After weeks of rewriting underlying components of our performance calculation engine, we're proud to present the first feature built on top of it - liabilities!

There are two new asset types - Loan and Mortgage, but generally any asset can be a liability by having a negative balance. You can choose one of the following:

Buy with a negative quantity (and then sell with negative quantity to close it),

Sell before you Buy (a.k.a. Short sell),

Set a negative balance with Account Balance.

You can also sell more than you own and vice versa - account balances of any asset can simply go both ways.

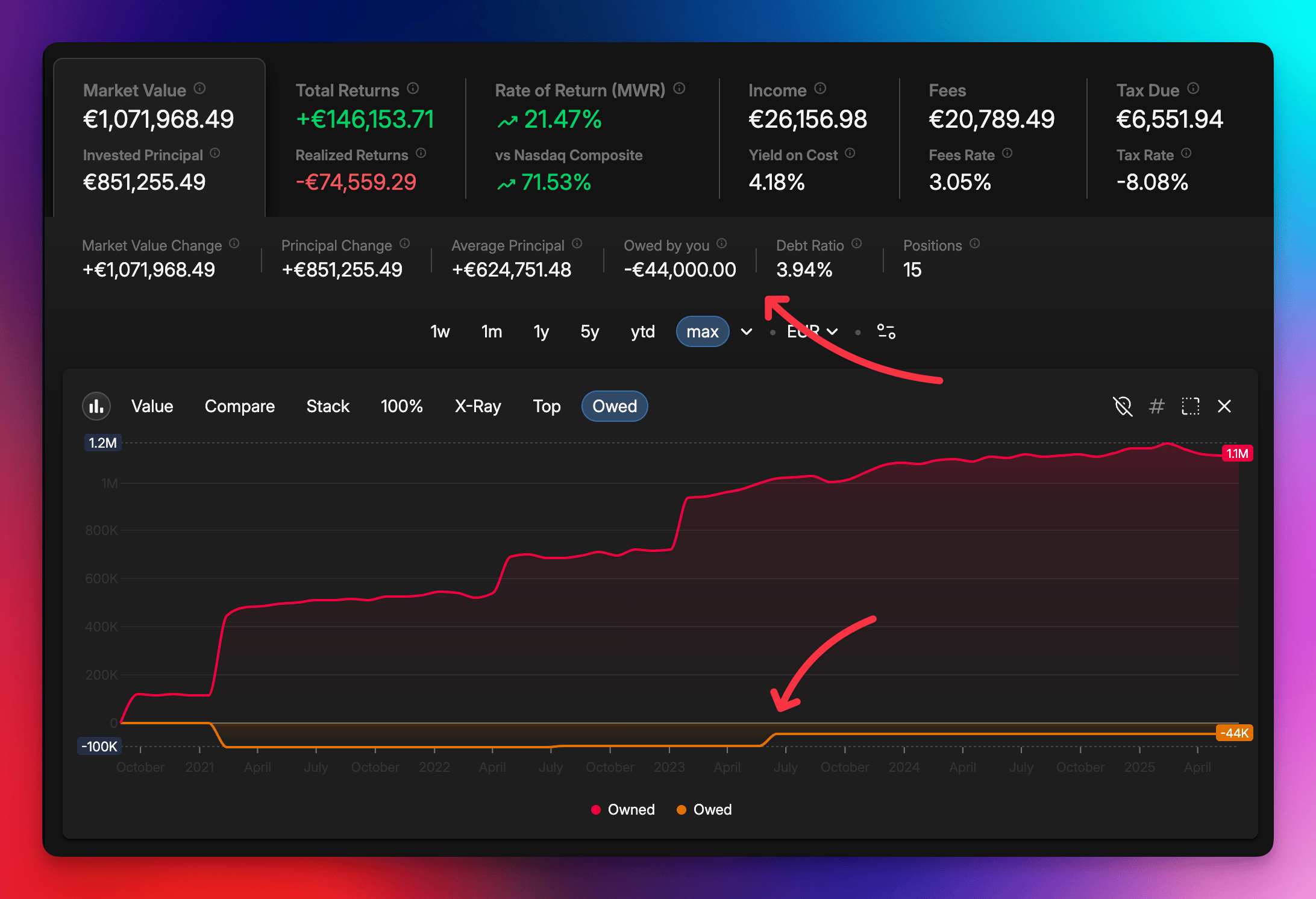

To control that, there are three new metrics: Owned, Owed and Debt Ratio. You can filter out positions with any debt, or just the units when position went under water (or above). Finally, there's an Owed chart under Market Value which shows both sides at the same time.

There's more!

Big projects should now be more responsive (as calculations can be up to 6x faster now).

There are two new filters that match the whole position - Position is opened and Position has income. Their old counterparts that match at the unit/lot level are now Unit closed date and Unit has Transaction Type.

Interest and Rent value can now be negative (both to capture negative interest on a loan, or interest corrections).

ROI and Fees Rate should capture fees and taxes more accurately, especially on negative positions.

Returns Attribution should now be more accurate.

Dark/Light theme switch in the top-right menu.