Capitally just became the first wealth tracker with truly comprehensive interest-bearing asset support!

You can automatically calculate interest accruals, payments, and principal repayments for everything from government bonds, deposits, margin accounts, mortgages to peer-to-peer loans - all based on the exact terms you specify.

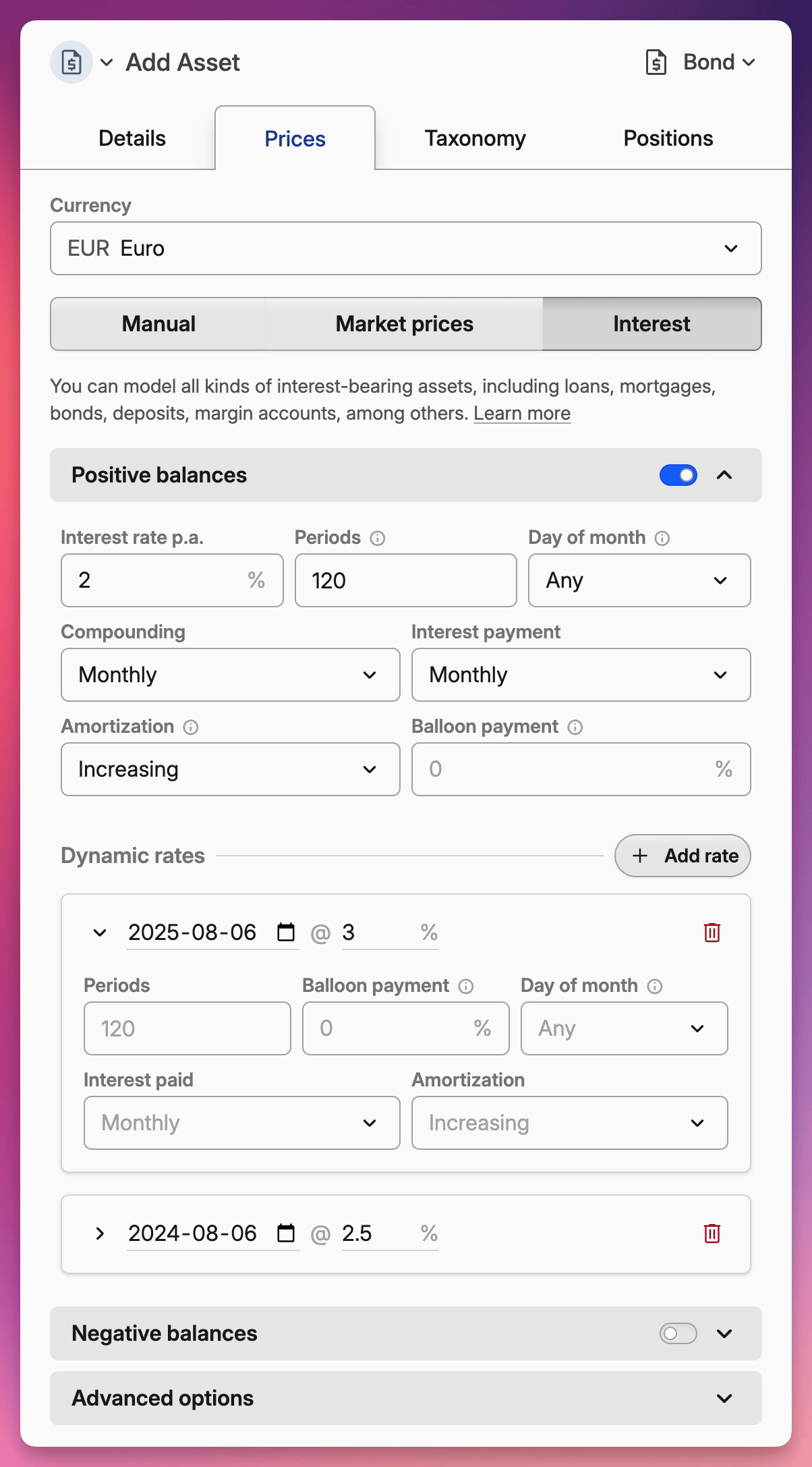

There are LOTS of options to cover all kinds of assets and liabilites

There are LOTS of options to cover all kinds of assets and liabilites

Automatic interest calculations – Set your interest rate, compounding frequency, and payment schedule once. Capitally generates all future cash flows automatically, eliminating manual entries for each coupon payment or loan installment.

Both sides of the balance sheet – Track assets that earn interest (bonds, CDs, savings accounts) and liabilities that cost you interest (mortgages, loans, overdrafts). Each side gets independent rates and terms, so your checking account can earn 0.5% on positive balances while charging 15% on overdrafts.

Real-world complexity made simple – Adjustable-rate mortgages? Promotional credit card rates? Bonds with balloon payments? Add rate overrides on specific dates to model exactly how your assets behave. You can even simulate payment holidays or early repayments.

Professional-grade accuracy – Choose from different day count conventions (Actual/Actual, 30E/360) to match your bond's prospectus. Set custom amortization schedules. Round coupon payments to match real-world precision.

Built-in scenario planning – Test how rate changes affect your portfolio value or compare refinancing options before pulling the trigger. See the impact of making extra principal payments or extending your loan term.

Built-in support for Polish government bonds – A long requested feature, just search for the bond's name or use the new importer to have them automated.

The feature integrates seamlessly with your existing data - imported interest transactions are automatically detected and won't create duplicates. You'll find the new pricing method when adding or editing any asset.

This has been brewing in early access for weeks, and we're thrilled to finally release it to everyone. Thanks to all the early-access users who helped us nail down the calculations and polish the experience.

Interest calculations involve complex variables and different calculation conventions. While we've worked hard to ensure accuracy, always verify important calculations against your official documents.