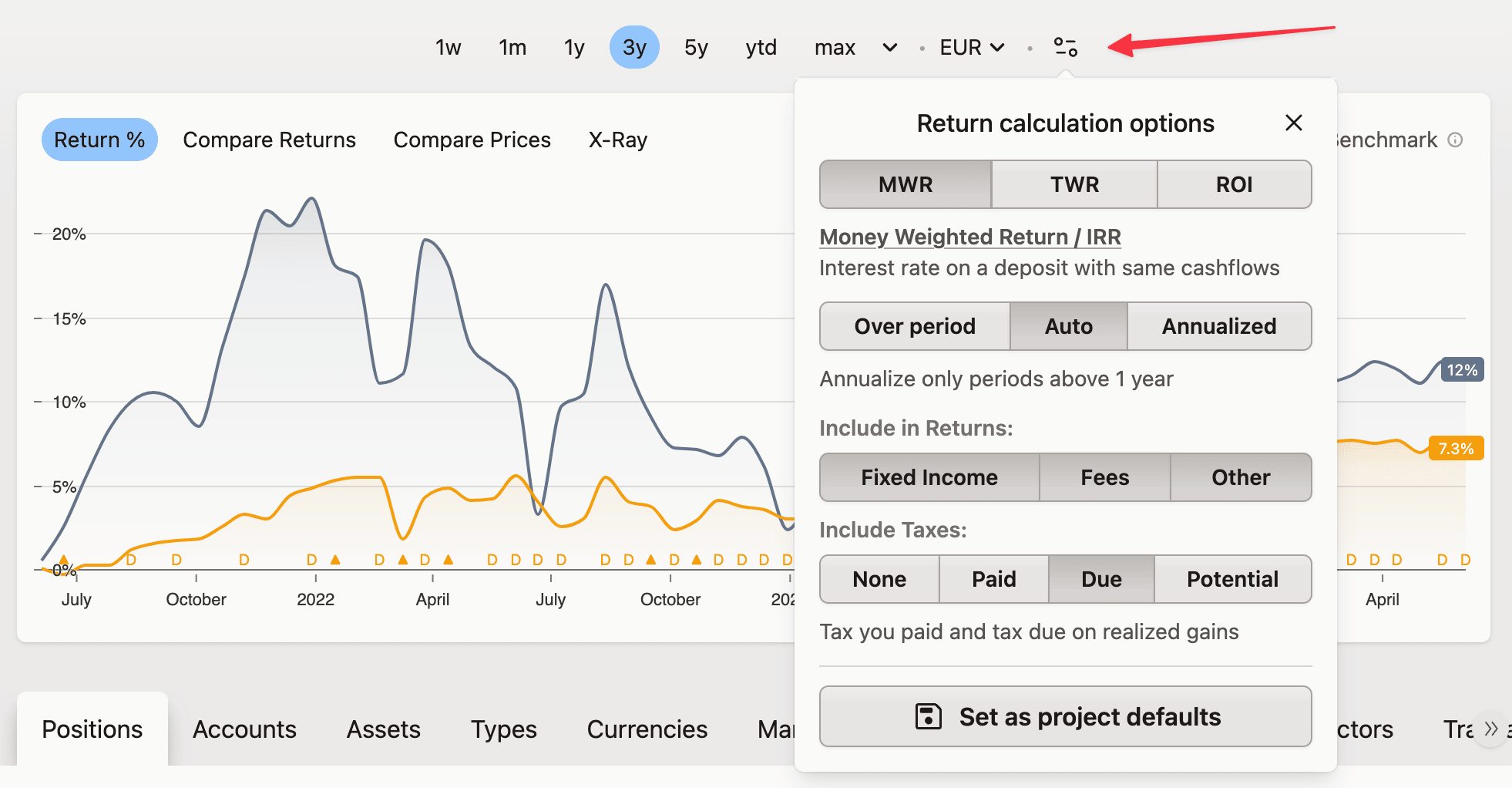

This update gives you even more control over how portfolio returns are calculated and refines some aspects to make it more accurate.

There are two new articles that describe how these work: Calculating returns in help and Measuring Investment Performance on our blog.

Improved Time Weighted Return

TWR should remove all investor actions from returns. Previously buying or selling at a discount was included in TWR. Now it's entirely removed and only the closing prices are used for calculation.

By using TWR and excluding Taxes, Fees and Other you now how a great Rate to compare your asset allocation strategy with benchmarks.

Improved cashflows in Return on Investment

ROI simply compares cashflows coming in & out of position. Previously however, if you reinvested money from a closed position, it would be counted twice, making the return much lower than it should be. The cashflows are now tracked to mitigate this.

Annualized returns

You can now choose to annualize any Rate of Return. We recommend using the Auto option as it will annualize only periods above 1 year.

All the rates will be annualized, including Price rates and Benchmarks.

Excluding Fixed Income and Other transactions

You can now exclude Fixed Income and value changes reported in Other transactions. This will be reflected in Return, Realized Return, Capital Return and Rate of Return.

If Fixed Income is excluded, it will be removed from benchmarks that are based on assets as well.

General improvements

IRR is now more accurately called MWR

The options selector and description popups have been completely overhauled, hopefully educating you on what the choices mean and what is enabled.

The Returns tab will now be labeled with appropriate metric name, so you can understand at a glance what returns are enabled. You will see Total Returns, Nominal Returns, Total A-tax Returns and so on.

As always, you can change the calculation options in the Settings -> Analysis or on the Portfolio page