The modern investment landscape is more complex than ever. Today’s savvy investor often holds more than just stocks and ETFs; their investment portfolio is a diverse mix of assets that can include real estate, private equity, cryptocurrency, managed funds, and even collectibles. The primary challenge is finding a single, reliable portfolio tracking tool to manage their entire portfolio in one place. An effective portfolio tracker should help you make informed decisions on your journey to financial independence.

Sharesight has long been a go-to choice, earning its reputation as a robust platform for portfolio tracking. But as portfolios diversify, many investors are seeking a powerful Sharesight alternative built to handle this complexity. This sharesight review will explore whether it's still the best portfolio tracker for you.

Enter Capitally, a modern platform designed for the investor with a global, multi-asset portfolio who demands granular control and absolute data privacy. We'll explore if it's the right solution for managing your investments.

Table of Contents

- At a Glance: Capitally vs. Sharesight

- Deep Dive: The Core Philosophies

- Asset & Liability Tracking: The Deciding Factor for Diverse Portfolios

- Data Handling: Limited Automation vs. Control

- Privacy & Security: Is Sharesight Safe?

- Reporting & Analysis: Predefined Reports vs Quick Exploration

- What Both Platforms Don't Do

- Pricing

- Conclusion: Is Capitally the best Sharesight alternative?

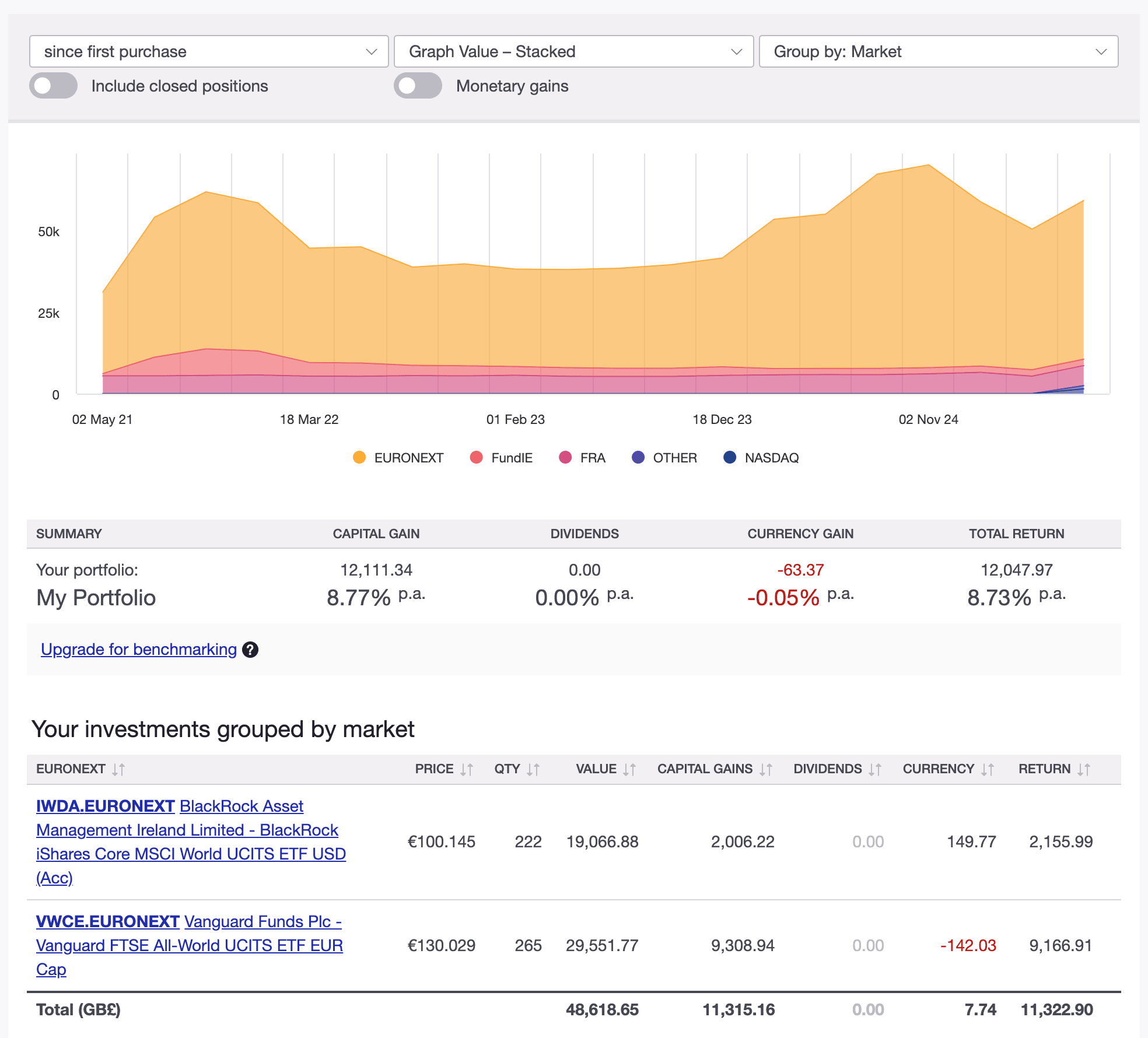

Sharesight dashboard

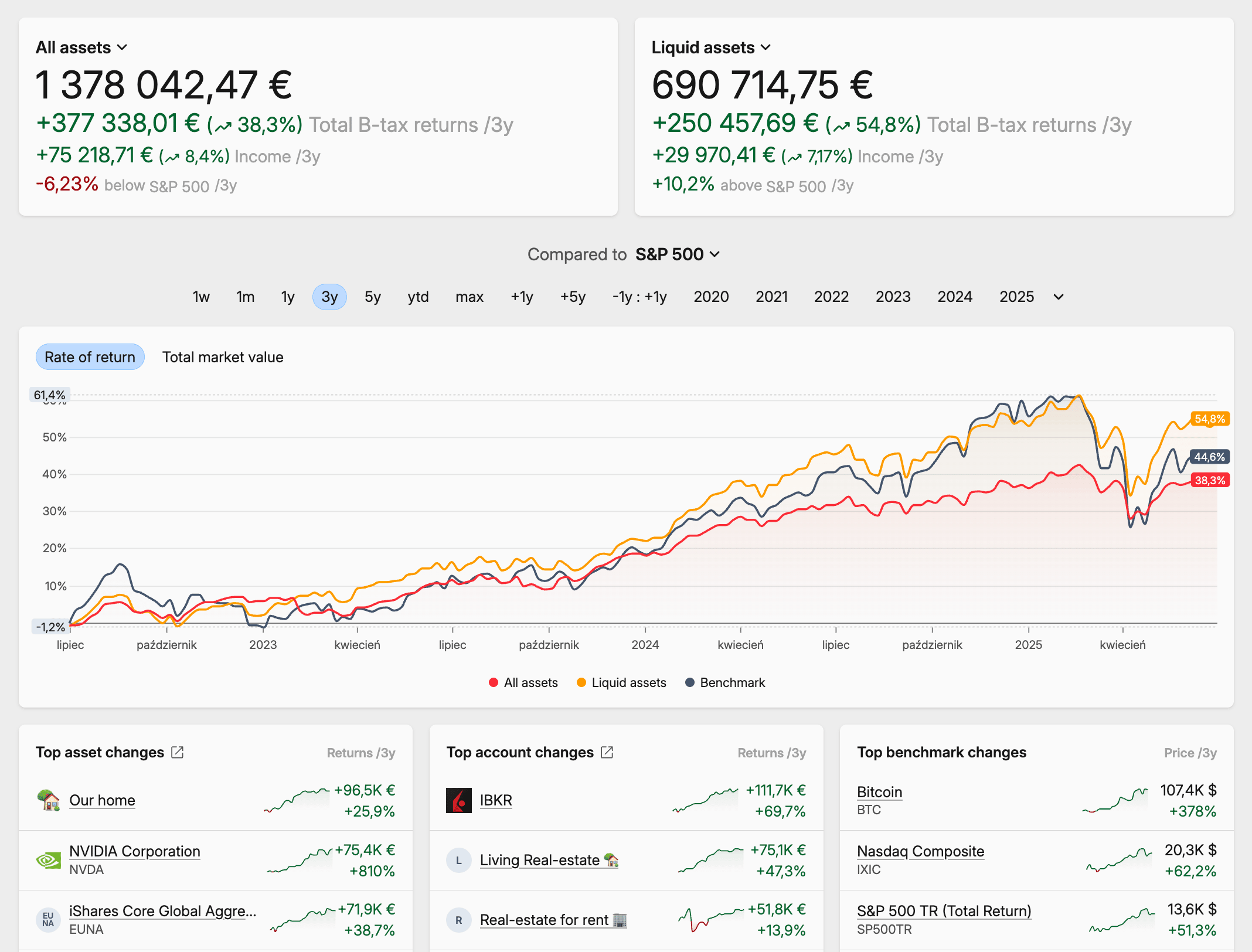

Sharesight dashboard Capitally dashboard

Capitally dashboardAt a Glance: Capitally vs. Sharesight

Both platforms are a powerful way to track your investments, sharing a strong foundation of core features. As a comprehensive portfolio tracker, each offers a free plan to get started and provides robust performance reporting to show you the performance of your portfolio. Both handle automated dividend tracking, including support for a dividend reinvestment plan (DRIP). Both give investors more control over their data and thanks to mostly manual transaction imports, they are both good sources of truth for calculating Capital Gains Tax - and both have tax support built-in.

Where they differ is in their core philosophy, their approach to privacy, and their flexibility in handling of non-traditional holdings.

Feature | Sharesight | Capitally |

|---|---|---|

Best For | Investors focused on listed securities in supported tax regions like New Zealand and Australia. | Investors with diverse, global portfolios across multiple asset classes. |

Asset Tracking | Stocks, ETFs, Crypto, Cash, Funds and Bonds. Manual entry for custom investments. | Stocks, ETFs, Crypto, Cash, Funds, Real-estate, Rentals, Deposits, Art, Collectibles, Ventures and more. |

Liability Tracking | Not supported. | Fully supported (mortgages, loans, short positions). |

Data Import | Auto-sync with a few brokers, confirmation email forwarding, and manual CSV imports. | Manual CSV imports for supported brokers. Powerful CSV/Excel/JSON imports with reusable logic & easy undo for the rest. |

Multi-Currency | Supported, but base currency is fixed per portfolio. Shorter list of supported currencies. | Freely change portfolio currency, transact in any currency including crypto and custom. |

Privacy Model | Standard server-side security. | On-device, end-to-end encryption. Zero-knowledge privacy. |

Tax Reporting | Detailed tax reporting for specific countries (AU, NZ, CA, UK, US). | Customizable tax logic for global use cases + some built-in support. |

User Interface | Functional and data-rich, but less modern. | Modern, highly customizable, easy to use and designed for quick exploration. |

Free Trial | Limited free version (10 holdings); You need to upgrade to test premium Sharesight features. | Full-featured 14-day free trial for all plans. |

Deep Dive: The Core Philosophies

Sharesight's approach: The "set and forget" for selected markets and brokers

Sharesight offers significant automation for selected brokers and markets (esp. Australia and New Zealand). It can sync with some brokers, automatically tracks dividend payments and corporate actions for listed securities, and has trustworthy tax reports for select countries. This makes it a popular tool for investors who want a low-touch way to monitor their public market portfolio - as long as they don't stray too far from the supported indices.

Capitally's approach: The "Hands-on command center"

Capitally is built on a philosophy of user control and flexibility. It assumes its user has a complex portfolio and wants to be actively engaged with their data. It provides the tools to track anything, import from any source, and analyze the data in any way you see fit, putting you firmly in the driver's seat.

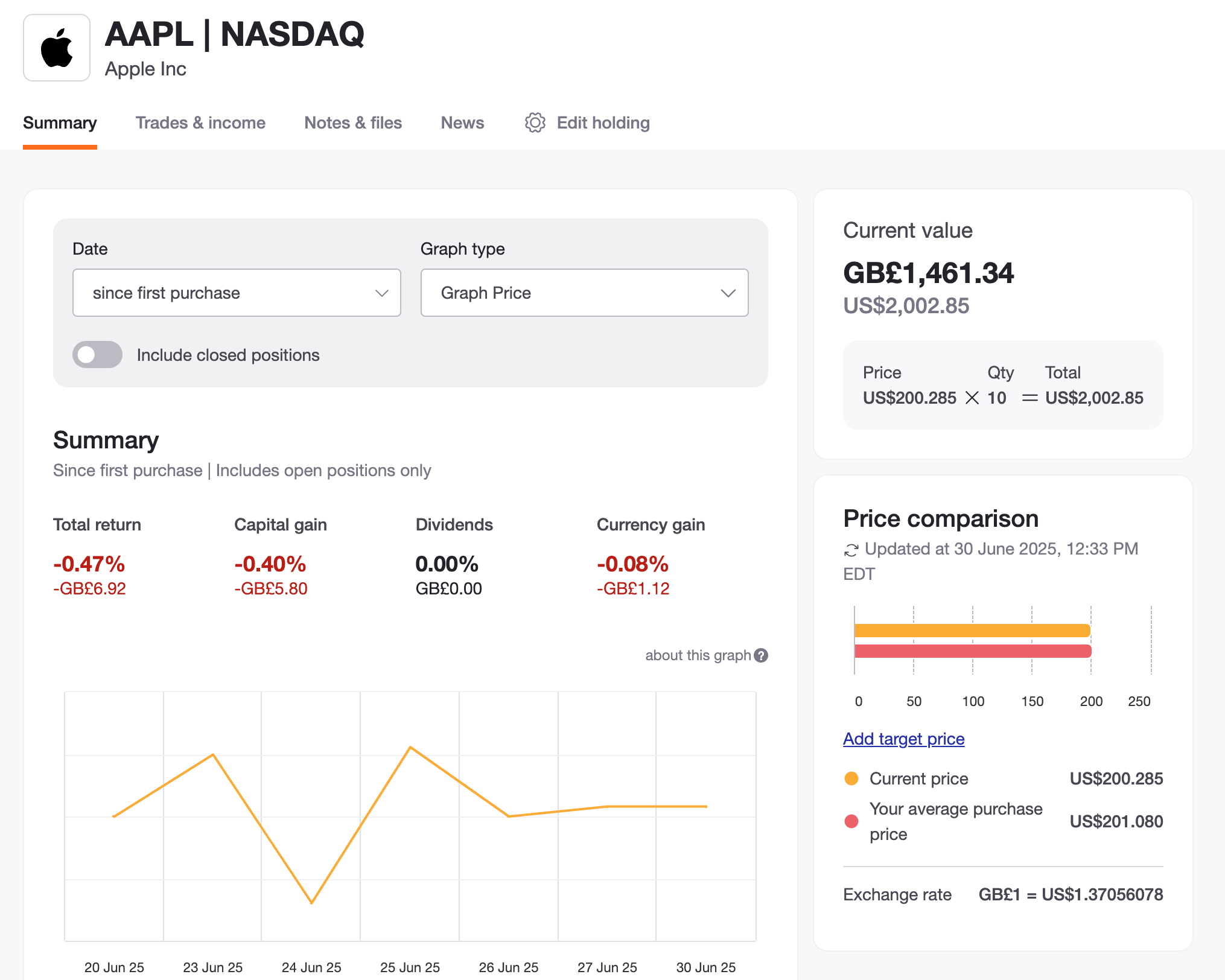

Sharesight asset screen

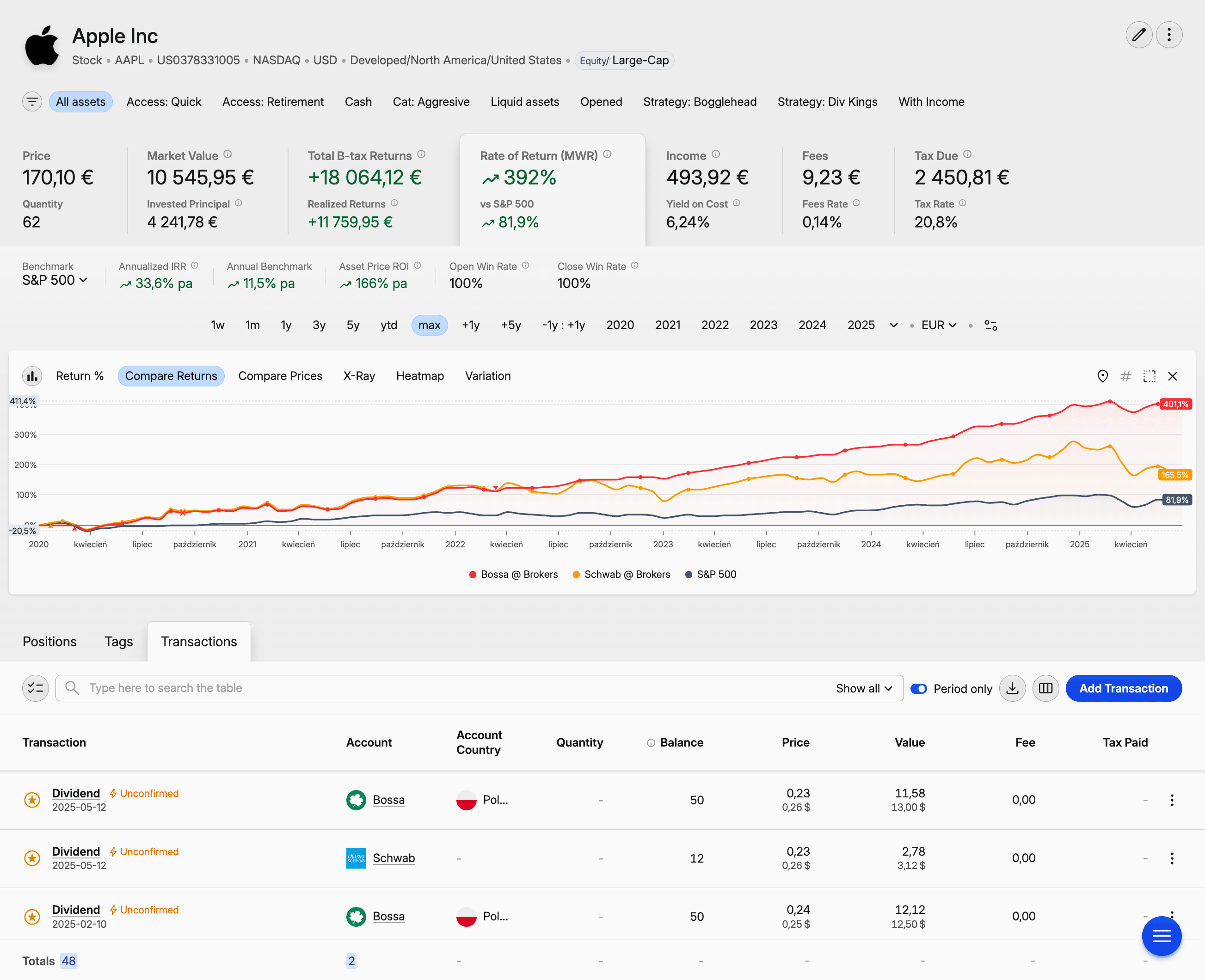

Sharesight asset screen Capitally asset screen

Capitally asset screenAsset & Liability Tracking: The Deciding Factor for Diverse Portfolios

Sharesight supports the tracking of publicly traded assets like stocks, ETFs, and managed funds very well. While it allows you to create a custom investment to represent assets like property, this tracking is entirely manual and these assets are treated somewhat differently from the built-in assets. Crucially, Sharesight does not support liability tracking, so you can't get a full picture of your net worth.

Capitally is designed from the ground up to "track anything." It treats real estate, private equity, art, and P2P loans with the same importance as stocks. Furthermore, Capitally fully supports liabilities. You can track a mortgage against a property, monitor loans, and even represent short positions from a trade, allowing you to know your true financial position.

Data Handling: Limited Automation vs. Control

Getting your historical data in is a critical first step. Sharesight automatically syncs trades from some brokers, especially for Australian users, and can process buy and sell confirmations from emails. For multiple brokerage accounts it relies on a CSV import process. You can import custom data, but it has to be formatted in a certain way to be imported.

Capitally focuses on giving you more control over the process. It relies entirely on manually importing transactions from brokers. There is built-in support for multiple brokers, but Its importer can handle any CSV, Excel, JSON or XML file, letting you map the data to transaction properties, including complex logic and formulas if needed. This makes it much easier to import a complete trade history - especially if you have custom data sources or unsupported brokers. You can save such configurations to automate future imports, and undo a bad import with a single click.

Privacy & Security: Is Sharesight Safe?

Sharesight uses enterprise-grade security and states that it conducts regular independent security audits. Your data is encrypted in transit and at rest. This common model is generally safe, but it relies on trust in the Sharesight team and internal controls to prevent data exposure. Centralized databases can be a target for sophisticated attacks and there are multiple high-profile data leaks every year.

Capitally takes a different approach with on-device, end-to-end encryption. Your financial data is encrypted on your device using a key that Capitally never sees. This "zero-knowledge" model means even Capitally cannot see your financial data, offering the highest level of privacy and making your portfolio data inaccessible to anyone but you. It's worth noting, that if you loose your password, your data is lost and nobody can recover it - so make backups!

Sharesight reports

Sharesight reports Capitally portfolio explorer

Capitally portfolio explorerReporting & Analysis: Predefined Reports vs Quick Exploration

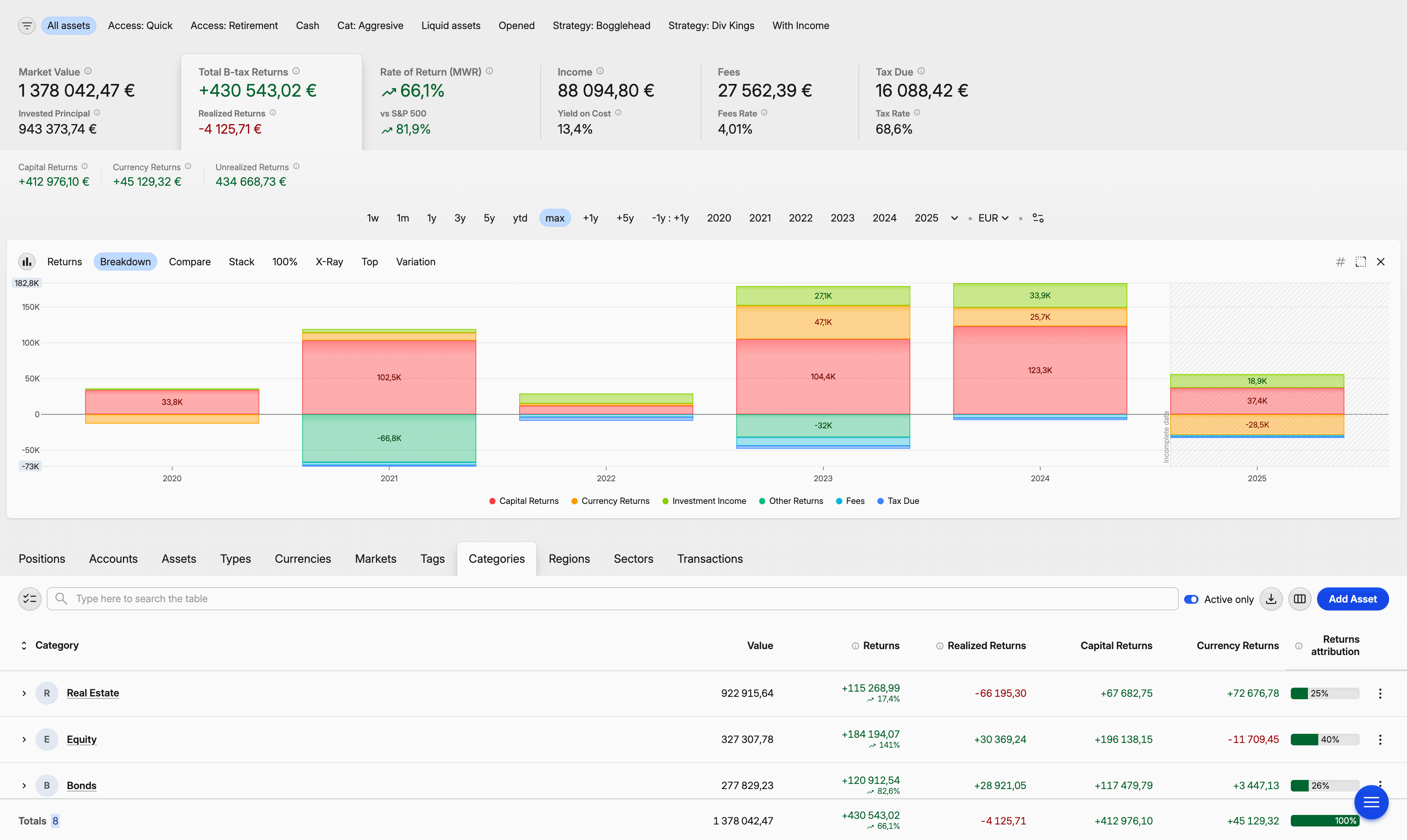

Sharesight reporting is strong, with predefined reports for performance tracking over any date range. Portfolio can be analysed using one of the purpose-built reports, access to which depend on your subscription tier. It is particularly useful at tax time, helping you calculate your capital gains tax for your tax return, which your accountant will appreciate. Apart from region and industry diversity, it also has a unique feature to see the underlying holdings of ETFs and compare asset exposure across your portfolio. However, customization is limited and every report has to be configured from scratch.

Capitally offers a highly responsive interface designed for quick exploration. While it has predefined reports, its power lies in letting you seamlessly navigate your data. You can instantly filter a view, group, change metrics, and charts without waiting for pages to load. It's like a pivot table, combined with a pivot chart on steroids. This fluid, interactive approach, combined with the ability to build custom views, allows for a deeper understanding of your portfolio. However, it might require getting used to, as it's the main analysis interface used to get all the insights that Sharesight has separate reports for.

What Both Platforms Don't Do

To set clear expectations, neither platform is a trading tool with advanced technical indicators like you might find from Morningstar or a broker. Their focus is on historical performance tracking and portfolio management, not market timing.

Pricing

Sharesight pricing has a tiered model that includes a free plan. However, this free version is limited to 10 holdings and has no access to most reporting features. To get a feel for the full power of Sharesight’s portfolio tracker, a starter ($83/y), investor ($216/y) or expert ($279/y) plan subscription is necessary and there's no free trial.

Capitally offers two straightforward paid plans - Sailor (€80/y) and Navigator (€130/y) and a full-featured, 14-day free trial. This allows you to conduct a thorough evaluation with your actual financial data before making a commitment.

Conclusion: Is Capitally the best Sharesight alternative?

So, should you use Sharesight or its alternative, Capitally?

Who is Sharesight for?

Sharesight is an excellent choice for an investor whose portfolio is primarily in public stocks, ETFs, and managed funds within a supported tax region. It won't give you hands-on approach, or top-notch privacy, but for many it may be just enough. It's simply a reliable and time-tested, albeit pricey, portfolio tracker. Many Sharesight customer reviews praise its ease of use for this purpose.

Who is Capitally for?

Capitally is the definitive Sharesight alternative for the investor who wants more. If your portfolio contains alternative assets, you operate globally, you demand granular control, have liabilities, or you consider financial privacy non-negotiable, Capitally is built for you. It is the command center for the investor who wants a complete, secure, and deeply personal view of their entire financial life.