Picture your money working for you, not the other way around. While most people trade hours for dollars, dividend investing lets your investments generate income without requiring your constant attention or effort.

Unlike the rollercoaster ride of stock prices, dividend income provides tangible, predictable cash you can count on. For beginners, this makes investing feel real and rewarding from day one.

In this guide, we'll walk you through the simplest dividend investing strategies that anybody can implement. No complex formulas or Wall Street expertise required - just practical steps to start building your dividend portfolio.

You'll discover:

How dividend-paying stocks create reliable cash flow for investors

Why companies pay cash dividends (and why some don't)

How to identify dividend stocks for beginners with minimal research

Simple ways to reinvest your dividends for compound growth

How to track your progress and optimize your strategy over time

Table of Contents

- How does a dividend income work?

- How to invest in dividend stocks? These dates you must know!

- How dividends affect stock price?

- Different types of dividends

- How to evaluate dividends? Know these terms!

- Dividend yield

- Dividend payout ratio

- Dividend growth rate

- Yield on cost

- Dividend aristocrats and kings

- DRIP (Dividend Reinvestment Plan)

- Putting it all together: Your evaluation framework

- The simplest dividend investing strategies for beginners

- 1. Dividend Aristocrats: The "quality first" approach

- 2. Dividend ETFs: The "set it and forget it" approach

- 3. Dogs of the Dow: The "simple formula" approach

- 4. Sector-based approach: The "balanced diet" method

- Key takeaways

- Your next steps

- Frequently Asked Questions

- What companies pay dividends?

- Why some companies don't pay dividends?

- How companies determine dividend amounts?

- Compound vs. simple interest: What's the difference for your investments?

How does a dividend income work?

Ever wondered how money magically appears in your brokerage account from stocks you own? Dividends aren't random gifts from companies - they are your share of a company's profits, paid out to you as a part-owner of the business.

The dividend cycle typically works like this:

The company earns profits throughout its fiscal quarter or year

The board of directors votes to distribute some of those profits to shareholders

The company announces the dividend amount per share

Payment gets processed on specific dates (more on these below)

Shareholders receive cash in their brokerage accounts

Most established dividend-paying companies operate on a quarterly schedule, meaning you'll receive payments four times per year. Some companies pay monthly (especially certain REITs and closed-end funds), while others pay semi-annually or annually.

How to invest in dividend stocks? These dates you must know!

These four dates govern the dividend process, so you need to understand what they mean:

Declaration Date: The day the company officially announces it'll pay a dividend. This announcement includes the dividend amount, ex-dividend date, record date, and payment date.

Ex-Dividend Date: Perhaps the most important date for new investors. To receive the upcoming dividend, you must purchase shares before the ex-dividend date. If you buy on or after this date, the previous owner gets the dividend.

Record Date: Usually one business day after the ex-dividend date. The company checks its records to determine who owns shares and, therefore, is entitled to receive the dividend.

Payment Date: The day when the dividend hits your brokerage account. This can be anywhere from a few days to a few weeks after the record date.

The ex-dividend date is the critical cutoff point!

Buy before this date to receive the upcoming dividend; buy on or after, and you'll need to wait for the next dividend cycle.

Let's see how these dates work with a real example from Apple’s stocks (AAPL):

February 1, 2023: Apple announces quarterly earnings and declares a $0.23 per share dividend

February 10, 2023: Ex-dividend date

February 13, 2023: Record date

February 16, 2023: Payment date

If you owned 100 shares of Apple, you'd receive 23 (0.23 × 100) on February 16th. But remember - you would need to have purchased those shares before February 10th to qualify for this payment!

How dividends affect stock price?

Typically, the stock price tends to drop by roughly the dividend per share amount on the ex-dividend date. This is because the company's assets are reduced by the amount of the dividend payment. However, this drop is usually temporary, and the stock price often recovers quickly. Do not be alarmed by this volatility.

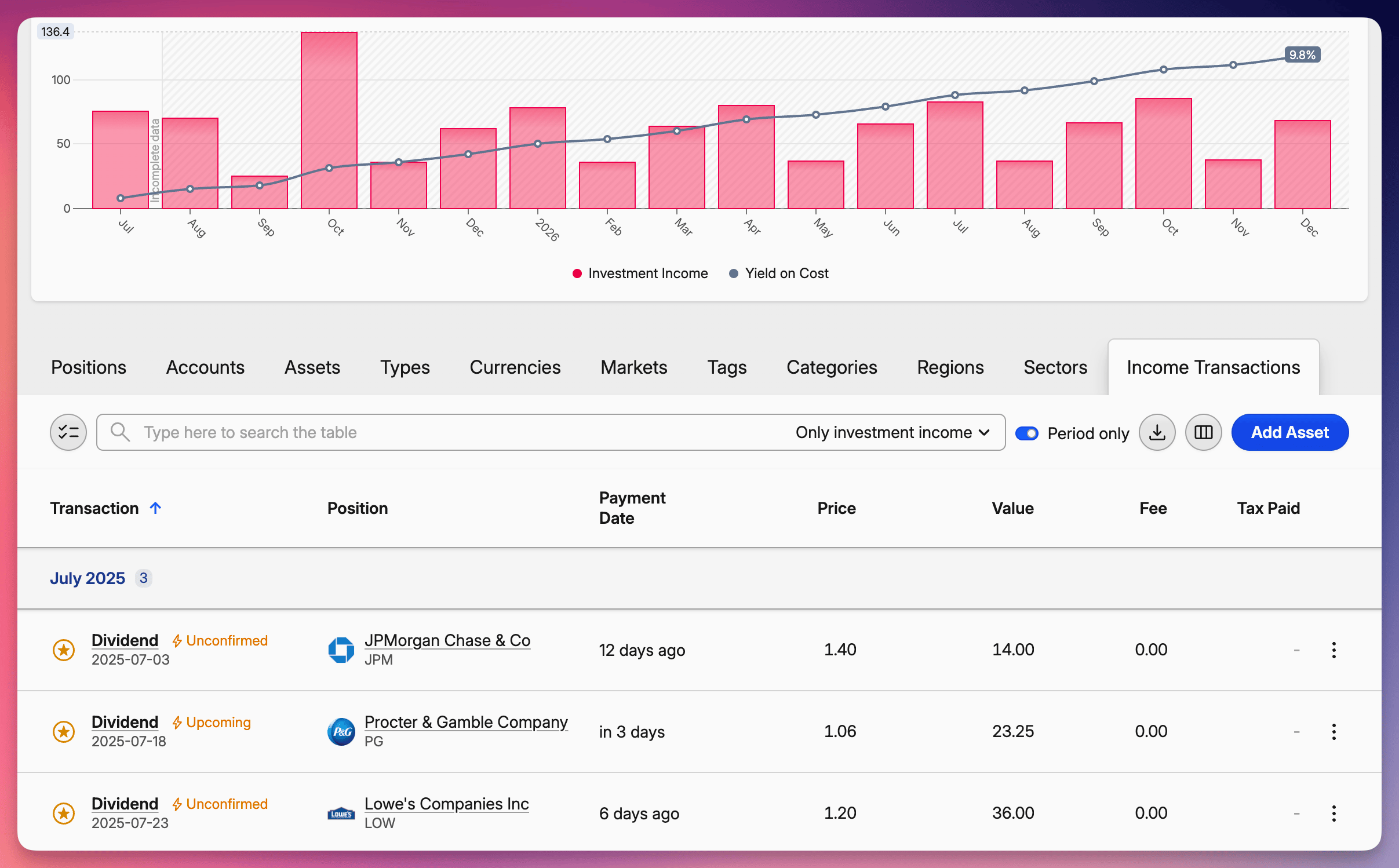

Tracking made simple

Following all these dates across multiple stocks can quickly become overwhelming. When you import your transactions into Capitally, the platform automatically displays your upcoming dividend payments in a clear calendar view, showing exactly when to expect each payment and how much you'll receive. This helps you visualize your cash flow and never miss an important ex-dividend date.

Different types of dividends

When companies share profits with shareholders, they don't always do it the same way. Let's look at the main types of dividends you might encounter in your investing journey.

Regular cash dividends - The most common type of dividend - regular cash payments deposited directly to your brokerage account. Companies distribute a portion of profits to shareholders, which are typically paid out quarterly. If you own 100 shares of a company paying 0.50 quarterly dividends, you'll receive 50 every three months. How they will be taxed depends on your tax jurisdiction.

Special dividends - One-time bonus payments outside the regular dividend schedule. Companies distribute excess cash from exceptional profits, asset sales, or restructuring. Microsoft's famous 3 per share special dividend in 2004 returned 32 billion to shareholders in a single payment. Nice to receive, but too unpredictable to count on for income planning.

Stock dividends - Instead of cash, you receive additional shares of the company. The company issues new shares proportionally to existing shareholders. A 5% stock dividend would give you 5 new shares for every 100 you already own. Generally, not taxable until you sell the shares.

Return of capital - When part of your dividend isn't coming from earnings but is returning a portion of your original investment. Common in REITs, MLPs, and certain funds due to accounting rules. Not immediately taxable, but it reduces your cost basis, potentially creating larger capital gains taxes later.

If you're starting your investment journey, focus primarily on companies paying regular cash dividends with consistent histories of payments. This provides the most predictable foundation for a dividend portfolio.

How to evaluate dividends? Know these terms!

Picking the right dividend stocks isn't about finding the highest dividend payments. It's about finding quality companies that can sustain and grow their dividends over time.

To do this effectively, you need to understand several key metrics that help you evaluate dividend quality. Let's break them down now:

Dividend yield

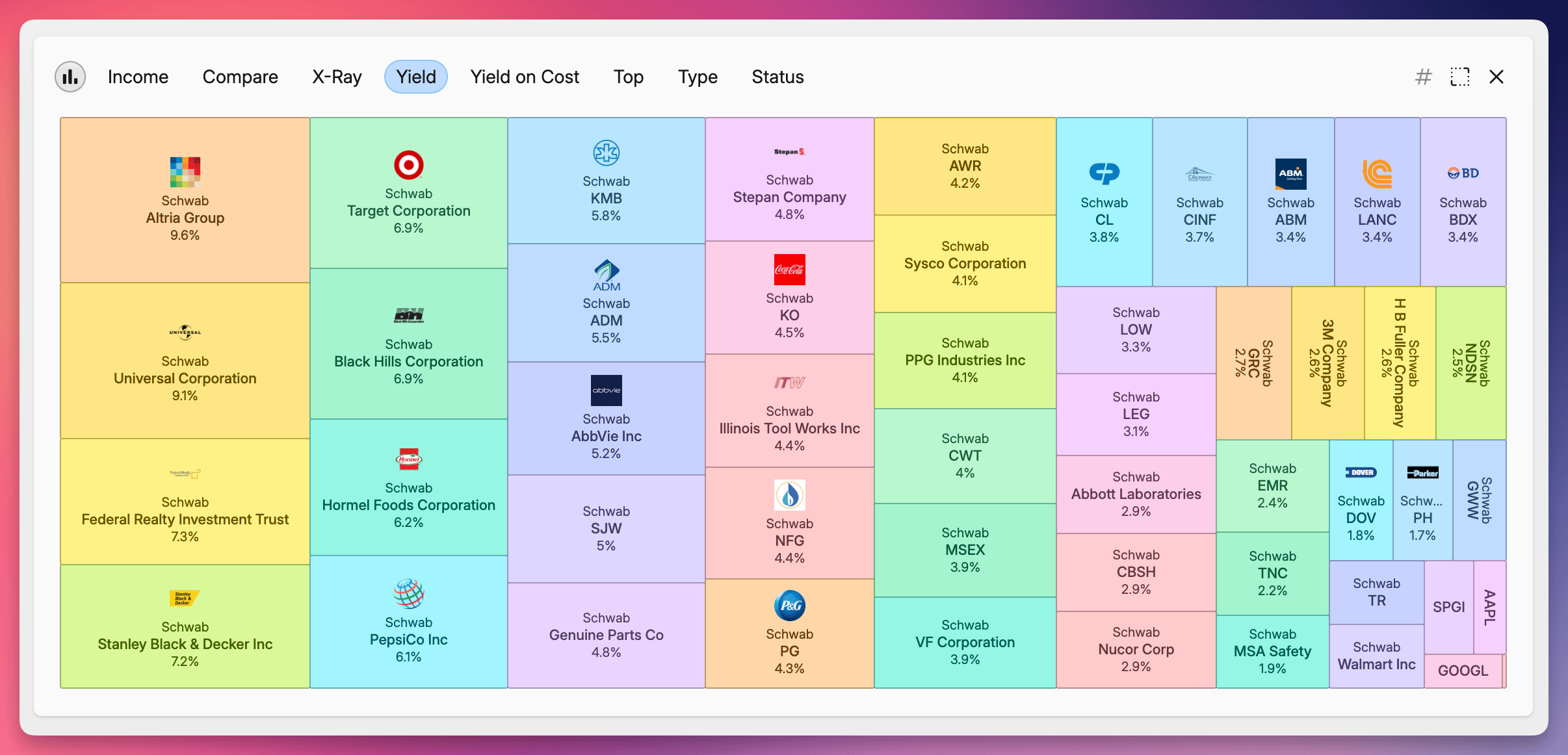

Assets paying the highest yield as displayed by Capitally

Assets paying the highest yield as displayed by CapitallyThis is the most common metric you'll encounter, but also the most misunderstood. Dividend yield represents the annual dividend payment as a percentage of the current stock price.

Formula: Annual Dividend per Share ÷ Current Share Price × 100%

Example: If Company ABC pays 2 per share annually in dividends and its stock price is 50, the dividend yield is 4% (2 ÷ 50 × 100%).

Why it matters: Dividend yield gives you a quick way to compare the income potential of different investments. However, an unusually high yield (typically above 6-7% for most industries) often signals potential problems rather than a great deal.

When a stock's yield suddenly jumps much higher than its historical average or industry peers, it's usually because the stock price has fallen due to problems - not because the company has become more generous.

Dividend payout ratio

This metric shows what percentage of a company's earnings are being paid out as dividends. It's one of the best indicators of dividend sustainability.

Formula: Annual Dividend per Share ÷ Annual Earnings per Share × 100%

Example: If Company XYZ earns 5 per share and pays 2 in annual dividends, its payout ratio is 40% (2 ÷ 5 × 100%).

Why it matters: Lower payout ratios (typically under 60% for most industries) suggest the company has plenty of room to maintain or increase dividends even if earnings temporarily decline. Higher ratios might indicate the dividend is at risk if business conditions worsen.

Industry context: Acceptable payout ratios vary by industry. Utilities and REITs typically have higher payout ratios (often 70-90%) than technology or consumer goods companies (typically 30-50%).

Dividend growth rate

This measures how quickly a company has increased its dividend over time, typically calculated as an annual percentage.

Formula: ((Current Annual Dividend ÷ Dividend from X Years Ago)^(1/X)) - 1 × 100%

Example: If Company DEF increased its annual dividend from 1.00 to 1.61 over 5 years, its

5-year dividend growth rate is approximately 10% per year.

Why it matters: Companies that consistently grow their dividends typically outperform those with stagnant dividends over the long term. A strong dividend growth rate often indicates a healthy business with increasing profits.

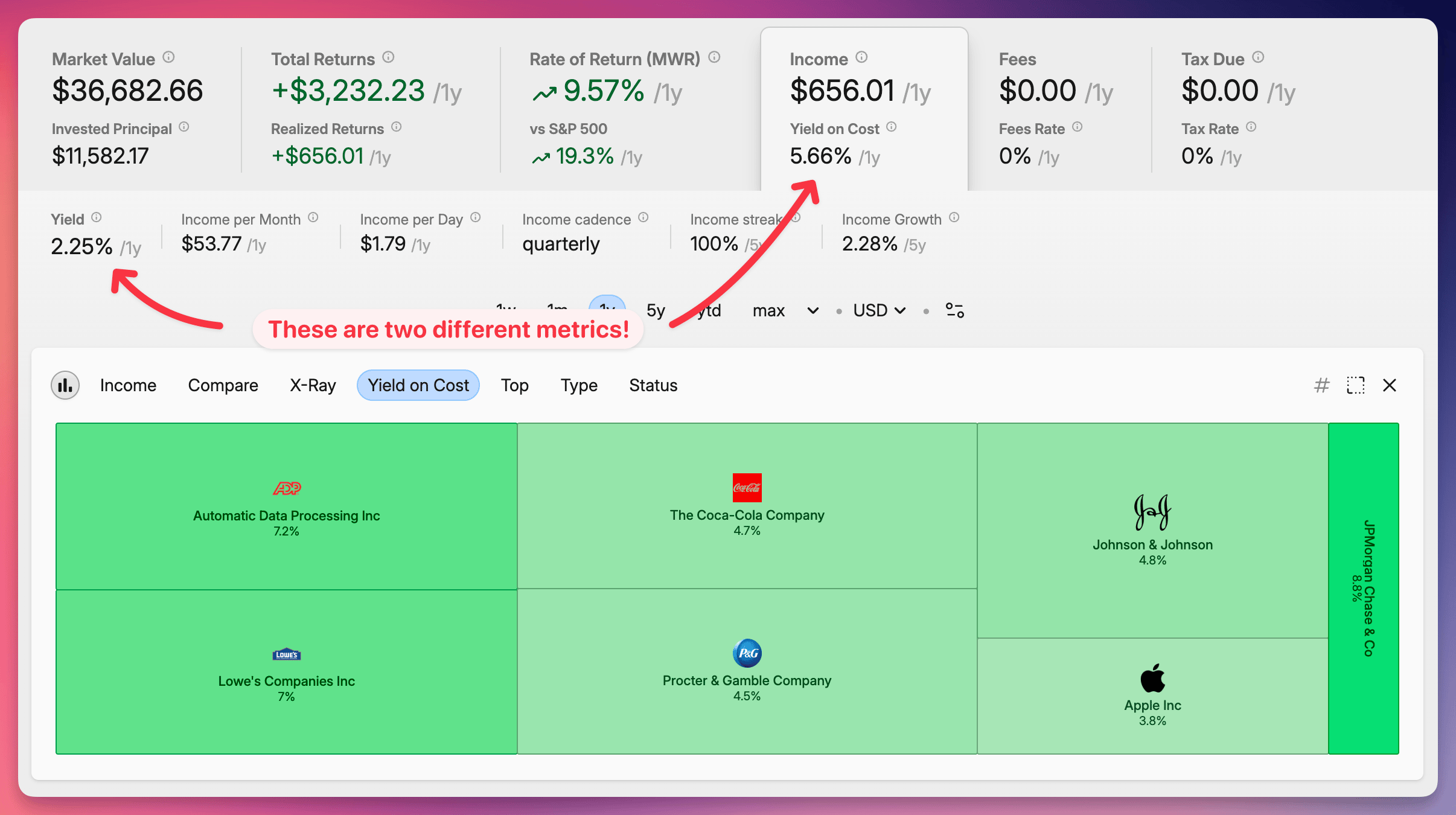

Yield on cost

This personal metric measures the current dividend yield based on your original purchase price, not the current market price.

Formula: Current Annual Dividend per Share ÷ Your Purchase Price per Share × 100%

Example: If you bought shares of Company GHI at 40 five years ago, and it now pays 3 in annual dividends, your yield on cost is 7.5% (3 ÷ 40 × 100%), even if the current market price has risen to $75 (which would give new investors only a 4% yield).

Why it matters: Yield on cost shows the power of dividend growth over time. Long-term dividend investors often end up with yields on cost far exceeding what's currently available in the market.

Track your real yield

Yield on Cost & Yield compared in Capitally

Yield on Cost & Yield compared in CapitallyCalculating yield on cost becomes complex when you've purchased shares at different prices over time. Capitally automatically calculates your true yield on cost across all your purchases of a particular stock, giving you an accurate picture of your actual dividend return based on your specific investment history.

Dividend aristocrats and kings

These are not metrics but categories of elite dividend-paying companies:

Dividend Aristocrats: S&P 500 companies that have increased their dividends for at least 25 consecutive years.

Dividend Kings: Companies that have increased their dividends for at least 50 consecutive years.

Why they matter: These companies have demonstrated extraordinary commitment to shareholder returns through multiple recessions, market crashes, and changing business conditions. They form the backbone of many dividend portfolios.

DRIP (Dividend Reinvestment Plan)

A DRIP is a program that automatically uses your dividend payments to purchase additional shares of the same stock, often without commission fees.

How it works: Instead of receiving cash dividends, the money is used to buy more shares (or even fractional shares) of the same company.

Why it matters: DRIPs harness the power of compounding - your reinvested dividends buy more shares, which generate more dividends, which buy more shares, and so on. Over decades, this compounding effect can dramatically increase your returns.

Example: If you own 100 shares of a 50 stock with a 4% dividend yield, you'd receive 200 annually in dividends. With a DRIP, that 200 would buy 4 more shares, increasing your next year's dividend payment to 208, and so on.

Putting it all together: Your evaluation framework

When evaluating a dividend stock, consider these factors in combination rather than isolation:

Moderate yield (typically 2-5% for most industries)

Sustainable payout ratio (generally under 60% for most industries)

Consistent dividend growth (ideally 5-10% annually)

Long dividend history (preferably 10+ years of increases)

Strong business fundamentals (revenue growth, earnings growth, manageable debt)

The best dividend investments aren't necessarily those with the highest current yields, but those that can reliably increase their payments year after year!

The simplest dividend investing strategies for beginners

Do you know that the most effective strategies for beginners are often the simplest ones? Below, I present 4 straightforward approaches you can implement right away, even with minimal investing experience.

1. Dividend Aristocrats: The "quality first" approach

How it works: Instead of chasing the latest tech trends or cryptocurrencies, you build a portfolio of companies with a proven track record of sharing profits with shareholders. Picture a company that not only pays dividends but actually increases them every single year - through financial crises, pandemics, and recessions - and does this consistently for at least 25 years straight.

Sounds like an investor's dream? These companies are what we call Dividend Aristocrats.

And if a company raises its dividends for more than 50 years? That's when they receive a 👑 and the title of Dividend King.

Some of these companies were increasing their payments to shareholders when Nixon resigned, during the 1987 crash, the dot-com bubble burst, and the 2008 global financial crisis. Sounds impressive?

Why it works for beginners:

It's like riding with an experienced driver instead of learning on your own - less risk of serious accidents (read: dividend cuts)

These companies have already survived several major recessions, raising dividends when others were cutting them

Generally stable businesses selling products we use daily - from toothpaste to medicine

Historically outperformed the broader market with less volatility

The stock price alone is only half the story

Consider this example: a non-dividend tech company might boast an 80% stock price increase over 10 years. Meanwhile, a "boring" dividend payer grew only 40%. Who won?

The answer isn't so obvious. If the dividend company paid a 4% dividend yield annually, and you reinvested those dividends, your total return could actually be 85-90% - outperforming the tech star!

A classic example: Johnson & Johnson. From 2010-2020, its stock price "only" increased about 125%. But including reinvested dividends, the total return exceeded 200%. This difference is the "invisible" part of gains many investors miss by focusing solely on price charts.

How to select the best dividend kings/aristocrats:

Not all crowns shine equally. Here's what to look for:

Dividend payout ratio - what portion of earnings gets paid out? Below 60% is typically the safe zone. A company earning 4 per share and paying 2 has a 50% ratio - a healthy balance between generosity and caution.

Dividend growth rate - would you prefer a 10% raise every year or 50% once every five years? Steady, predictable growth (5-10% annually) usually indicates a well-managed company.

Financial health - companies with low debt and substantial cash reserves can maintain dividends even during economic slowdowns. It's like the difference between a friend with savings and one who's always asking for loans.

Competitive advantage - does the company have something competitors find hard to replicate? Coca-Cola has its formula and brand, Apple has its ecosystem, Johnson & Johnson has thousands of patents.

Brief explanation: Growth investing vs Dividend investing

Many investors believe they must choose between growth stocks or dividend stocks. The reality is more nuanced. While companies that pay dividends often reinvest less in their business than non-payers, many dividend aristocrats have achieved remarkable long-term growth while maintaining their dividend policies.

Companies like Microsoft have transformed from pure growth plays into dividend payers as they matured, demonstrating that the best long-term strategy might be finding companies capable of both increasing their market value and distributing dividends to shareholders.

Investing can be a great balancing act between current income and future growth potential. The dividend aristocrats strategy gives you a bit of both worlds.

The power of reinvestment

Imagine starting with 10,000 invested in a portfolio of dividend aristocrats with an average dividend yield of 3%. In the first year, you receive about 300 in dividends. Not much? Just wait.

If you reinvest their dividends and the companies increase their payments by an average of 7% annually (typical for aristocrats), after 30 years your initial 10,000 could turn into over 100,000 - even if stock prices increase only minimally. That's the magic of compound interest in action.

This is how small amounts transform into serious money.

Sample portfolio for beginners:

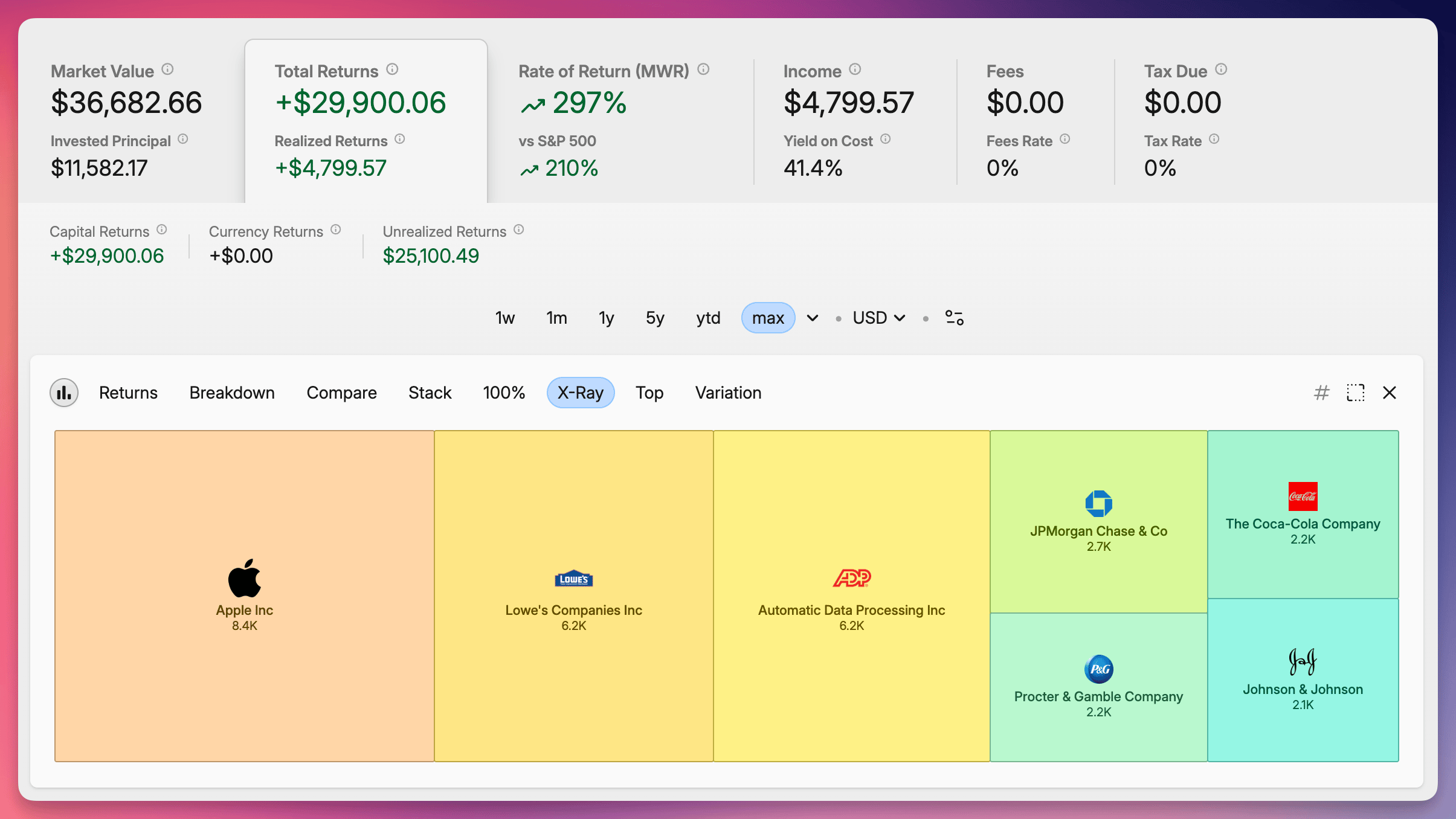

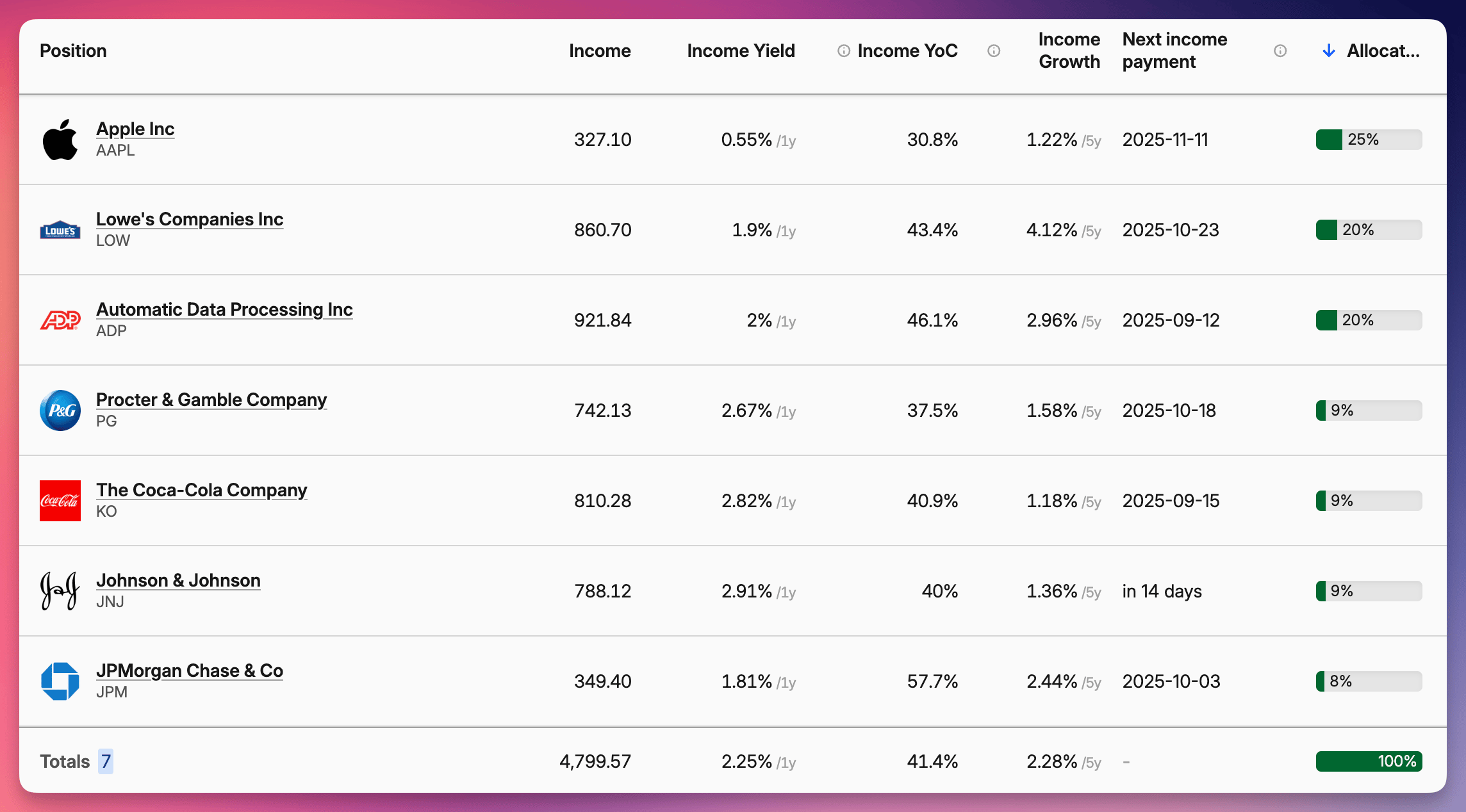

Throughout this article, I've used the example of a beginner's portfolio, who bought the following 5 dividend-paying companies on January 5, 2015, for a total of $10,000, at $2,000 each.

Johnson & Johnson (JNJ) - $2,000 (Healthcare)

Procter & Gamble (PG) - $2,000 (Consumer staples - maker of Gillette, Pampers, Tide)

Coca-Cola (KO) - $2,000 (Beverages)

Lowe's (LOW) - $2,000 (Retail - second-largest home improvement retailer)

Automatic Data Processing (ADP) - $2,000 (Business services - handles payroll for 1 in 6 workers in the US)

Total returns of this portfolio as displayed by Capitally

Total returns of this portfolio as displayed by CapitallyOther American aristocrats/kings worth knowing:

McDonald's (MCD) - has raised dividends for over 40 years, even as eating habits changed

Walmart (WMT) - retail giant that's paid increasing dividends since 1974

Clorox (CLX) - cleaning products manufacturer that shined during the pandemic

Looking outside the America?

Unilever (UL) - British-Dutch giant behind brands like Dove, Ben & Jerry's, and Lipton

Novartis (NVS) - Swiss pharmaceutical powerhouse with dividends growing for over 20 years

Royal Bank of Canada (RY) - Canadian bank that weathered the 2008 crisis better than most American counterparts

Picking individual aristocrats is too daunting?

You're not alone. Check out Dividends forum on Reddit, where thousands of dividend investors share their portfolios, strategies, and lessons learned.

You can also use Capitally to show your portfolio to others.

You can also use Capitally to show your portfolio to others.And the next ETF strategy will tell you how to buy an entire basket of aristocrats in one go 😉

2. Dividend ETFs: The "set it and forget it" approach

If you're just starting, dividend ETFs offer instant diversification across dozens or hundreds of dividend-paying stocks with a single purchase.

How it works: You buy shares of an ETF that specifically focuses on dividend-paying stocks. The ETF manager handles all the stock selection and portfolio management for you.

Why it works for beginners:

Provides instant diversification across many companies

Professional management of the portfolio

Lower risk than picking individual stocks

Often lower fees than actively managed mutual funds

Can start with small amounts (often under $100)

Accumulating vs. Distributing ETFs: Choose your dividend journey

Not all dividend ETFs handle dividends the same way, and this distinction significantly impact your investments.

Accumulating ETFs automatically reinvest dividends paid by companies in the fund. Think of them as compound interest machines working silently in the background. The benefits? You don't pay taxes on these dividends immediately (tax is deferred until you sell), making them truly "set and forget" investments. Your number of shares stays the same, but each share gradually becomes more valuable as dividends are reinvested.

Distributing ETFs pay out dividends directly to your brokerage account, typically quarterly. This creates a regular income stream you can either spend or manually reinvest. The downside? You'll need to pay taxes on these dividends each year, and you'll miss out on some compounding unless you diligently reinvest. However, many investors appreciate seeing that cash flow hit their accounts regularly.

Many ETFs can be found in both versions.

Watch out fot specialized High-Yield ETF strategies

Beyond traditional dividend ETFs, specialized funds have emerged that focus exclusively on generating high dividend yield.

The YieldMax family of ETFs takes an aggressive approach to income generation, often using options strategies to produce monthly income with yields sometimes exceeding 20%.

Funds like TSLY (YieldMax TSLA Option Income ETF) or APLY (YieldMax AAPL Option Income ETF) generate income from companies that may not even pay dividends themselves.

While these funds can produce eye-popping yields, they come with significantly higher risk and often underperform in strong bull markets. They're less about long-term wealth building and more about maximizing current income - perfect for retirees perhaps, but questionable for young investors with long time horizons.

Aristocrat-Focused ETFs:

If you're drawn to dividend aristocrats but don't want to pick individual stocks:

ProShares S&P 500 Dividend Aristocrats ETF (NOBL) - Holds all S&P 500 companies that have increased dividends for at least 25 consecutive years

SPDR S&P Dividend ETF (SDY) - Tracks the S&P High Yield Dividend Aristocrats Index, focusing on companies with at least 20 years of dividend growth

Vanguard Dividend Appreciation ETF (VIG) - While not strictly limited to aristocrats, it focuses on companies with a history of dividend growth

What makes these aristocrat-focused ETFs special is their emphasis on dividend growth rather than just high current yield. This helps investors avoid dividend traps - stocks with unsustainably high yields that often lead to dividend cuts and price declines. The S&P 500 index has historically delivered strong returns, and dividend-focused ETFs often provide more stable returns with less volatility.

How to start:

You can purchase ETFs through any brokerage account with as little as the price of one share (typically $50-150).

Consider setting up automatic monthly investments to build your position over time.

ETFs for European investors

Europeans only have access to so-called UCITS ETFs. Many American ones have a European variant, but watch out - guides often recommend US-based funds not available in Europe. The ones available may differ in composition, currency risks, and results.

3. Dogs of the Dow: The "simple formula" approach

This straightforward strategy involves buying the 10 highest-yielding stocks in the Dow Jones Industrial Average at the beginning of each year.

How it works:

On January 1st, identify the 10 Dow stocks with the highest dividend yields

Invest equal amounts in each of these 10 stocks

Hold for one year

Rebalance on the next January 1st, selling stocks that are no longer in the top 10 by yield and buying new ones that have entered

Why it's beginner-friendly:

Clear, mechanical rules with no subjective decisions

Only requires attention once per year

Focuses on large, established companies

Naturally buys stocks when they're potentially undervalued

This strategy can sometimes concentrate in certain sectors, so be aware of potential lack of diversification!

4. Sector-based approach: The "balanced diet" method

This strategy ensures you're diversified across different economic sectors, each with its own dividend characteristics.

How it works: Build a portfolio with dividend stocks from multiple sectors, recognizing that different industries have different dividend profiles.

Sector breakdown for beginners:

Utilities (e.g., NextEra Energy - NEE): Higher yields, slower growth

Consumer Staples (e.g., Procter & Gamble - PG): Moderate yields, steady growth

Healthcare (e.g., Johnson & Johnson - JNJ): Lower yields, reliable growth

Financials (e.g., JPMorgan Chase - JPM): Variable yields, cyclical growth

Technology (e.g., Microsoft - MSFT): Lower yields, higher dividend growth

Why this works: Different sectors perform differently depending on economic conditions. Having exposure across sectors provides more stable overall dividend income regardless of economic cycles.

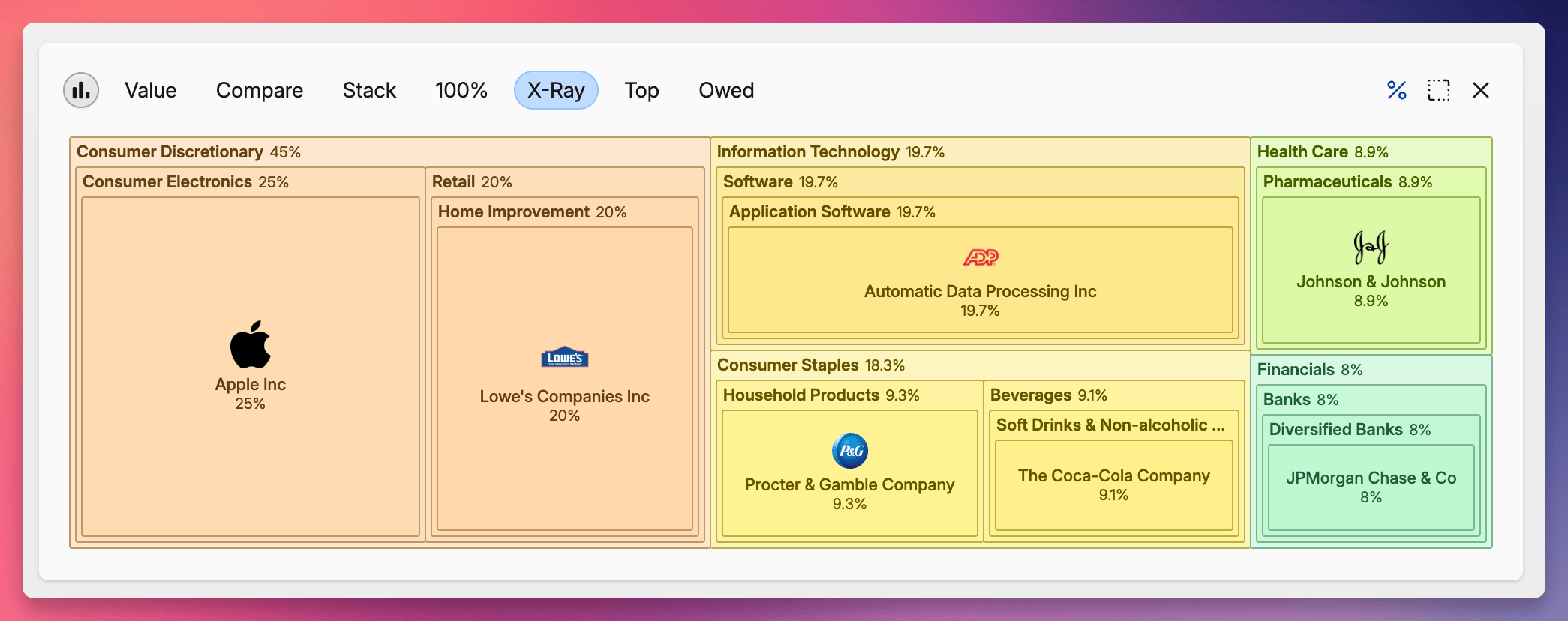

Check your sector allocation

As you build your dividend portfolio, keeping track of sector exposure becomes increasingly important.

Detailed sector allocation as displayed by Capitally

Detailed sector allocation as displayed by CapitallyImagine we add some Apple and JP Morgan stocks, also bought at January 5, 2015.

This means another sectors we invest in. Despite sector diversification is good, because it gives us security, we don't want to accidentally have too much exposure in one sector.

Luckily, Capitally automatically categorizes your holdings by sector, showing you clear visualizations of where your dividend income is coming from. This helps you identify if you're too heavily concentrated in any one area, allowing you to make adjustments before a sector-specific downturn affects too much of your income.

Key takeaways

Dividend quality matters more than yield alone. Focus on companies with sustainable payout ratios, consistent dividend growth, and strong business fundamentals rather than just chasing the highest yields.

Different types of dividends serve different purposes. For beginners, regular cash dividends provide the most predictable foundation for income investing.

Simple strategies work best for new dividend investors:

Dividend ETFs for instant diversification

Dividend Aristocrats for quality and reliability

Sector-based approach for balanced exposure

Or a combination of these approaches

Starting small is perfectly fine. Whether you have $100 or $10,000, the principles remain the same: invest regularly, reinvest your dividends, and maintain a long-term perspective.

Dividend investing combines the potential for capital appreciation with the certainty of regular income - a powerful combination for building long-term wealth. By starting with the simple strategies outlined in this guide, reinvesting your dividends, and maintaining a long-term perspective, you're well on your way to creating a growing stream of passive income that can help fund your financial goals for decades to come.

Your next steps

As you build confidence and knowledge, consider these next steps:

Start tracking your dividend income separately from price movements. This helps maintain focus on the growing income stream rather than daily price fluctuations.

Learn to evaluate dividend safety by understanding financial statements, payout ratios, and cash flow coverage.

Gradually expand your dividend portfolio across different sectors and potentially international markets for additional diversification.

Consider creating a dividend calendar to visualize when your income will arrive throughout the year.

Join dividend investing communities online to learn from others and share experiences.

Remember: The best time to plant a dividend tree was twenty years ago. The second best time is today.

Good luck with your investments!

Frequently Asked Questions

What companies pay dividends?

Not all companies pay dividends. Typically, dividend-paying companies share these characteristics:

Established businesses with predictable cash flows and profits

Mature companies in later stages of their business lifecycle

Companies in certain sectors like utilities, consumer staples, real estate (REITs), energy, and financials

You'll generally find dividends in these types of companies:

Blue-chip stocks: Large, well-established companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble

Utilities: Companies providing essential services like electricity, water, and natural gas

REITs (Real Estate Investment Trusts): Companies that own and operate income-producing real estateConsumer staples: Companies selling essential products people buy regardless of economic conditions

Established financial institutions: Many banks and insurance companies

Why some companies don't pay dividends?

Some companies choose not to pay dividends to reinvest their earnings back into the business for growth. This is common among young, rapidly growing companies in the technology or biotech sectors. While you won't receive dividend income, the potential for capital appreciation may be higher. Assess the company's growth prospects and investment strategies when considering non-dividend-paying stocks.

How companies determine dividend amounts?

Companies don't just pick random numbers for their dividends. The process typically involves:

Analyzing current profits and cash flow

Considering future business needs and investments

Reviewing their dividend history and investor expectations

Getting board approval for the final amount

Most stable dividend-paying companies aim for consistency and gradual growth rather than dramatic changes. They typically target a specific percentage of profits (called the payout ratio) to distribute to shareholders, often between 30-60% for healthy companies.

Compound vs. simple interest: What's the difference for your investments?

Compound interest earns returns on both your original investment AND on previous returns. Your money makes money, which then makes more money.

For dividend investors:

Taking dividends as cash = simple interest

Reinvesting dividends = compound interest

Example: $10,000 invested with 4% dividends over 30 years:

Taking dividends as cash: End with 22,000 (10,000 original + $12,000 in collected dividends)

Reinvesting all dividends: End with $32,400 (47% more!)

This is why reinvesting dividends is so powerful for long-term investors. The longer you stay invested, the bigger the difference becomes.

Reinvest your dividends!

Those impressive market returns you see in financial charts? They assume dividend reinvestment! But dividends don't reinvest themselves - they sit as cash in your account unless you take action.

For hassle-free compounding, consider setting up a Dividend Reinvestment Plan (DRIP) with your broker. DRIPs automatically purchase additional shares whenever you receive dividends, often commission-free. Many major US-based brokers (Fidelity, Schwab, Vanguard) offer this feature with a simple account setting change.

Buying an Accumulating ETF is an equivalent of a DRIP account.

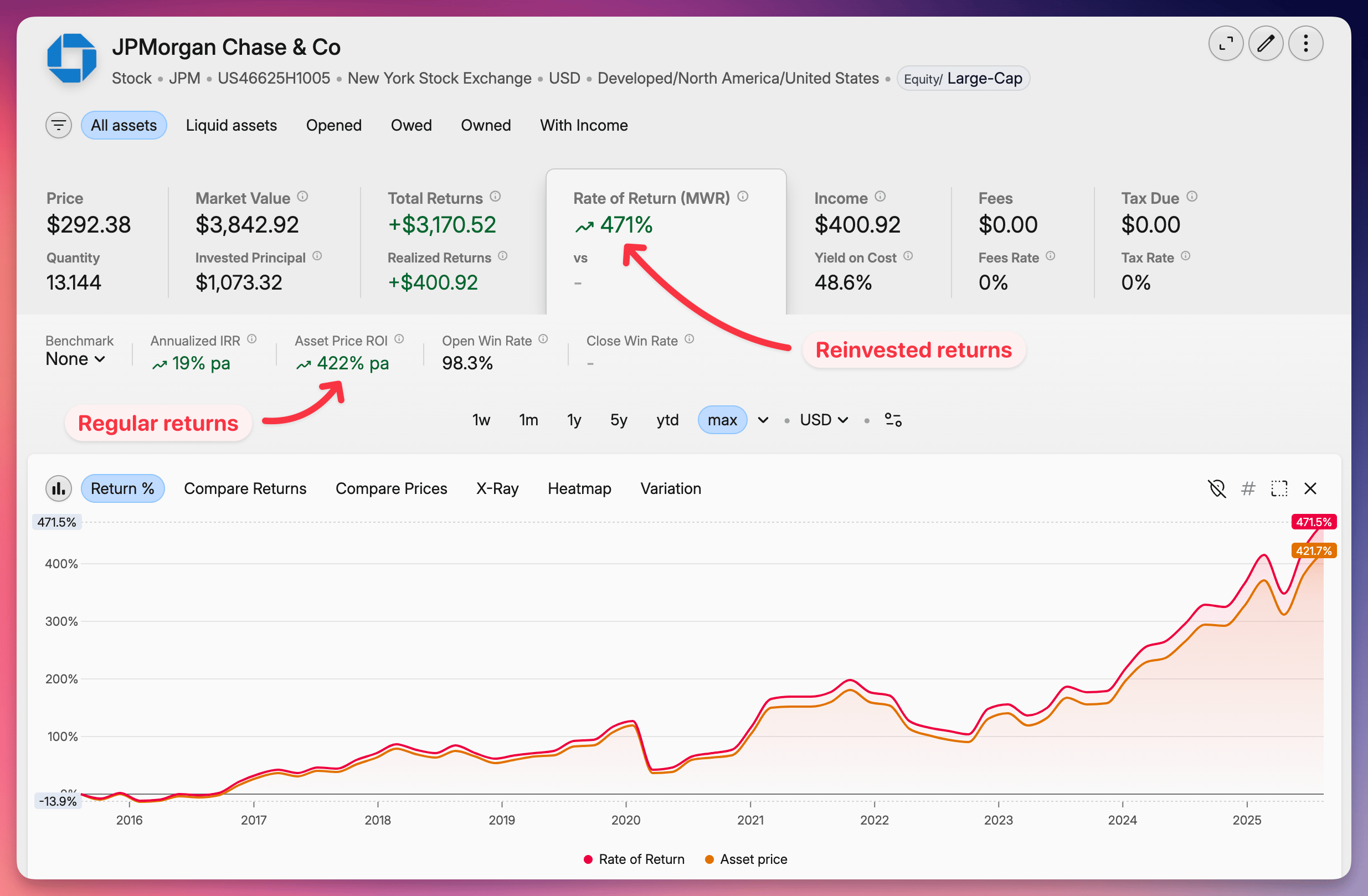

Difference in returns between paid out and reinvested dividends in Capitally

Difference in returns between paid out and reinvested dividends in Capitally