Managing a diverse investment portfolio has become increasingly complex. If you're like many DIY investors today, your wealth isn't just sitting in a single brokerage account. You might own rental properties generating monthly income, hold stakes in private equity deals, have money tied up in closed-end funds, and perhaps even collect art or rare wines as alternative investments.

Traditional portfolio trackers often fall short when dealing with this complexity. They excel at tracking publicly traded stocks but struggle with assets that don't have ticker symbols. Even more concerning is the privacy aspect—most platforms require you to hand over your financial credentials to third-party aggregators, creating potential security risks that many high-net-worth individuals find unacceptable.

This review examines four portfolio tracking platforms that take different approaches to these challenges. We'll explore how each handles diverse asset classes, protects your privacy, and helps you understand your true investment performance across all your holdings.

Table of Contents

Side-by-Side Breakdown of Differences

Feature | Capitally | Kubera | Sharesight | Snowball Analytics |

|---|---|---|---|---|

Primary Focus | Holistic Wealth & Performance Analysis | Net Worth Snapshot | Stock Performance & Tax Reporting | Portfolio Strategy & Goal Tracking |

Data Privacy Model | On-Device, End-to-End Encryption | Standard | Standard | Standard |

Alternative Asset Support | Excellent | Good | Good | Limited |

Liabilities Support | Excellent | Balances only | None | None |

Data Import | File-based (CSV/XLS, Broker Exports) | Auto-sync (via Plaid/Yodlee), AI parsing, Manual entry | Auto-sync, Email Forwarding (Regional), Manual CSV | Auto-sync (via Yodlee) & Manual CSV |

Dividend Tracking | Advanced (DRIP, calendar, forecast) | Not supported (treated as cashflow) | Basic (calendar) | Advanced (DRIP, calendar, forecast) |

Multi-Currency Analysis | Deep (Capital vs. currency gain/loss) | Basic (View in different currencies) | Good (Capital vs. currency gain/loss) | Basic (View in different currencies) |

Portfolio Strategies | Allocation breakdown only | Allocation targets | None | Allocation targets, rebalancing, goals |

Tax Support | Good for supported countries, extendable | Manual estimates | Great for supported countries | Manual estimates |

Detailed Reviews

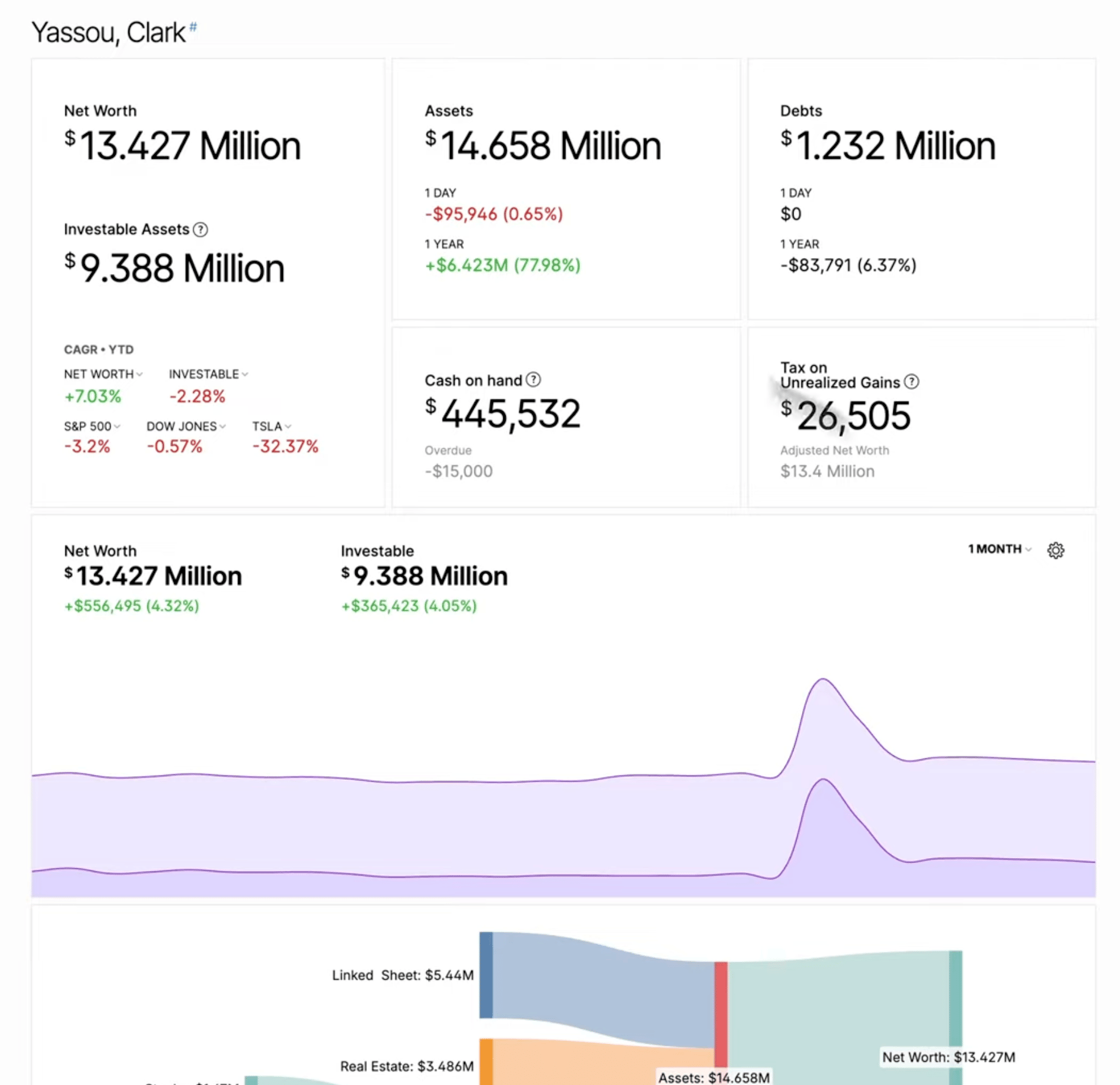

Kubera: Best for Simplified Net Worth Tracking

Kubera takes a refreshingly simple approach to wealth tracking. Instead of overwhelming you with transaction details and complex charts, it presents your net worth like a well-organized spreadsheet that automatically updates asset values.

The platform shines when tracking diverse assets. You can add your vacation home with Zillow integration for automatic valuations, track your classic car collection with VIN-based pricing, and even monitor domain names or NFTs. Private equity investments fit naturally into the system, complete with capital calls and distributions tracking.

What makes Kubera particularly interesting is its "trusted angel" feature. Should something happen to you, the platform can automatically grant access to a designated beneficiary after a period of inactivity. For investors thinking about estate planning, this solves a real problem—how to ensure your family can access your financial information without compromising current security.

However, Kubera's simplicity comes with trade-offs. The platform doesn't track individual transactions or provide historical cost basis information. If you need to analyze your investment performance over time or prepare detailed tax reports, you'll find Kubera lacking. It's essentially a sophisticated balance sheet without the supporting transaction ledger.

Privacy-wise, Kubera uses standard security practices but relies on multiple third-party aggregators like Plaid and Yodlee for automated account connections. Your financial data resides on their servers, accessible to employees with appropriate permissions. While they follow industry security standards, you're still trusting a third party with your complete financial picture.

At $249 per year for the basic plan, Kubera isn't cheap. The $2,499 Black tier adds nested portfolios for complex structures like family trusts but feels way overpriced unless you're managing significant wealth with multiple entities.

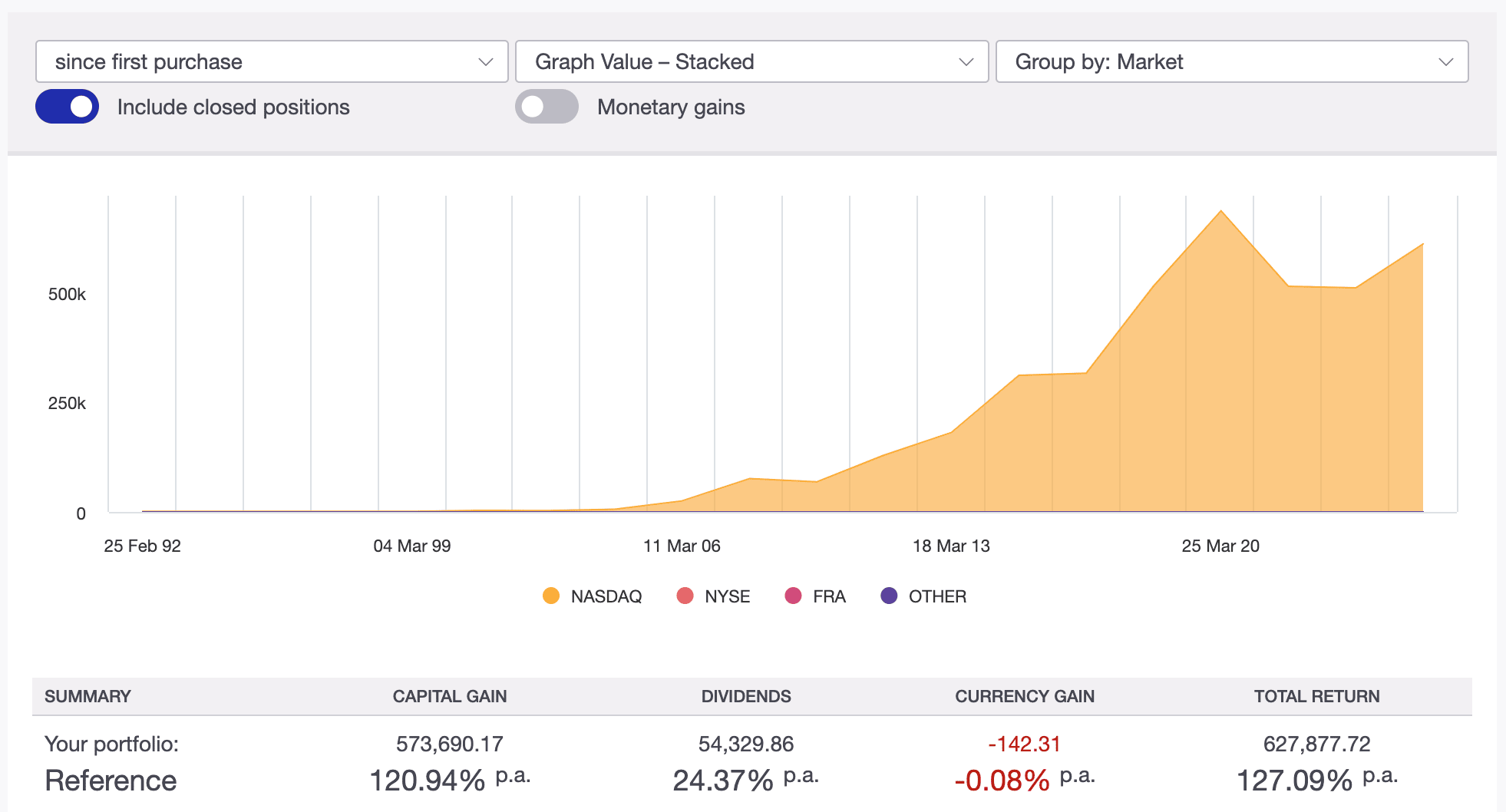

Sharesight: Best for Tax-Focused Stock Portfolio Management

Sharesight has been around since 2007, making it one of the more mature platforms in this comparison. This Australian-born tracker has built its reputation on accurate dividend tracking and tax reporting, particularly for investors in Australia, New Zealand, Canada, the UK, and the US.

For tax time, Sharesight generates country-specific reports that align with local tax requirements. Australian investors, for example, get detailed franking credit calculations. This localized approach saves hours during tax season.

The platform also offers something unique—ETF overlap analysis. If you're investing in multiple ETFs, Sharesight looks through to the underlying holdings, helping you understand your true diversification. This feature alone can reveal hidden concentration risks in seemingly diversified portfolios.

Unfortunately, Sharesight struggles with anything beyond publicly traded securities. While you can manually add custom investments like real estate or private equity, these feel like a second-tier assets. Also, there's no support for debt tracking at all.

Each Sharesight account locks you into a single base currency chosen during setup, which can't be changed later. For international investors managing assets across multiple countries, this creates unnecessary complications and potentially requires multiple portfolios.

The free plan's 10-holding limit is too restrictive for serious testing, and there's no trial for paid tiers. You'll need to commit at least one month's fee (around $23 for the Expert plan) just to properly evaluate the platform.

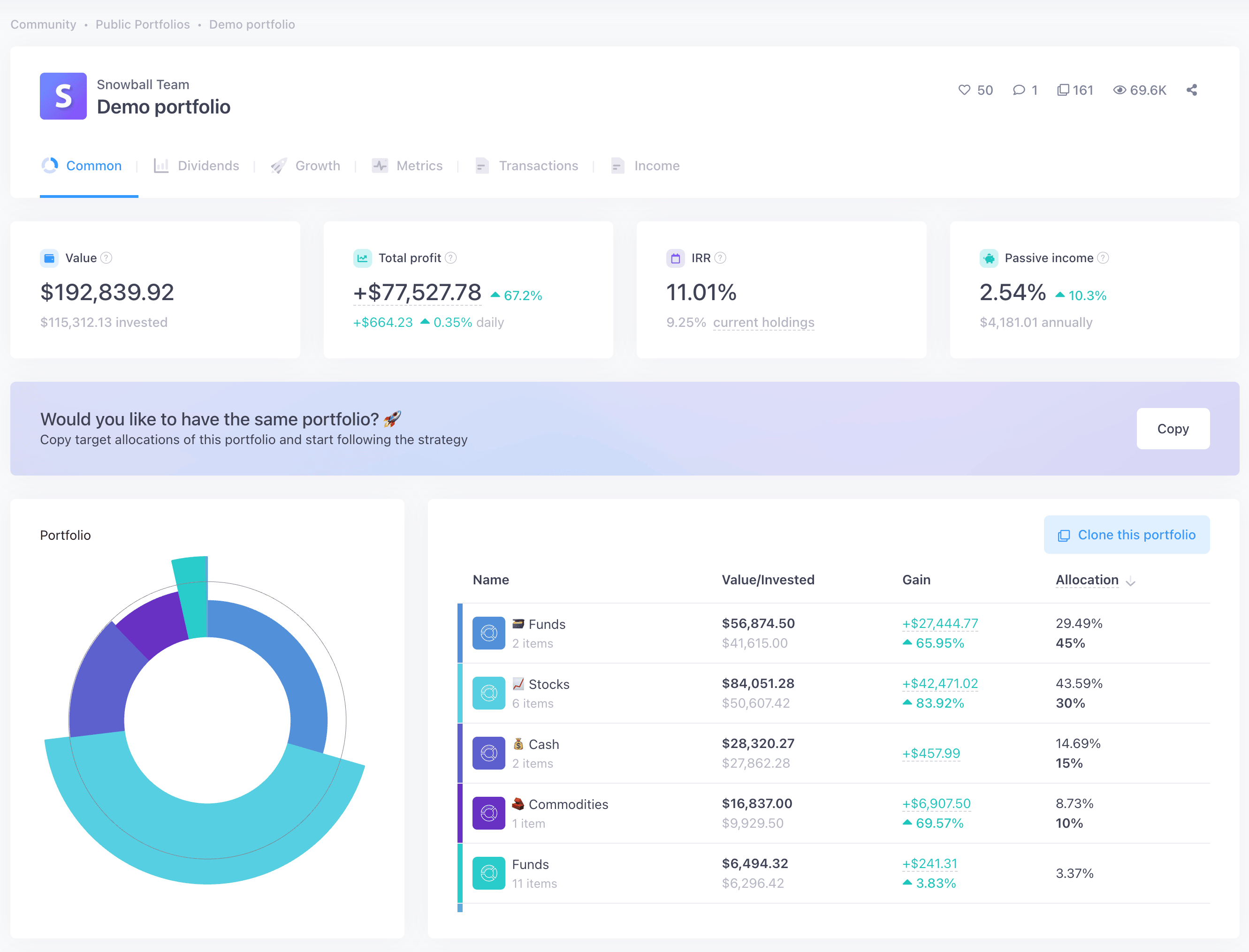

Snowball Analytics: Best for Goal-Based Portfolio Strategy

Snowball Analytics brings a European perspective to portfolio tracking. It targets passive investors and those pursuing financial independence, offering tools that go beyond simple performance tracking.

The platform's standout feature is its comprehensive strategy toolkit. You can define target allocations across asset classes, and Snowball will propose what to buy or sell to rebalance your portfolio. The backtesting feature lets you see how different allocation strategies would have performed historically, though this only works with publicly traded assets.

Snowball's dividend rating system evaluates the stability and growth potential of dividend-paying stocks, while the 12-month payout forecast helps plan future cash flows. The platform even includes a goal tracker where you can set targets for portfolio value or passive income, adjusting for factors like inflation and contribution rates.

The user interface feels modern and intuitive, with numerous pre-built reports providing quick insights. The mobile apps, while not feature-complete, offer a consistent experience for checking your portfolio on the go.

However, Snowball has notable limitations. The platform can't track liabilities, making it impossible to see your true net worth if you have mortgages or loans. Custom assets like real estate can be added but can't be assigned to sectors or regions for proper diversification analysis. Price updates for these assets must be entered manually, one date at a time, or through specially formatted CSV files.

Privacy remains a concern, as Snowball uses Yodlee for automated broker connections. This means sharing your brokerage credentials with a third-party service. While convenient, it introduces another potential security and privacy vulnerability into your financial life.

The pricing structure offers good value, with a free tier for beginners and paid plans ranging from $80 to $250 annually. The 14-day trial for all paid tiers lets you test features without commitment.

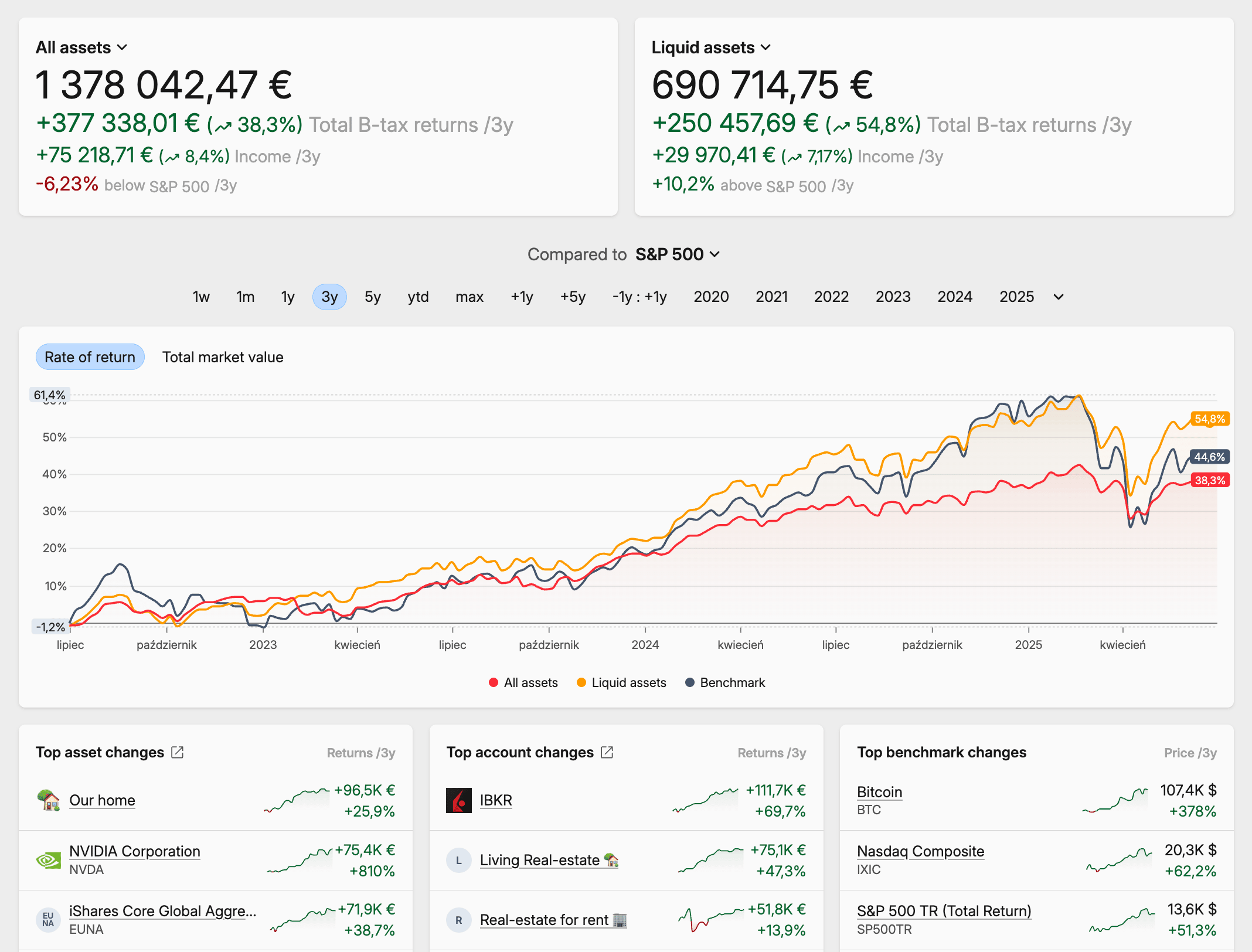

Capitally: Best for Privacy-Conscious Investors with Complex Portfolios

Capitally, founded in 2023, takes a fundamentally different approach to portfolio tracking. While other platforms prioritize automation and ease of use, Capitally focuses on privacy, flexibility, and complete user control.

The platform's defining feature is on-device, end-to-end encryption. Your financial data is encrypted using a key derived from your password that never leaves your device. Even Capitally's employees can't access your portfolio information—a level of privacy unmatched by any other platform in this review. For high-net-worth individuals concerned about data breaches or corporate surveillance, this represents true financial privacy.

Capitally's flexibility in handling diverse assets is remarkable. You can track anything—from traditional stocks to wine collections, from cryptocurrency to intellectual property. The platform fully supports liabilities, margin accounts, and short positions. Multi-currency support is deeply integrated, showing you exactly how foreign exchange movements impact your returns separately from capital gains.

The interface encourages exploration through a powerful portfolio analyzer that combines pivot table functionality with charting capabilities. You can create custom views, save them as bookmarks to quickly access them later. The platform works offline and can be installed as a Progressive Web App, feeling like a native application on both desktop and mobile devices.

The trade-off for this privacy and flexibility is manual data management. Without automated broker connections, you'll need to export statements from your brokers and import them into Capitally. However, the platform makes this as painless as possible with sophisticated import tools that remember your preferences and can handle almost any CSV format through customizable mapping logic.

For investors comfortable with a hands-on approach, Capitally offers professional-grade analytics including money-weighted returns, time-weighted returns, and currency impact analysis. The dividend tracking system handles complex scenarios like foreign tax withholding and stock dividends, while the tax reporting features can be customized for many country's requirements.

At €80-€130 per year, Capitally is competitively priced, especially considering it includes all features in both tiers—the only difference being the number of projects and trackable assets.

Conclusion

Choosing the best portfolio tracker depends on your specific needs and priorities. Each platform we've reviewed excels in different areas while making distinct trade-offs.

For investors seeking true financial privacy and maximum flexibility to track any asset type, Capitally stands out. Its end-to-end encryption and comprehensive feature set make it ideal for high-net-worth individuals and those with complex, diverse portfolios. The manual import process is a small price to pay for complete control over your financial data.

Sharesight remains the go-to choice for stock-focused investors in Australia, New Zealand, Canada, the UK, or US who prioritize automated tax reporting. Its narrow focus is both a strength and limitation.

Snowball Analytics offers the best balance of features for European investors or those wanting portfolio strategy tools. While not excelling in any single area, it provides solid functionality across the board at reasonable prices.

Kubera suits investors wanting the simplest possible wealth tracking experience with estate planning features, though its high price and limited analytics make it hard to recommend for most users.

For DIY investors managing diverse portfolios including real estate, private equity, and other alternatives, while caring about data privacy, Capitally emerges as the most compelling option. It's the only platform that truly respects your privacy while providing professional-grade tools to understand and optimize your complete investment picture.