Automatic tax withholding on income transactions

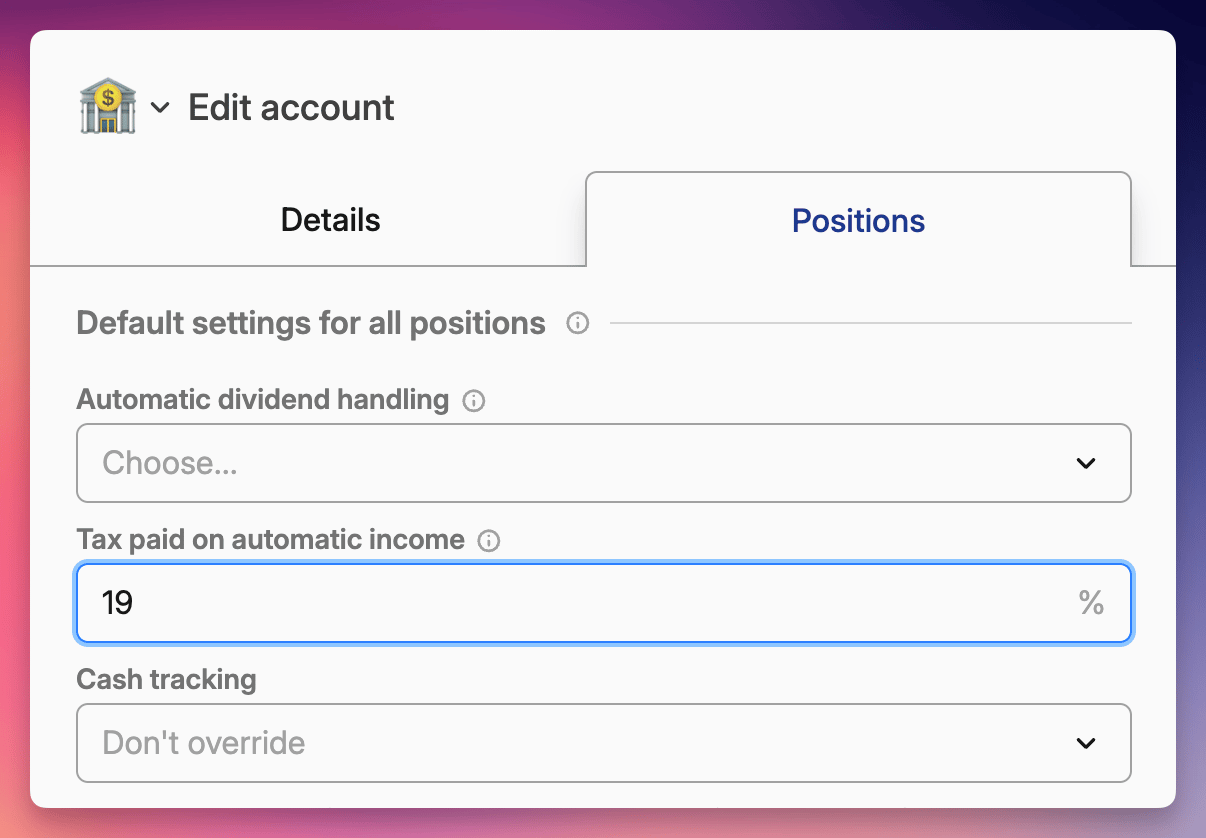

You can now configure automatic tax withholding percentages for dividends and interest payments that Capitally generates for you.

Set your tax rate at any level that makes sense for your situation:

Account level - applies to all positions in that account

Asset level - specific rate for a particular stock or bond

Individual position - override for a single holding

To configure this, edit your account or asset, navigate to the Positions tab, and enter the tax paid percentage that your broker typically applies. From now on, all automatically generated income transactions will include the correct tax withheld amount.

This feature only affects transactions that Capitally creates automatically - it won't modify transactions you import from your broker, ensuring your actual broker data remains unchanged.

Important distinction: Tax withheld (deducted at source by your broker) is different from tax due (what you'll need to pay to tax authorities later). This feature handles the former.

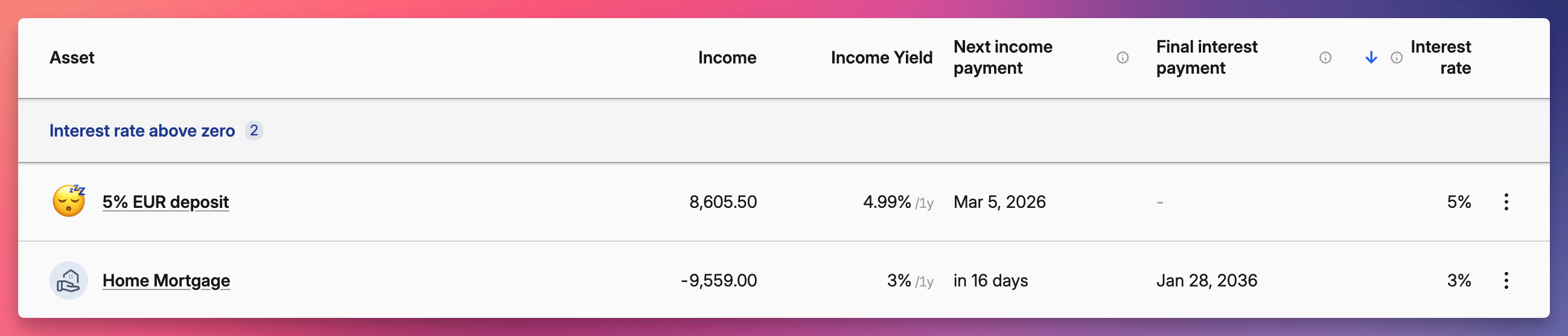

New income tracking columns

We've added three helpful columns to give you better visibility into your income streams. You can now enable these in both the Positions and Assets tabs:

Next income payment - see when your next dividend or interest payment is expected

Final interest payment - track the maturity date for bonds and fixed-income investments

Current interest rate - monitor the yield on your interest-bearing assets