TL;DR

Kubera offers automated (if you share financial credentials with third-party integrations), very simplified wealth tracking, and costs a whopping $2,499/year for the top-tier with "Concierge Onboarding" and VIP support.

Capitally provides superior privacy through on-device encryption, handles diverse assets better, and let's you do actual portfolio analysis and tax optimizations for €130/year.

- Choose Kubera for automated convenience;

- Choose Capitally for privacy and comprehensive tracking of complex portfolios.

Table of Contents

- TL;DR

- Is Kubera safe? Understanding data privacy concerns

- Tracking diversified portfolios and asset classes

- Managing multiple portfolios and complex structures

- Data import and historical tracking

- Reporting capabilities of both wealth trackers

- Dividend and passive income tracking

- Multi-currency

- Pricing analysis

- Making the right choice

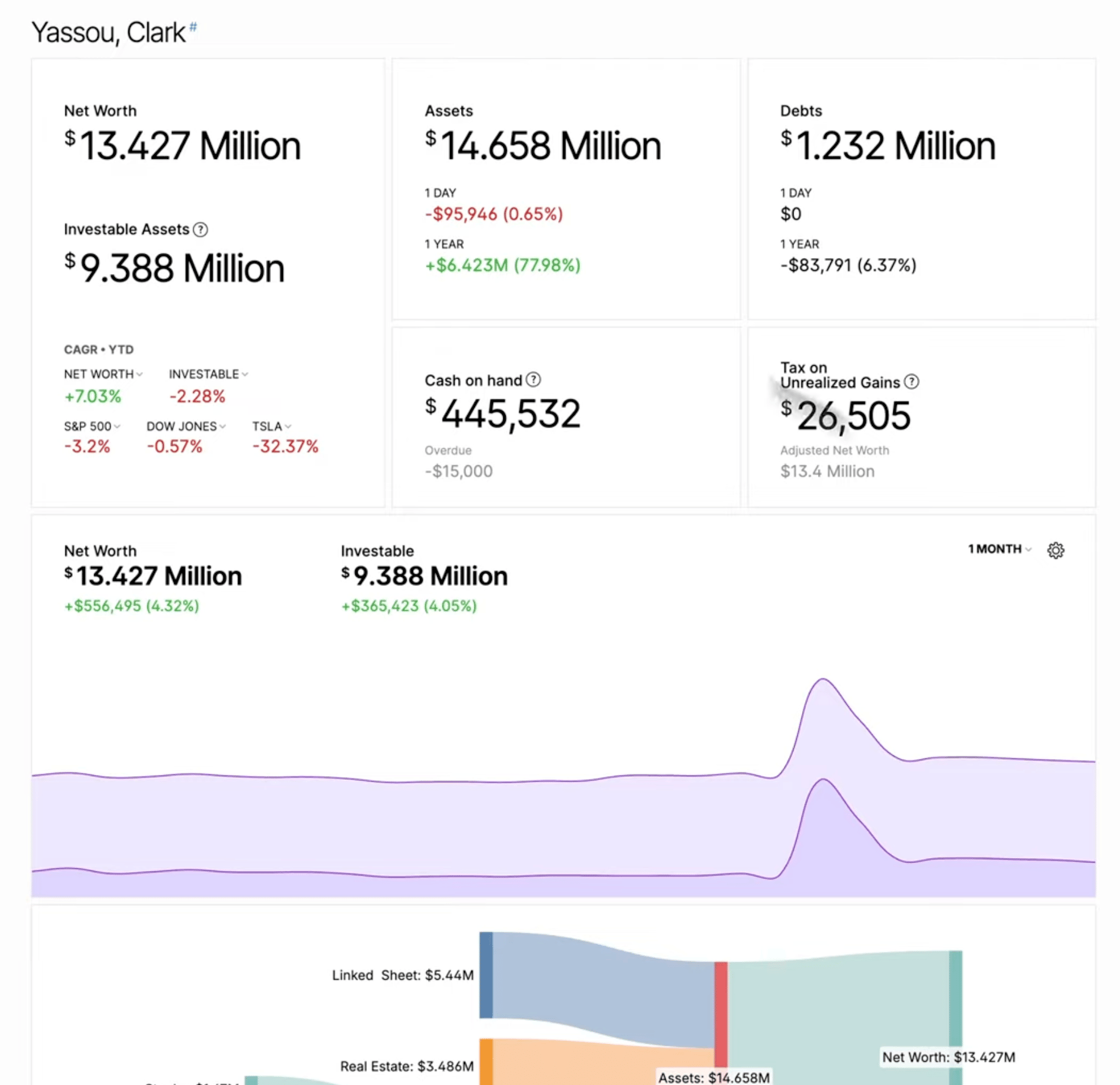

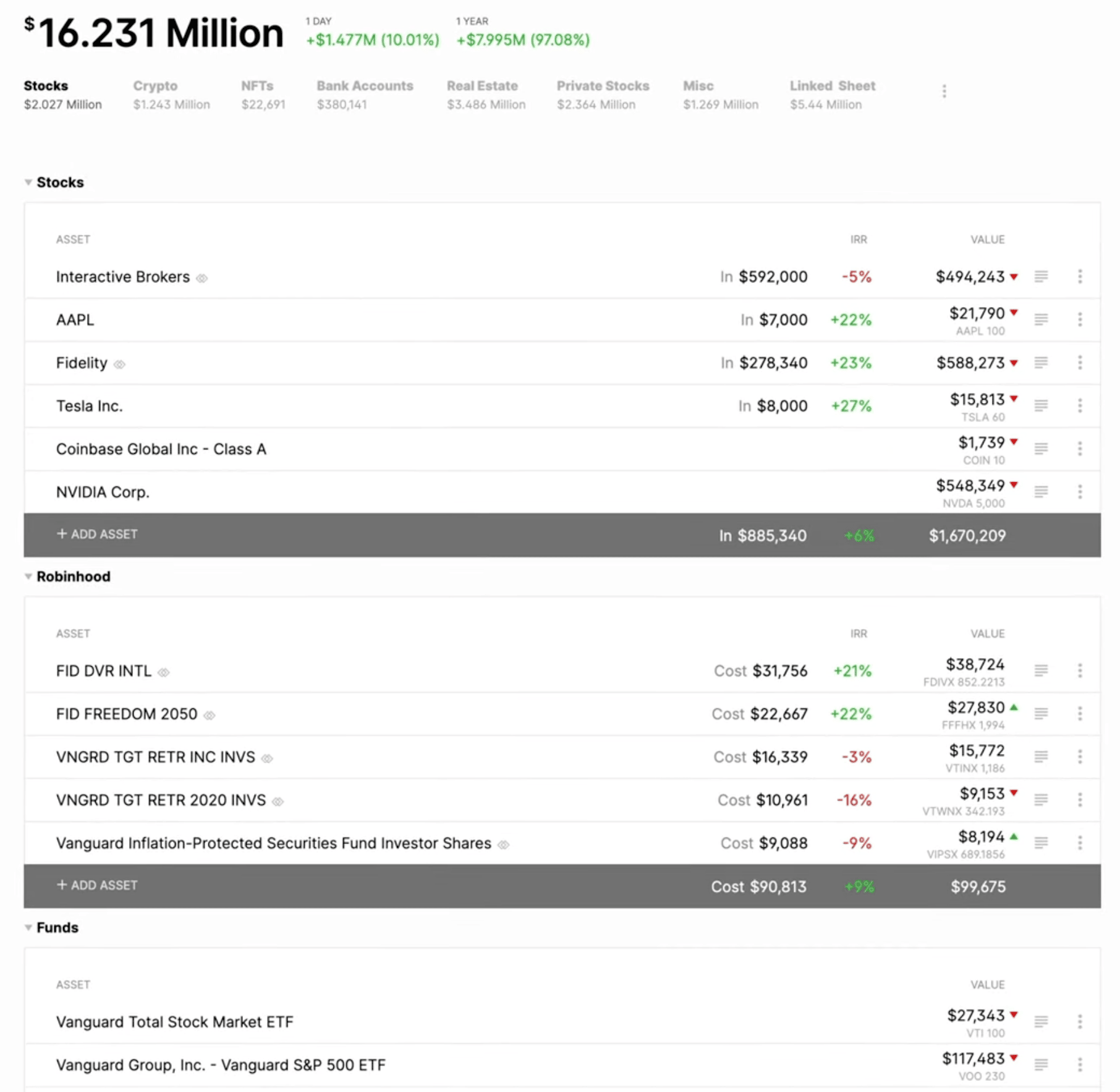

Kubera dashboard

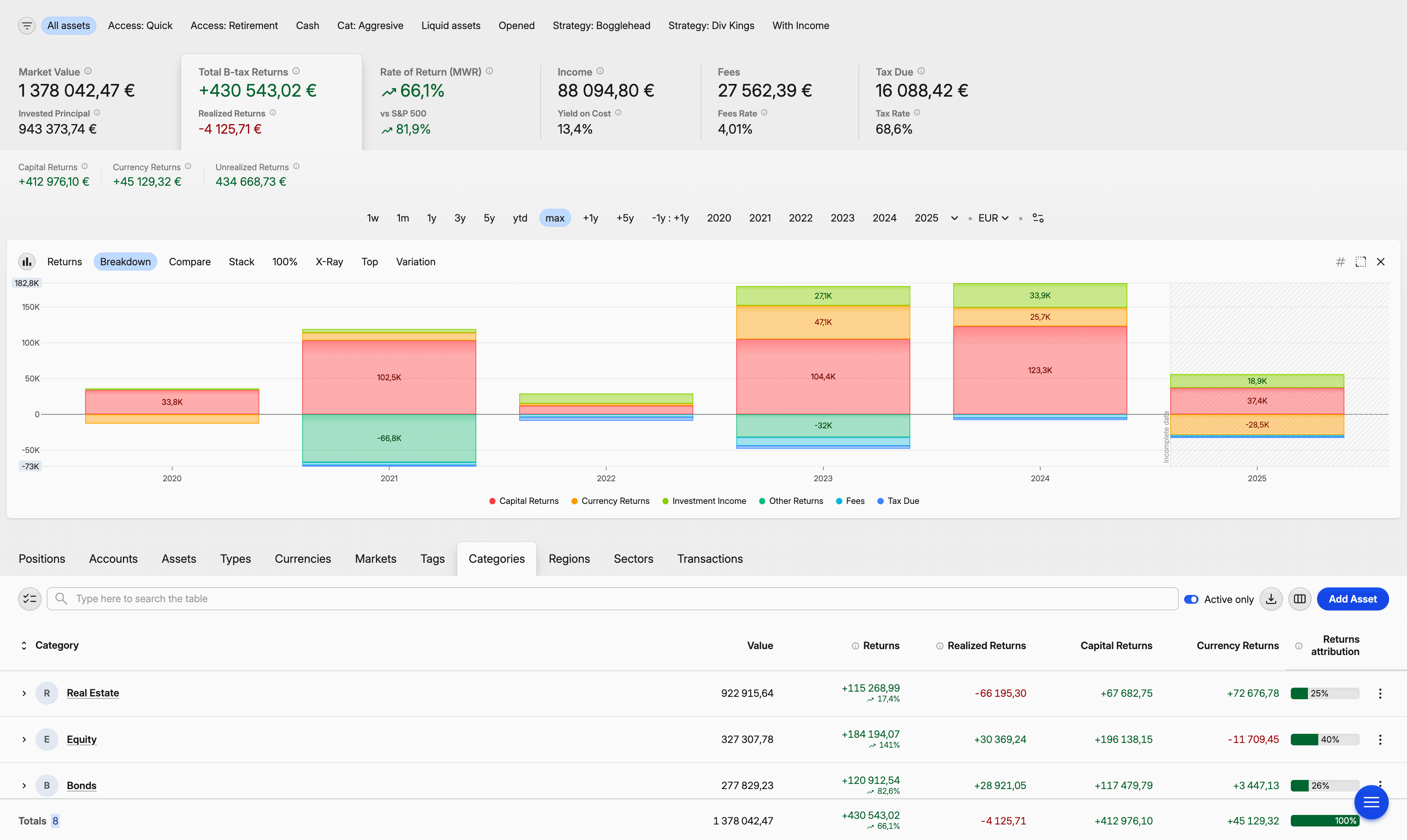

Kubera dashboard Capitally dashboard

Capitally dashboardManaging a diverse investment portfolio as a high net worth individual presents unique challenges. Your holdings likely span multiple asset classes—from traditional stocks and bonds to private equity, real estate, and alternative investments. You need a platform that can handle this complexity while protecting your financial privacy.

Two platforms have emerged as serious contenders for sophisticated investors: Kubera, the established player founded in 2018, and Capitally, a privacy-focused wealth tracker from 2023. Both target investors with complex portfolios, but they take dramatically different approaches to data security and portfolio management.

Is Kubera safe? Understanding data privacy concerns

Kubera uses standard security practices with HTTPS encryption and data encryption at rest. However, your information lives on their servers where employees and potential hackers could theoretically access your unencrypted financial data.

The bigger privacy concern lies in automated broker connections. To sync your accounts, you must share login credentials and two-factor authentication codes with third-party aggregators like Plaid and Yodlee. This creates multiple points where your sensitive financial information is transmitted and stored across different companies.

Capitally addresses these concerns through on-device end-to-end encryption. Your financial data never leaves your device in readable form, encrypted with a private key that never touches Capitally's servers. Even if Capitally wanted to access your data, they couldn't. Government requests, data breaches, or rogue employees couldn't compromise your financial information because it remains encrypted with a key only you possess.

Tracking diversified portfolios and asset classes

High net worth portfolios often extend far beyond traditional stocks and bonds. Both platforms recognize this reality but handle alternative investments differently.

Kubera integrates with Zillow for automated US property valuations and supports private equity with capital calls and distributions. It handles digital assets like domain names, DeFI and NFTs automatically as well. Organizing these assets is simplified, but you can file them into sheets and groups - very much like you would in your own spreadsheet.

Capitally treats all assets as fully customizable. You can track properties anywhere in the world with rental income, create custom assets for any private equity fund, and handle virtually any asset class—art collections, wine investments, collectibles, peer-to-peer lending, venture capital stakes. All price valuations for custom assets are manual though, and there's no support for committed capital yet.

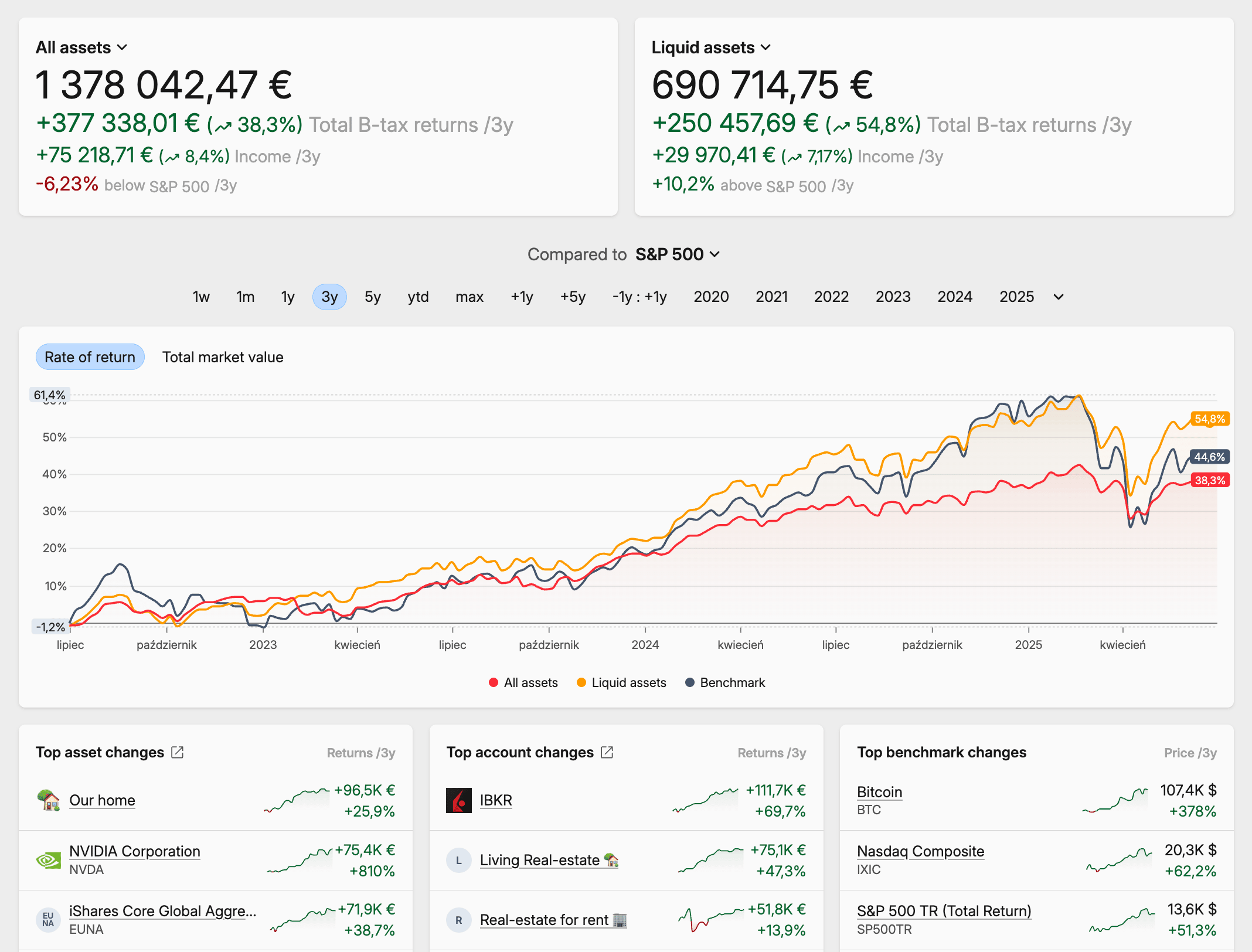

Kubera nested portfolios

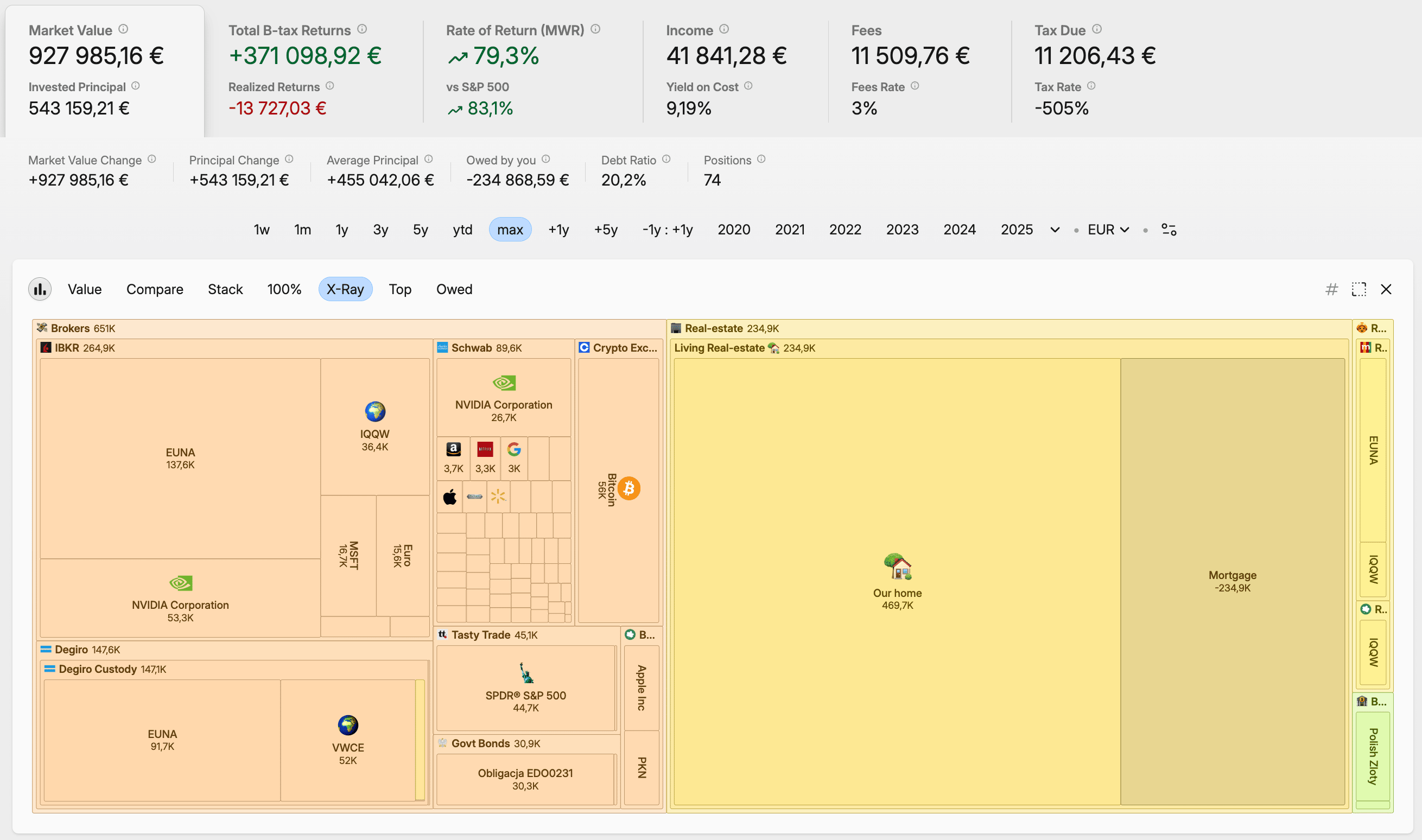

Kubera nested portfolios Capitally nested accounts

Capitally nested accountsManaging multiple portfolios and complex structures

High net worth individuals often manage assets across multiple entities—family trusts, holding companies, personal accounts, and business investments.

Kubera requires their expensive Black tier at $2,499 annually for multi-portfolio management. This enables hierarchical portfolio structures suitable for complex wealth management but makes it one of the most expensive portfolio tracking solutions available.

Capitally includes multiple projects in their Navigator plan at €130 per year. You can create separate projects for different entities, test investment strategies, or organize family member portfolios independently. Projects are completely separate, so if you want to track them together, you can build a deeply nested structure of Accounts to recreate their structure in the app.

Data import and historical tracking

The platforms' different philosophies become most apparent in data handling.

Kubera emphasizes automation but only syncs current balances, not transaction details. If your broker connection fails for a week, you lose that transaction history permanently and need to fix it manually. A nice feature, is an AI-powered PDF and CSV import that can be used to import all these non-standard investments, and let's be honest, many of them operate solely on PDF statements.

Capitally requires manual effort but provides complete control. You export statements from your brokers and import them whenever convenient. Because you're working with actual broker data, you maintain complete transaction histories suitable for tax reporting and detailed analysis. It also provides flexible importing system, which lets you drop any tabular data, teach it how to extract information from it, and store such preset for later.

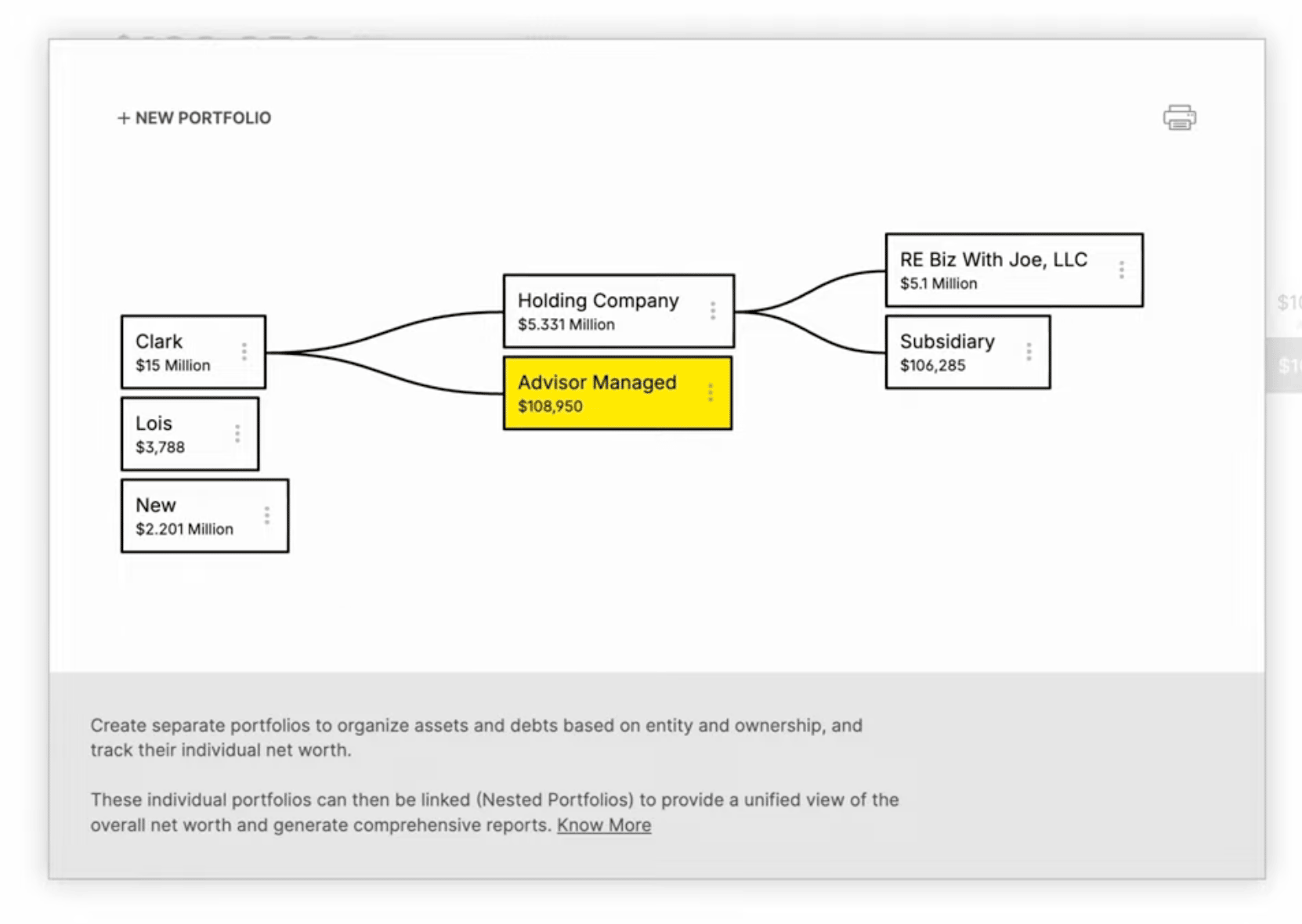

Kubera assets overview

Kubera assets overview Capitally portfolio analysis

Capitally portfolio analysisReporting capabilities of both wealth trackers

Kubera keeps reporting simple and visual. You get net worth trends over time, basic allocation breakdowns by asset class, region, and sector, plus IRR calculations. The platform includes a Sankey diagram showing cash flows, which helps visualize how money moves through your portfolio. You can compare performance against a limited selection of market indices, and there's a "Fast Forward" feature that lets you model potential future scenarios by entering assumed growth rates and planned cash flows.

The reporting philosophy matches Kubera's overall approach—clean, uncluttered views that give you the essential information without overwhelming detail. For many investors, this level of analysis suffices for monitoring overall wealth trends and basic allocation decisions.

Capitally takes a more comprehensive approach to performance analysis and wealth tracking. The platform calculates multiple return metrics including money-weighted returns (MWR), time-weighted returns (TWR), and simple ROI. You can create custom charts across any time period, filter positions with advanced logic, and group results by asset, account, currency, or investment category.

What sets Capitally apart is its portfolio explorer interface—essentially a pivot table combined with pivot charts and extensive filtering capabilities. You can drill down into specific portions of your portfolio, compare performance across different dimensions, and create custom views that you can save and reuse. This proves particularly valuable for complex portfolios where you need to understand how different strategies or asset classes contribute to overall performance.

Dividend and passive income tracking

Investment income handling reveals another key difference between the platforms' approaches to detail and customization.

Kubera treats dividends as regular cash flows without special handling. You won't find dividend-specific reports, dividend reinvestment plan (DRIP) tracking, or income forecasting features. The platform focuses on overall portfolio performance rather than breaking down income sources.

Capitally provides comprehensive dividend analysis that rivals dedicated dividend tracking tools. Dividends are automatically included when you import broker statements, complete with withholding tax data for accurate tax reporting. The platform supports both cash dividends and stock dividends, plus dividend reinvestment plans. You can track key dividend metrics including dividend yield, yield on cost, and dividend growth rates. There's a dividend calendar and future dividend estimates as well.

This extends beyond traditional dividends to include rental income from real estate, interest payments from bonds, peer-to-peer lending returns, and cryptocurrency staking rewards.

Multi-currency

International investors often hold assets in multiple currencies, making robust multi-currency support essential.

Kubera supports currency conversion for portfolio assets but offers limited currency-specific analysis. You can see your portfolio in different base currencies, but doesn't tell you how currency movements affect your returns.

Capitally excels at multi-currency portfolio management. Transactions can use any supported currency, and the platform separates capital returns from currency returns in its analysis. This proves invaluable for understanding whether your international investments are performing well in their local currencies or if you're benefiting from currency movements.

Pricing analysis

The cost difference is substantial. Kubera's Essentials plan at $249 annually provides basic single-portfolio tracking. Most high net worth individuals need the Black tier at $2,499 annually for multi-portfolio support.

Capitally's Navigator plan at €130 annually includes unlimited assets, multiple portfolios, and all advanced features. For the cost of one year of Kubera Black, you could use Capitally Navigator for nearly 20 years. And rest assured, you will receive help with onboarding your data.

Making the right choice

Choose Kubera if you prioritize automated updates, your current net-worth is mostly what you need, and don't mind sharing financial credentials with third-parties. The platform works well for investors who prefer simplified, managed services and can afford the premium pricing for white-glove treatment.

Choose Capitally if data privacy is paramount and you have international or diverse assets requiring detailed tracking. The platform excels for investors who want complete control over their financial data and prefer hands-on portfolio management without premium pricing.

Both platforms offer trials, allowing you to test their approaches with your actual portfolio data. Given the significant differences in philosophy, pricing, and features, trying both platforms helps you understand which approach better suits your specific needs as a sophisticated investor.