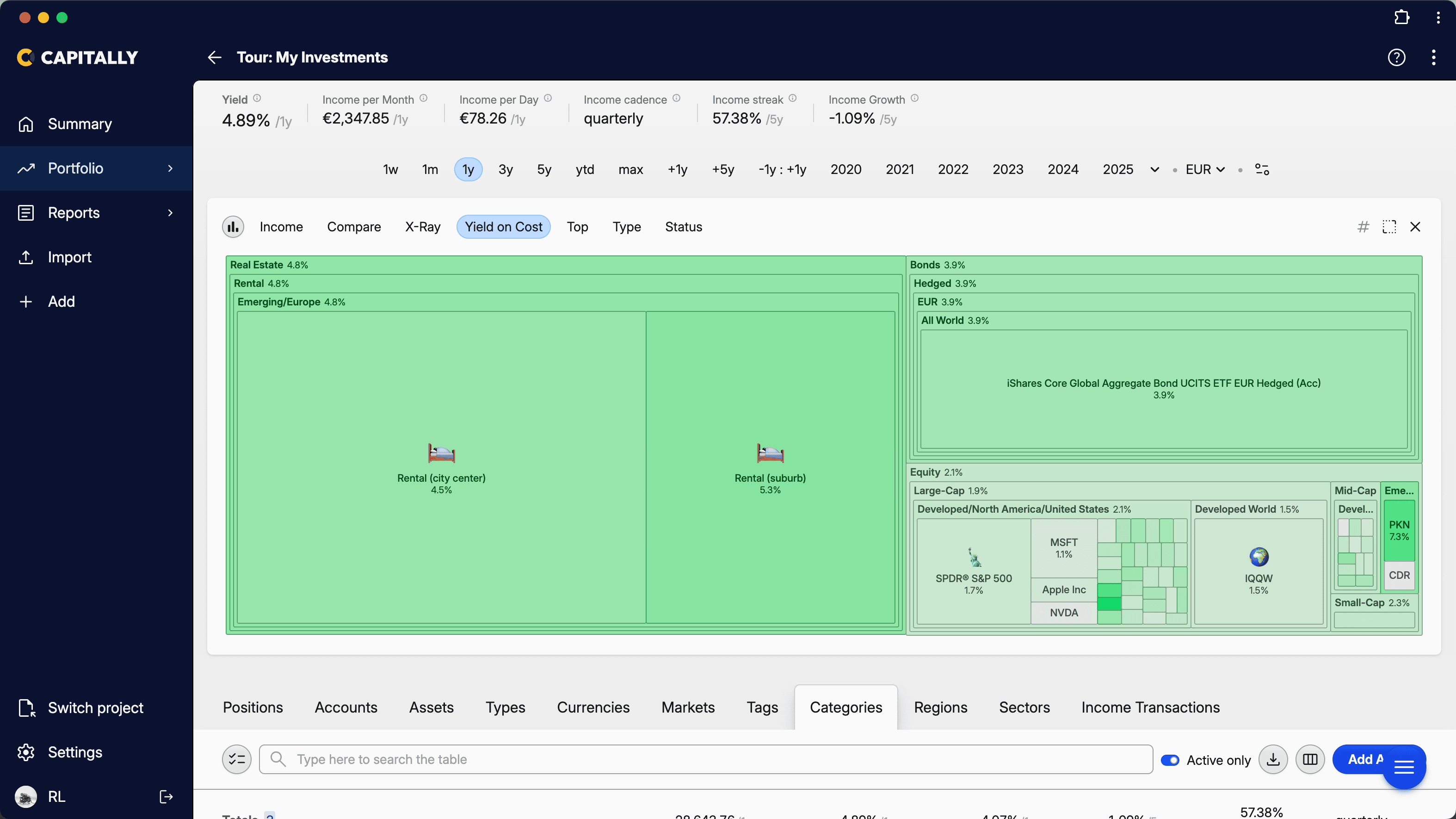

- Identify top income assets on a heatmap

Visualize your own "dividend kings" with an intuitive heat map showing your best-performing income assets.

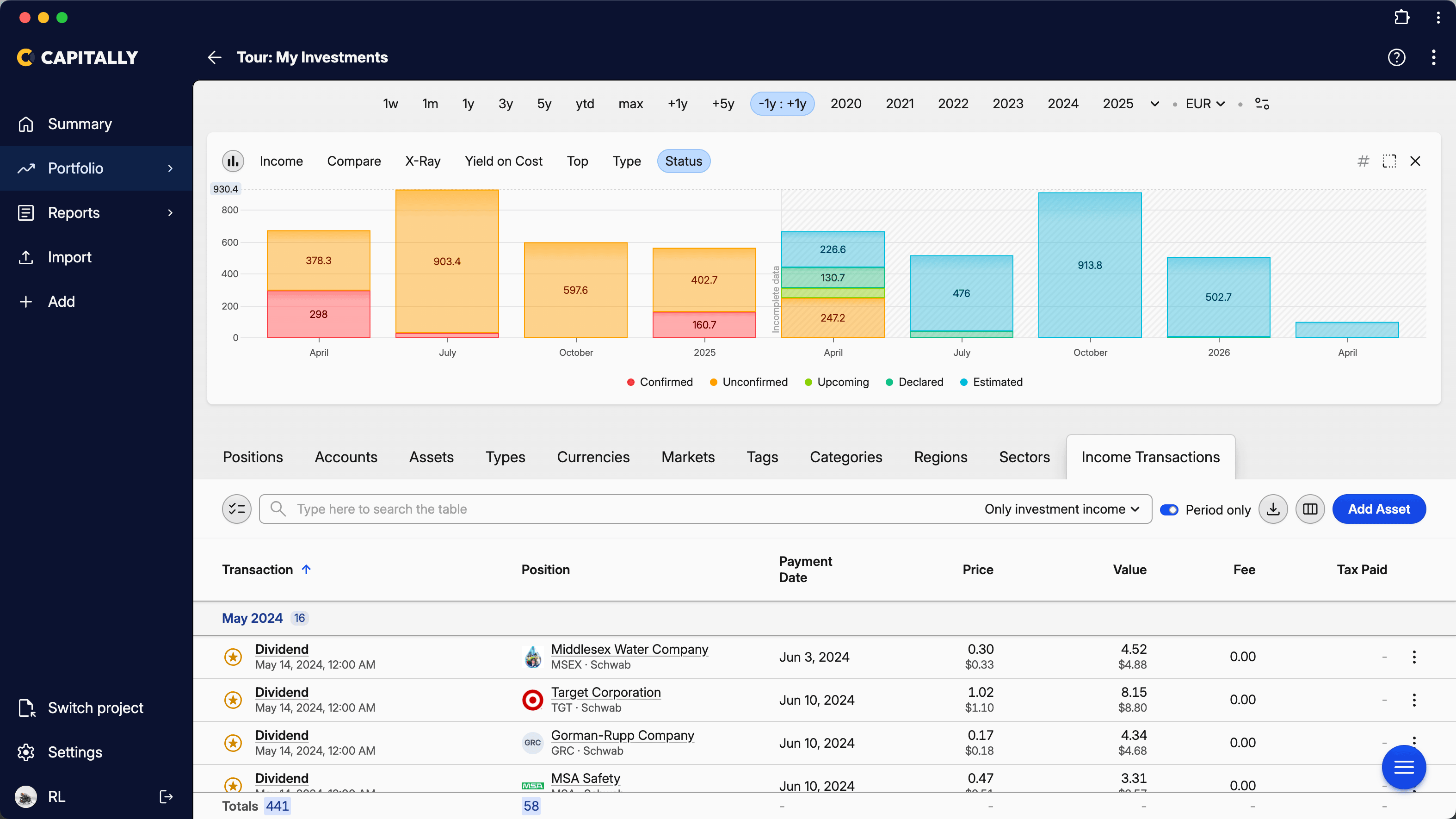

Dividend portfolio calculator

When your portfolio becomes your paycheck?

To make confident decisions, you need clear insight into future cashflows. Capitally helps you visualize how your passive income could grow over time, so you can easily assess when your investments might finally cover your expenses.

Gain complete visibility into your passive income streams and see your path to financial freedom unfold in real-time.

- Dividend CalendarSee upcoming dividend dates and precisile know how much income you can expect each month, quarter, and year.

- Anticipate future dividendsAnticipate future income by viewing announced dividends and smart estimates to project your potential earnings years ahead.

- Visualize your growth potentialVisualize dividend growth patterns (based on 5-year history) to identify opportunities and forecast future income potential.

- Test many strategies. Risk-FreeExperiment and backtest different dividend approaches in separate projects to confidently find your optimal income strategy.

Rent and interest coupons

Go beyond dividends!

Modern income investors rarely rely on dividends alone. That's why Capitally treats every income stream with equal importance - whether it's rental income from properties, interest from bonds, returns from P2P lending, or staking rewards from crypto. See all your passive income sources side by side, compare their true yields, and understand which ones drive you on your way to financial freedom.

- Monitor all income sourcesEasily track diverse income streams (rent, bonds, P2P, crypto staking) to consolidate all your passive income in one clear view.

- Compare yields across all assetsCompare true yields across all assets (stocks, real estate, bonds) using standardized metrics to stop guessing and definitively know which investments perform best.

- See full income pictureView your passive income combined from all your investments to get a unified picture of your total cash flow.

- Spot and optimize top earnersDiscover which assets deliver the highest returns with standardized income growth tracking; visualize 5-year growth patterns across stocks, real estate, and alternatives in one view to precisely optimize your portfolio.

The only portfolio tracker where your data is only yours

We take your privacy seriously. In fact, we can't see your data, and neither can anyone else.

- Your financial data is end-to-end encrypted

- This is in addition to the standard security measures

- Hosted in Europe on Google Cloud Platform

- No 3rd-parties, no trackers, no ads, no upselling

- All your data is synced to your device

- You can import and export everything at any time

And it's much more than that!

- 🌈All types of assetsEasily track wealth across multiple asset classes – Stocks, ETFs, Crypto, Bonds, Real-estate, Art, Ventures, or any other custom asset.

- 📥Import from anywhereImport from dozens of brokers, or your own spreadsheets. All transactions or just balances.

- 💶Multiple currenciesTrack and view assets in any currency. See capital & currency returns separately.

- 🧠Deep portfolio analysisDetailed portfolio metrics, like MWR, TWR, ROI, Dividend Yield, Yield on Cost, etc.

- 🏆Advanced benchmarksCompare your results with indexes, ETFs, custom assets or any part of your portfolio

- 🌎Exposure analysisSee your exposure to regions, industry sectors, and investment categories.

- 💰Dividend trackerTrack dividends, rent, interest or any other investment income. Complete with DRIP support and metrics.

- 🔮Income calendar & estimatesSee upcoming dividends or rent payments and estimate them years ahead.

- 🏦Liabilities, bonds and depositsModel mortgage payments, bond interest or P2P loans with dynamic terms and rates.

- 🤹Stock options trackerTrack stock options alongside the rest of your portfolio.

- 🛟Short positions and marginTrack short positions and sold options along with their margin requirements.

- 🏛️Capital gains taxesInclude taxes in your returns, do tax-loss harvesting and calculate your tax obligations at year's end.

- 🏷️Organize & filter your wayNest accounts, tag transactions, categorize assets. Then filter and group them however you need.

- 💄Extensive customizationCreate your own charts, filters, date periods, tables, importers, tax presets or even menus.

- 🧪Test investment scenariosCreate "what-if" projects to experiment with different strategies risk-free.

- 🥷On-device encryptionKeep data private with industry-leading encryption (literally the only tool to do that).

- 🚫No ads or 3rd-party trackersComplete privacy with no data sharing, unlike most investment platforms.

- 📱Fully-featured mobile accessTrack your investments on the go, on multiple devices at once. Even offline.

Created for people just like you

"Capitally is an absolutely great tool that allows you to grasp all your investments at a glance, thanks to its clear and well-designed appearance. At the same time, it provides practically unlimited possibilities for exploring data. The whole thing works equally well on a computer and a phone. As a user, I can count on excellent support (thank you!). I also like the pace of development and the features being added - since I purchased the license, the ability to calculate tax liabilities has been introduced, and I also have an early version of options support - something no other solution I know of offers. I definitely recommend it!"

Michał Szafrański

Bestselling author of "Finansowy Ninja"

"I'm really impressed by the quality and versatility of the app. I like that I can customize almost anything. I wanted to have a view of all of my family's assets in one place and the possibility to filter and organize data in any way I want, which is fantastic with the tags. The features that I love the most are the tags, the IRR data, the filtering capabilities and the X-Ray graph."

Boris

Canada

"I just wanted to share how brilliant your tool is for managing investments. It is so comprehensively thought-through and the ease with which it can be used is admirable. I used to actively manage my investments via Excel, but this helps to save a lot of time and effort. I'm very impressed!"

Kunal Parwani

Singapore

"I started building something similar for myself as a combination of Python + Excel and I came to the conclusion that it would be more economical to choose a ready-made option"

Tomasz Onyszko

@tonyszko

"Capitally is an excellent tool that provides a complete overview of all our assets, including real-time stocks, real estate, and private equity. It saves us a lot of time and effort compared to manually keeping track of everything. It's user-friendly and intuitive, with a fantastic support team that is always ready to assist. We highly recommend it to anyone looking for an efficient way to manage their investments."

F3 Capital

Investment Fund

"I like the simple UI, the DeGiro import worked pretty well, and I can track everything in my portfolio properly. Dividends and broker cost tracking work well, too."

Jamie Schembri

Netherlands

"I spent 4 years building my 16MB Excel spreadsheet for portfolio tracking. In just two evenings with Capitally, I replicated everything and got even better analytics! The data visualization is incredible - slice and dice however you want. But what really blew me away was when the developer fixed an issue before I even reported it. This is next-level software and support! 😂"

TomeK Karczewski

Poland

"The game changer that Capitally brings is that it has a very high degree of customization when it comes to selecting assets and recording transactions. For me the differentiator is the ability to record transactions in a currency that differs from the asset currency. My investment portfolio spans multiple global markets and accounts and normal portfolio tracking tools just don't recognize the fact that I may be purchasing a given equity in more than one currency in different accounts."

Stuart Davidson

USA

"I tried Portfolio Performance, but quit it multiple times because of errors in currency handling, importing is too clunky and error-prone in general and there’s a lack of automatic adjustments for dividends and splits. Capitally does all these things right and the reporting is visually nice and quick."

Andries Zwikstra

Netherlands

"Really pleased to be part of Capitally’s clients! Love the fact that it brings so many functionalities within an efficient interface. Every time I think of something I'd like to do or a piece of data I'd like to have, I always find a way to get it. It's amazing! I’ve also added a shortcut on my iPhone’s home screen, so I can easily access all my data even when I’m away from home. Perfect!"

Frank

France

All-inclusive Pricing

Frequently Asked Questions

If you don’t use Capitally for tax reporting, you don’t need to import dividends from your broker - you can do it just once a year or whenever you prefer.

If you want to settle your tax with Capitally, first you need to upload a list of dividend companies you own. Then all dividends will be automatically added to your portfolio based on market data. If you prefer, you can enter them manually. Then the manual records will override the automatic one, so don’t worry about duplicates.

Yes! You can track dividends from international stocks and funds just like any others. Also you can manually enter or import any tax withheld at the source directly from your broker’s data.

Capitally calculates future dividend projections using the last 5 years of dividend payments for publicly traded instruments (regardless of whether you held them the whole time). For custom assets, we use the last 5 years of data you’ve entered. The next expected dividend amount is calculated as the last dividend paid multiplied by the average growth rate over the last 5 years.

Currently, there’s no such option. Check our roadmap to see if this is planned for a future update!

Yes. Just add a manual transaction and select the type: dividend, rent, or interest. This way, you can track any kind of passive income stream, even if it’s unconventional.

We don't sell or analyze your financial data or behavioral patterns. Our focus is solely on delivering the best user experience, which involves analyzing the general adoption of features and application performance, all in accordance with our Privacy Policy.

In fact, your financial data is encrypted on your device using a private key that's derived from your password. This means that only you can decrypt this information. Neither we nor anyone else can access this data, even if we wanted to.

This ensures that even in the unlikely event of a security breach or if one of our contractors acts inappropriately, the data that could potentially be extracted from our systems would be useless. This is a level of security that sets us apart from our competitors.

Additionally, we adhere to industry-standard security best practices:

We utilize a trusted computing platform (Google Cloud).

All server communications are encrypted with HTTPS.

All data is encrypted at rest.

Access to data is granted on a need-to-know basis and is logged.

We implement robust security measures to keep our systems secure.

For a more detailed explanation of our encryption mechanism, please refer to our security guide.

In the app, you’ll see a list of all upcoming dividend payments for your holdings, including expected dates and amounts.

Yes! With the Navigator Plan, you can create additional Test Projects, and within each project you can set up multiple Accounts to simulate different dividend strategies. You can then compare these Accounts side by side on a single chart to evaluate how each strategy performs over time.

Please note: it's not possible to compare different Test Projects directly – comparisons are only available between Accounts within the same project. and only with Navigator Plan.

What are you waiting for? Start optimizing your investments today

- Works great on a desktop or laptop

- Fully featured on mobile

- Add to home screen for quick access and security