Stock Options

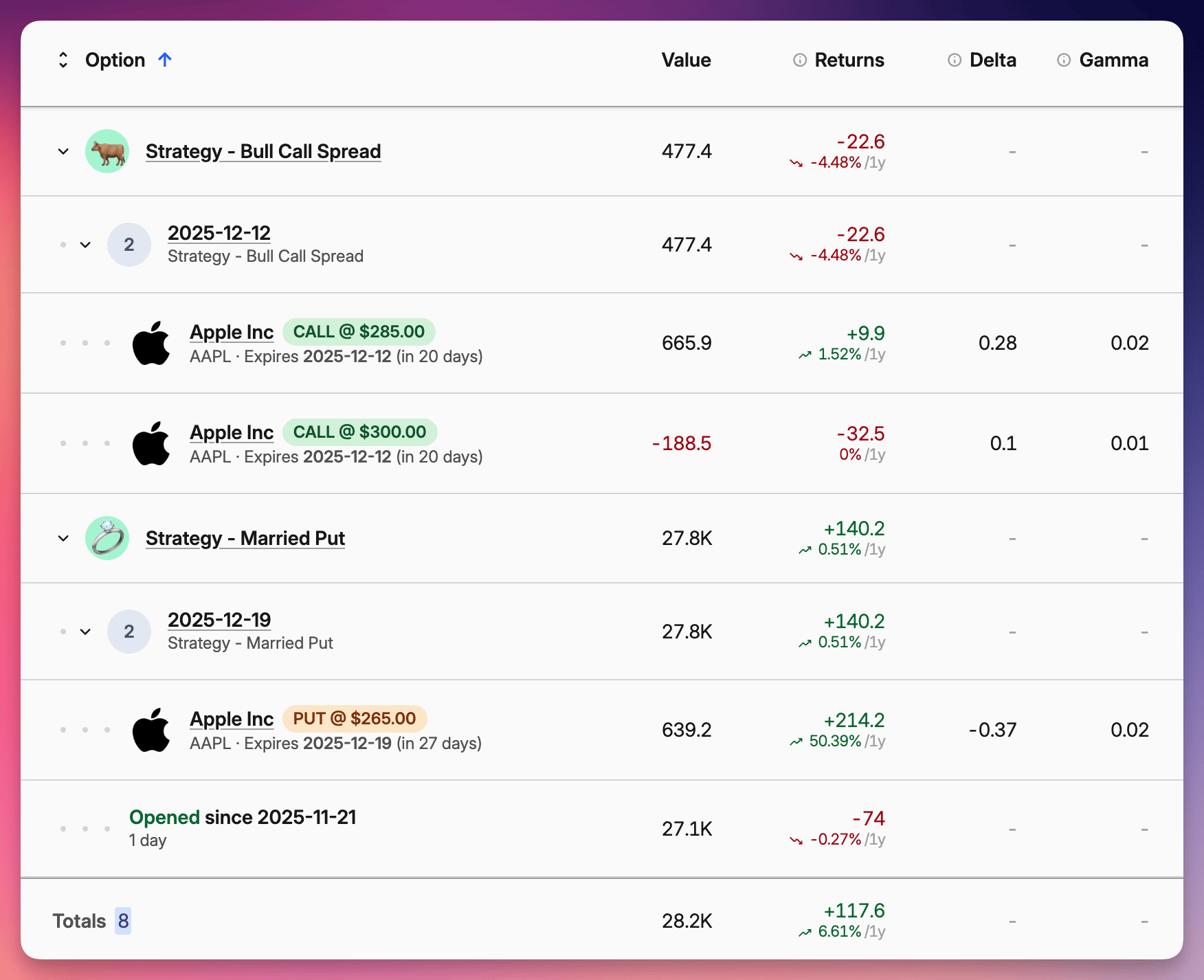

You can now import options directly from Interactive Brokers or add them manually, using any asset as the underlying. We automatically calculate their fair price using Black-Scholes-Merton (European) or Barone-Adesi-Whaley (American) models. Their performance along with relevant greeks is displayed in an all new Options tab.

If you trade strategies, Capitally will bundle multiple legs together under a single Lot Group - a new feature applicable not only to options. You can analyze the strategy as a whole or dig into individual components.

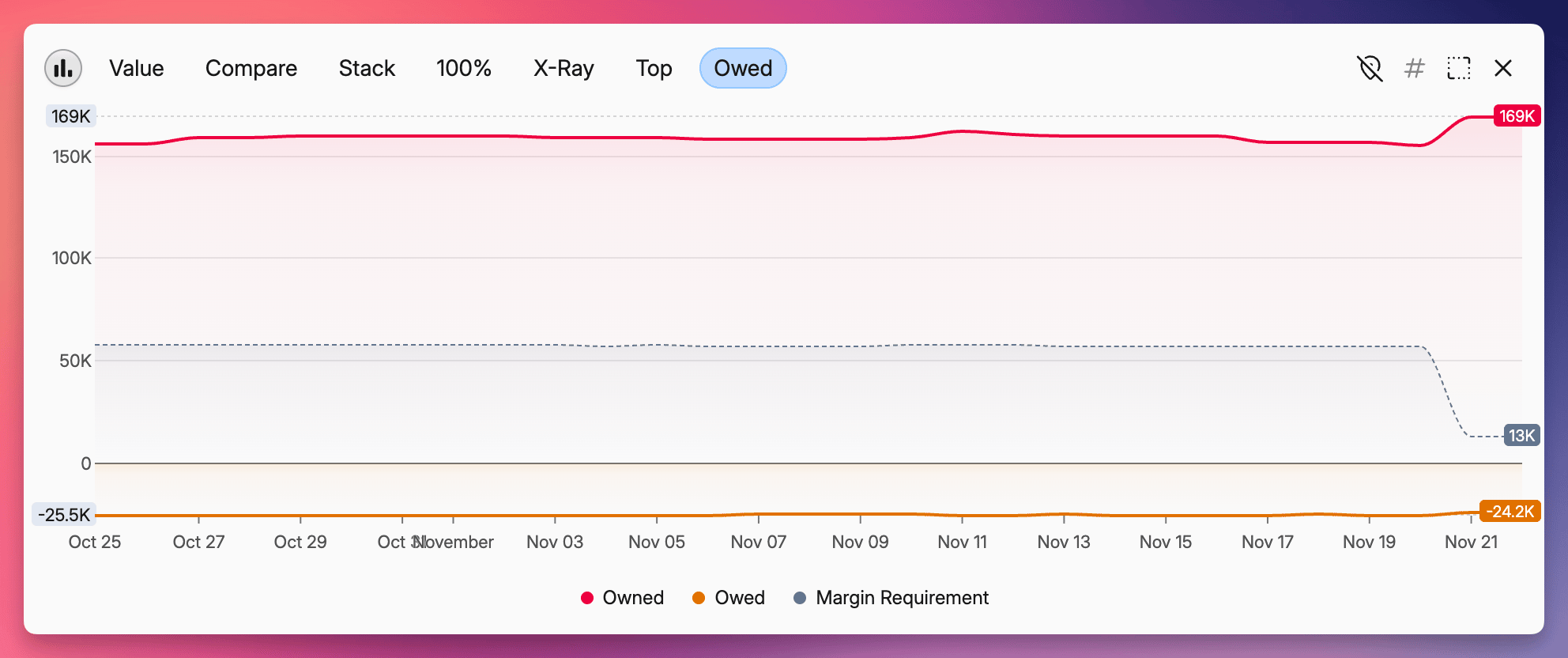

Margin Requirements

When shorting stocks or options, visualization is a helpful safety tool. You can now check your margin requirements right on the Owed chart. It will display a dotted line indicating the minimum assets required on your account to avoid a margin call, helping you keep an eye on your safety buffer.

Value-based Asset Pricing

Sometimes you invest in a "black box" - like a wealth manager or a private fund - where you only know how much cash you put in or out and the current total value (NAV), but not the specific share price or underlying assets.

By enabling Value pricing on an asset, you can just enter the cash flows as Transfers and the current Net Asset Value by updating the Account Balance. We take care of calculating the true performance metrics from these data points. You can enter these by hand, or via a new custom import template called Account Cashflows.

New Captain Plan

These advanced features are available on our legacy Founders plan and the new Captain plan (€250/year). This tier is built for complex wealth management, with unlimited projects and support for Private Equity tracking is coming soon.