Are you staring at charts, feeling lost about whether your investments are actually performing well? You've bought some stocks, maybe a mutual fund or ETF, but now you're wondering, "Am I really making money?"

While investing is the first step, observing and understanding your results is what separates successful investors from those who just hope for the best. But you don't need a finance degree or expensive investment advice to manage that.

This guide will show you exactly how to use platforms to track all your investments in one go. At Capitally, we help investors get clarity and confidence about their money without needing a professional fund manager. By the end of this guide, you'll learn how to monitor your stocks, bonds, real estate, and other assets - all in a way that matches your strategy. Whether you're a long-term investor checking twice a year or someone who prefers more frequent updates, the goal is staying informed without without spending too much time on it.

We've structured this article in a logical order – from the basics to more advanced concepts – but feel free to jump ahead to the sections that matter most to you :)

Table of Contents

- Ignoring Tracking Your Investment Portfolio Costs You Money!

- Beyond Stock Prices: Different Types of Data That Actually Matters

- Category 1: Performance metrics

- Category 2: Asset allocation

- Category 3: Dividends and income

- Category 4: Fees and expenses

- Category 5: Tax implications

- Common Mistakes in Investment Tracking

- Mistake 1: The Price-Only Trap

- Mistake 2: The Daily Checking Obsession

- Mistake 3: The Forgotten Dividends Error

- Mistake 4: The Total Neglect Risk

- Essential Metrics for Portfolio Performance

- Total Return – The Absolute Must-Know Metric

- Secret Power of Money-Weighted Return (MWR)

- Compare Your Strategy with the Right Benchmark

- Understand Volatility – The Key to Staying Calm With Investments

- How to Track All Investments in One Place? Ways to Monitor Investments and Track Your Portfolio

- Traditional Excel Spreadsheet

- Take a Glimpse on Digital Portfolio Trackers!

- 1. Brokerage and Bank platforms: more than financial goal tracker

- 2. Stock tracking apps: latest news to help you track stock portfolio

- 3. Fully automated tracker apps

- 4. High-fidelity platforms

- From Just Tracking to Managing: A Smarter Way to Track Your Net Worth

- 1. Specific Goal

- 2. Strategy

- 3. Execution

- 4. Optimization

- Ready to Choose Your Investment Portfolio Tracker?

Ignoring Tracking Your Investment Portfolio Costs You Money!

Some people think that tracking portfolio means is about watching numbers fluctuate. But the truth is it's much more about strategically balancing your asset allocation to align with your financial goals.

Sounds complicated? For the beginning, think about it as your financial GPS - it's not just about knowing what you own, but using an investment tracker to understand if you're actually moving in the right way. Without measuring, you're essentially driving blindfolded, hoping you're heading in the right direction.

Fortunately following your portfolio effectively doesn't require you to become a spreadsheet wizard or spend hours crunching numbers. It all comes down to watching a few key elements...

Fortunately following your portfolio effectively doesn't require you to become a spreadsheet wizard or spend hours crunching numbers. It all comes down to watching a few key elements...

Beyond Stock Prices: Different Types of Data That Actually Matters

Let's break down the five key categories of data that matter most for your investment measuring. Think of these components as vital signs for your financial health - they tell you if your approach is thriving or needs some attention:

Category 1: Performance metrics

Outcome metrics reveal the ultimate truth about your investments - beyond the simple ups and downs you see in your brokerage app. These numbers cut through the noise to show if your $1,000 investment from last year really grew into $1,100, or if inflation ate away those gains, leaving you with less purchasing power than when you started. They're the difference between feeling good about a 10% return and realizing that the market overall grew by 15% during the same period.

Remember, that green arrows in your investment app only tell part of the story. Performance metrics show if your money is really working as hard as it should, within the risk you are comfortable with 📈

In the next section Essential Portfolio Metrics you will find out which metrics actually matter the most.

Category 2: Asset allocation

It’s fancy-speak for "what you own and how much of each thing."

Asset allocation simply means understanding what percentage of your money goes into different types of investments. Some of your wealth might be in:

stocks for growth potential,

bonds for stability

real estate usually the biggest part of most portfolios. While many see their home just as a place to live, treating it as an investment has advantages:

Property often grows in value over time

Mortgage payments build equity

Property can protect against inflation

Tax benefits in many countries

If you have more properties, you can earn rental income (and easily monitor it as part of your wealth).

gold, crypto or other investments to diversify further

Getting this mixture right matters because it directly impacts how much your portfolio could grow and how much risk you're taking on. While a stock-heavy portfolio might offer better growth potential, it also means dealing with bigger market swings along the way.

Category 3: Dividends and income

If you dream of passive income, earning money for you even when you sleep, this metric will be crucial for you.

Dividends are like your portfolio's paycheck. They provide a clear measure of your portfolio's ability to generate ongoing returns, beyond just price appreciation. Understanding your dividend income - how much you receive, how often it comes in, and whether it's growing over time - gives you concrete insight into your portfolio's income-generating potential. This becomes particularly valuable whether you want to achieve financial independence or create a steady income stream from your investments.

Category 4: Fees and expenses

Fees are the silent money-drainers of your portfolio. Even small percentages can significantly impact your returns over time. Consider this: a 1% annual fee on a $10,000 investment means $100 lost in the first year, but over 20 years - assuming a 7% market return - those fees would cost you over $6,600 in total returns. That's 17% of your potential wealth gone to fees!

By observing these costs, you can spot where you're paying too much and make smarter choices about where to place capital.

Category 5: Tax implications

Finally, there's the tax piece of the puzzle - where smart managing can save you serious money and significantly enhance your net worth.

For example, selling an investment after 11 months versus waiting one more month for the one-year mark can mean paying 35% instead of 15% in taxes on your gains. On a $5,000 profit, that's the difference between keeping $4,250 or just $3,250 - a full thousand dollars saved just by recording your holding periods!

Smart tax watching puts more money in your pocket. Knowing when to sell, what to hold, and how dividends affect your taxes can save you significant amounts each year.

Common Mistakes in Investment Tracking

Mistake 1: The Price-Only Trap

Many new investors make the mistake of focusing only on stock prices, but this gives a dangerously incomplete picture. Here's why: imagine you bought 100 shares of a company at $20 each ($2,000 total). A year later, the price is $22. Looks like a 10% gain, right? Not necessarily. Let's look at the complete picture:

Price increased from $20 to $22 (+$200)

You paid $50 in trading fees

The company paid $0.50 per share in dividends (+$50)

Inflation during this period was 4% (-$80)

Your broker charges a 0.5% annual fee (-$10)

So while the price gain suggests you made $200 (10%), your actual real-world gain was $110 (5.5%). Checking price-only misses all these crucial elements that impact your true returns. Real portfolio tracking gives you the complete picture: how much money you've actually made (or lost), whether your investments are growing faster than inflation, and if your strategy is working or needs adjustment.

Mistake 2: The Daily Checking Obsession

One of the biggest traps? Obsessing over daily price changes. Imagine you check your weight every hour. Wouldn't it drive you crazy?

It is the same with constantly checking the value of investments. Many beginners compulsively check their investments multiple times a day, leading to stress and potentially hasty decisions. Instead, set a regular schedule for portfolio reviews, maybe monthly or quarterly, to spot actual trends rather than daily noise.

Mistake 3: The Forgotten Dividends Error

Many investors also fall into the trap of ignoring reinvested dividends in their calculations. Say your shares pay dividends that you automatically reinvest - if you don't count these reinvestments, you're missing part of your actual returns. You're also missing a way to easily track your overall gains. It's like forgetting to count your spare change - it might seem small, but it adds up over time, affecting your overall net worth.

Reinvesting dividends is a powerful way to grow your investments. If you forget to do that, you're leaving your money sleeping on a couch. Don't let your dividends sit idle! Many brokers offer automatic dividend reinvestment at no extra cost - it's a simple way to make your money work harder.

Mistake 4: The Total Neglect Risk

Finally, there's the "set it and forget it" mistake. You might say “But I’m the long-term investor!”. Well, while long-term investing is great, completely ignoring your portfolio for years isn't.

Long-term investors sometimes forget there’s a pretty good chance the strategy they took, or the way they execute it, is not doing the job they intended it to do. Verifying this helps you stay on the right path.

Even if your strategy is a gem, your investment mix naturally changes over time as different investments grow at different rates. For example, if stocks perform exceptionally well, they might grow from 60% to 80% of your portfolio - exposing you to more risk than you planned. That's why occasional portfolio reviews matter: to keep your investment strategy aligned with your goals.

Essential Metrics for Portfolio Performance

That moment had to come finally…now we’ll dive into the numbers that really matter for your portfolio. But don't worry, we'll keep it as simple as possible.

Total Return – The Absolute Must-Know Metric

If you were to measure only one metric, it should be Total Return (TR). It shows everything you've earned, not just whether your stock price went up. What’s the difference? Say you bought a stock for $100, it's now worth $110, and you got $5 in dividends along the way. Your total return isn't just the $10 price increase - it's $15 in total. This single number tells you exactly how much money you've made from your investment. Of course, remember that you have to reduce it by fees and taxes.

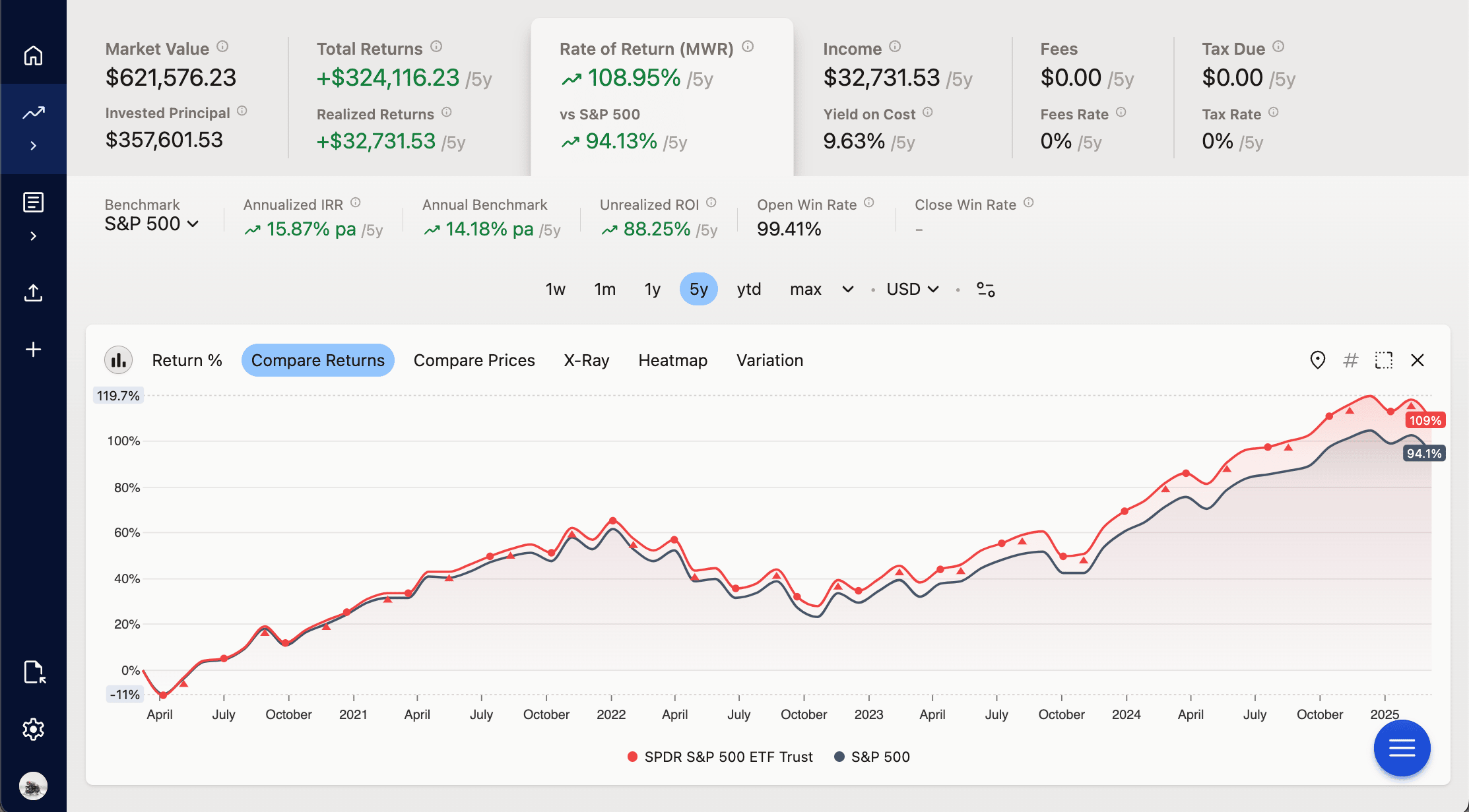

Secret Power of Money-Weighted Return (MWR)

Money-Weighted Return (MWR) shows how well your investments performed when you add or withdraw money over time.

Here's a simple example: You put $1,000 into stocks in January, add another $500 in March, and by December your account shows $1,800. How much did you actually earn? At first glance, you made $300 ($1,800 minus $1,500). But that's not accurate because your $1,000 was invested for the full year while the $500 only for nine months.

MWR calculates your true return by considering when each dollar was staked in. It might show your actual return was 15% - higher than the simple calculation suggests. This matters because it helps you tell the difference between good investment results and just adding more money to your account.

Let's compare your investment from the previous example with a savings account: Imagine you put the same $1,000 in January and $500 in March into a savings account with 5% annual interest. By December, you'd have $1,575 ($1,000 × 1.05 + $500 × 1.0375). Your investment account has $1,800, which is $225 more. MWR tells you your investments earned about 15% compared to the savings account's 5%. This clear comparison helps you decide if the extra risk of investing is worth it. Generally speaking, if your strategy beats safer alternatives in the long-term, that's fine. If not, perhaps you need to reconsider your approach.

In this article, we show you how to easily count MWR from a ready-made formula!

Think of MWR as your personal investment scorecard - it measures your specific journey, not just the final number in your account.

Compare Your Strategy with the Right Benchmark

When it comes to benchmark comparison, think of it as having a measuring stick for your investments. If your U.S. stocks went up 10%, that sounds great - until you learn that the overall market went up 15%. It's like knowing not just your test score, but also the class average.

Common benchmarks include market indexes. If you mainly invest in the US, you should look at S&P Total Return. If you are diversified around the world - MSCI World would be better.

But if you have a typical 80/20 stock to bonds mix, it's better to compare yourself to V80A (Vanguard LifeStrategy 80%)

What's the difference between S&P 500 Index vs S&P 500 Total Return?

When comparing your investment performance to the market, choosing the right benchmark makes a big difference.

The S&P 500 only shows how stock prices changed. The S&P 500 Total Return shows how much money you would actually make if you reinvested all dividends back into the index. That's it - that's the entire difference. The Total Return version just assumes you put every dividend payment back into the market instead of spending it.

Choose as benchmark the basic S&P 500 when:

1. You regularly withdraw dividends instead of reinvesting them

2. You want to compare just the price appreciation of your stocks

3. You're focusing on growth stocks with low dividends

Use the Total Return index when:

1. You reinvest your dividends automatically

2. You want to measure your portfolio's true performance

3. You hold dividend-paying shares or funds

4. You're evaluating long-term investment performance

Most individual investors should compare their returns to the S&P 500 Total Return because it better reflects how most people invest - keeping and reinvesting their dividends. It's more honest about what you could earn from a simple index fund.

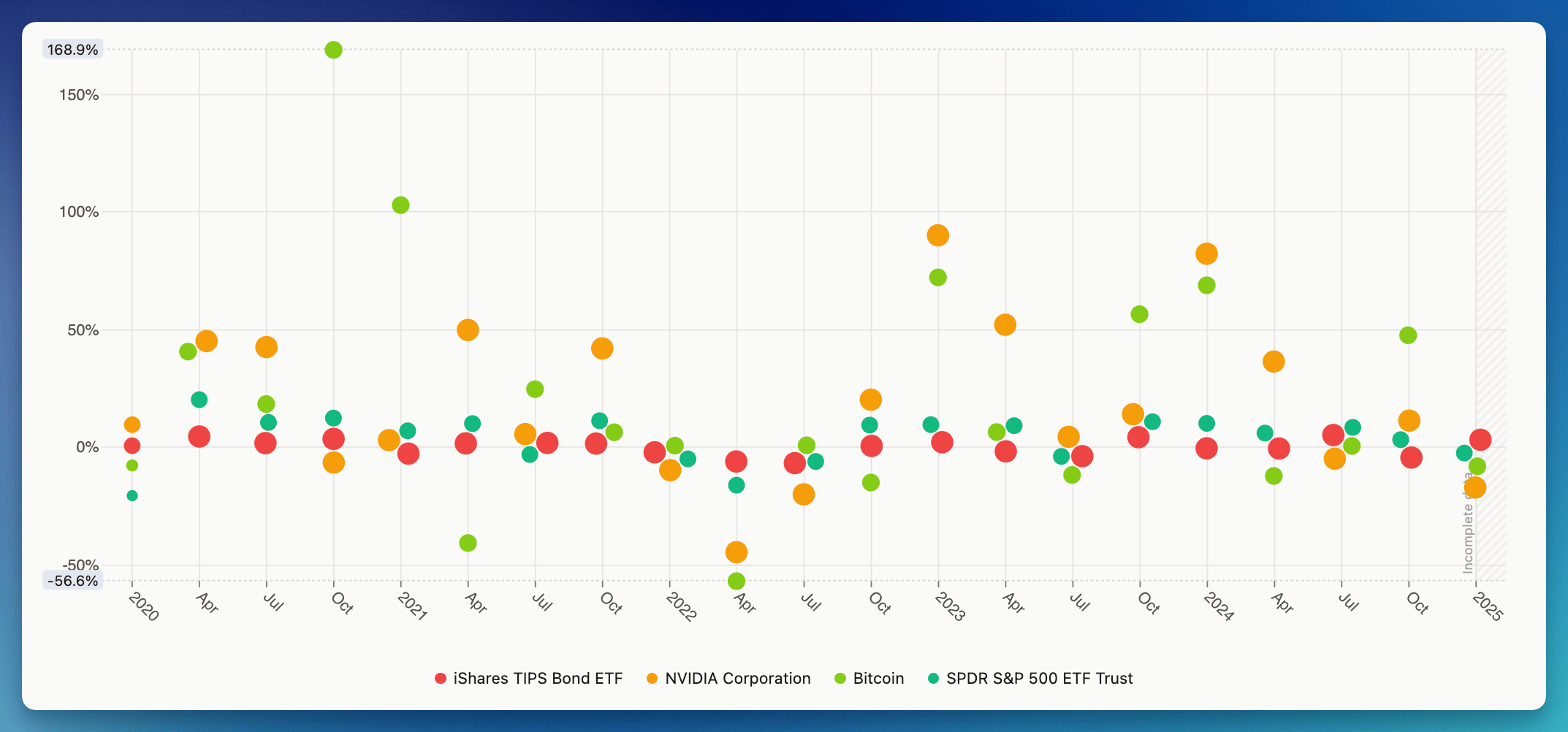

Understand Volatility – The Key to Staying Calm With Investments

Imagine checking your investment worth over time. With some investments, the value changes very little - maybe your $1,000 investment moves up or down by just a few dollars each month. That's low volatility. It's predictable and steady, which is typical for bonds and that’s why many people put money in them.

Returns volatility comparison between Bonds, Single stock, Crypto and SPY500 (in Capitally) - would you survive a 50% loss?

Returns volatility comparison between Bonds, Single stock, Crypto and SPY500 (in Capitally) - would you survive a 50% loss?

But other investments might bounce around a lot more. One day your $1,000 could be worth $1,100, the next week it might drop to $900, then jump back up to $1,050. That's high volatility - common with crypto or stocks, especially small companies but not only. In 2022, Tesla stock swung from $400 to $200 within just a few months. Meanwhile, a typical government bond fund might have moved just a few percentage points during the same time

There are rare periods of higher volatility even on bonds!

If it happens to the bonds you put money in, stay calm because it's natural. If you're looking for less volatile assets, take an interest in retail bonds (typically government), which are not traded on the stock market.

Knowing the volatility of your investments helps you:

Avoid panic selling when big drops happen

Choose investments that match your comfort level and risk tolerance

Understand what's normal for your type of investment

Make better decisions about mixing different investments together

The key is diversification. Pick assets with a level of volatility that lets you stick to your plan without losing sleep. If checking your investment value and seeing it down 20% would make you want to sell everything immediately, you might want to choose less volatile investments.

Remember, you don't need to master all these metrics right away. Start with total return and gradually add others as you get more comfortable. The goal isn't to become a math whiz - it's to understand your investments well enough to make good decisions.

How to Track All Investments in One Place? Ways to Monitor Investments and Track Your Portfolio

Let's look at how you can track your investments, starting with the most basic approach that the world knows.

Traditional Excel Spreadsheet

Many investors begin tracking with spreadsheets, and for good reason. Spreadsheets offer several key advantages that make them an excellent starting point:

Complete control over your data and calculations

Flexibility to customize managing to your specific needs

Easy to understand your own calculations

No dependency on external services

Free to use with basic office software

Great for learning investment basics

Simple to start and expand over time with investment tracking tools.

Works offline!

For investors with simple portfolios or those just starting out, spreadsheets can be an effective solution. As your investment knowledge grows, your tracking methods can evolve too.

You may think of spreadsheets like using a paper map - they still can get you where you need to go, but there are more efficient modern alternatives outside. We'll explore spreadsheet observing in detail in our upcoming comparison article, but for now, let's just say they're a common starting point for many investors.

Take a Glimpse on Digital Portfolio Trackers!

Modern tools can help you tracking your investments as easy as checking your social media feed. Imagine having a personal financial assistant and investment advisor that automatically records all your investments, calculates your returns, and alerts you to important changes. If you invest in many currencies, in more than 1 asset or through more than 1 broker, they will probably be more useful to you than Excel.

No more manual complex calculations; these tracker apps do the heavy lifting for you.

We've organized them from the simplest solutions to more comprehensive ones so you can easily choose the best for you:

1. Brokerage and Bank platforms: more than financial goal tracker

Perfect for beginners and those investing only through a single broker. These platforms offer several advantages:

Everything in one place: your checking account, savings, and investments

Familiar interface you already know how to use

No need to set up additional accounts or services

Usually free if you're already a customer

Simple enough to start tracking investments without feeling overwhelmed

Good basic reports for understanding performance

They might be connected to your bank, serving as both a budgeting tool and financial goal tracker while also counting your monthly expenses.

However, they aren't designed to manage your portfolio if you have investments across multiple brokers or need detailed performance analysis. For simple financial journeys where your investments live alongside your checking account, brokerage platforms offer a convenient starting point with minimal effort.

2. Stock tracking apps: latest news to help you track stock portfolio

These focus on real-time data from stock markets and deliver the latest news and trading signals. They're great for:

Instant stock prices and quick updates

Technical charts and pattern indicators

Company-specific news alerts

Suggestions on when to buy or sell

These apps help active traders track stock portfolio changes minute-by-minute and manage frequent trades.

But if you're new to investing or focused on long-term growth, be careful. Taking a glimpse too often can lead to emotional decisions and unnecessary trading. Research shows that constantly checking your investment management tools often results in poorer performance. These apps typically don't show important long-term metrics like asset allocation, tax implications of capital gains, or dividend income based on your trades.

For those investing toward retirement or other future goals and risk levels, these quick-update tools might actually damage your returns by tempting you to make too many trades. They excel at showing what happened in the last five minutes but rarely help you understand if the trades you made align with your long-term financial plan.

3. Fully automated tracker apps

These tools connect to your multiple investment accounts to monitor your investment portfolio automatically. Perfect for investors using several brokers who want everything in one view without manual entry. They bring all your investments - shares, funds, ETFs, cry- into a single dashboard.

The main selling point is convenience - track your portfolio in one place with automatic updates, analytics, and visual reports. Both free and paid versions save you the hassle of logging into multiple accounts. However, they have important limitations. Auto-imports often contain mistakes you'll need to fix manually anyway. Most only import recent history (3-12 months), making it hard to see how your portfolio would have performed long-term. They typically can't include real estate or private investments, leaving gaps in your wealth picture.

Data quality can be a serious issue - errors in imported information lead to misleading analysis of the performance of your investments. The app also might only show basic overviews without important details, and often calculate returns less accurately than specialized tools.

Privacy is another concern. To track performance automatically, you must share your broker login details with the service. While they use security measures, you're still giving a third party access to sensitive financial data.

Despite these drawbacks, automated trackers can help you monitor your investment portfolio effectively if you have straightforward investments across multiple accounts. They're less ideal if you have complex tax situations, significant non-traditional assets, very old positions, or strong privacy concerns.

4. High-fidelity platforms

These investment portfolio tracker solutions deliver more accurate analysis, though they require more manual setup at first. Unlike automated services, they let you import your complete history, not just recent transactions. The biggest benefit? Control. You can verify and correct data yourself, ensuring your analysis uses accurate information. This quality-first approach means you can truly trust the insights you receive.

High-fidelity platforms help you manage and monitor your complete financial picture. You can include everything at once - stocks, bonds, real estate, private holdings, collectibles, track NPS balance, track ESOPs, and even debts like mortgages. This creates a comprehensive view of your wealth, not just scattered pieces.

The sophisticated features reveal patterns that basic tools miss. You can see tax implications, understand what's driving performance, and help you plan different strategies - similar to having professional guidance without the cost.

These comprehensive platforms are ideal for:

Investors with multiple brokers and diverse asset types

Long-term investors wanting precise performance metrics

Privacy-conscious people avoiding third-party account connections

DIY investors willing to invest time upfront for better long-term insights

Tech-savvy users who appreciate advanced features

Tax-focused investors needing complete historical records

With these tools, you can see exactly how your portfolio is performing while maintaining complete data control. You also have the option to enter all information manually if privacy is your priority.

Remember, you don't have to stick with your first choice forever. Many investors begin with simpler tools and gradually upgrade to more comprehensive solutions as their needs evolve. The key is finding a way to track your investments consistently, whatever method you choose.

From Just Tracking to Managing: A Smarter Way to Track Your Net Worth

As we said, many people focus solely on stock prices, but successful investing requires a broader view. Portfolio management brings together all aspects of your investments into a clear strategy that works for you. But before you can smartly manage your investments, you need 4 key elements:

1. Specific Goal

Forget vague ideas like "making money" - your goals need to be specific. Consider these examples:

I need $50,000 for a home down payment in five years

I want to build a $1 million retirement fund by age 60

I'm aiming for $2,000 monthly passive income from dividends by age 50

These clear targets will shape every investment decision you make. For instance, the down payment goal might lead you toward more conservative investments since your timeline is shorter, while the retirement goal allows for more growth-oriented choices.

2. Strategy

Once you know where you're headed, you choose the right mix of investments to get there. This article by Vanguard will tell you how to easily choose the right assets.

If you’re just beginning, you also For beginners, you don't need a custom-made strategy. Popular approach will be more than enough for you. Bankrate did a great job describing the 5 most popular strategies for individuals, so start by reading their article.

Your strategy needs to match the market you're investing in, your age, and the currency you earn and spend in. Younger investors can take on more risk with more stocks, while those approaching retirement might want a safer approach. Equally important is your base currency - if you earn and spend in euros, having too much invested in dollar-based assets adds currency risk to your portfolio.

The Age-Based Portfolio Rule

The simplest way to decide how much to invest in stocks is the "100 minus your age" rule. This suggests that the percentage of your portfolio in stocks should be 100 minus your current age. The rest goes into safer investments like bonds.:

If you're 30 years old: 100 - 30 = 70% in stocks, 30% in bonds

If you're 60 years old: 100 - 60 = 40% in stocks, 60% in bonds

Nowadays some advisors suggest using 110 or even 120 instead of 100 because people are living longer today. This gives you more growth potential throughout retirement. Whatever number you choose, this rule offers a simple starting point that automatically becomes more conservative as you age.

3. Execution

This is where you put your strategy into action and begin overseeing your investments. Tracking isn't just collecting data - it's about verifying you're making progress toward your goal.

For instance, if your goal requires a 6% annual return but results show you're only achieving 4%, you can make adjustments early rather than discovering the shortfall years later.

4. Optimization

A good tracking tool helps you find ways to improve your investments. It can show you:

When your mix of investments has changed because some grew faster than others

If you're paying too much in fees compared to similar options

Which pieces of your whole wealth aren't performing as well as they should

With proper tracking, you might discover that too much of your money is in one type of investment, letting you spread it out better to reduce risk without sacrificing returns.

Or you might confirm that your simple 80/20 approach is on track and requires only small adjustments once a year using an investment tracker. That’s fine too! Either way, you'll know for sure.

Ready to Choose Your Investment Portfolio Tracker?

As you can see, choosing the right tool to monitor investments is crucial. It will allow you to test your strategy, help you persevere when stock markets starts fluctuating, and simplify rebalancing.

But understanding what to follow and why is even more important! Without clear purpose, even the best platform becomes just another dashboard with meaningless numbers. The metrics you use to analyse your portfolio should directly connect to your investment goals and help you make better decisions.

The key is finding a solution that lets you see your entire investment portfolio while matching your personal habits - because the best method is the one you'll actually use consistently. Many of our FAQs from users center around this exact challenge. Your tool should let you track stocks while you also monitor bonds, real estate, and other assets that make up your overall portfolio.

Good luck with your investments!