StockMarketEye - a pretty popular investment tracker just announced it will shutdown operations on 26th September leaving it's users mere weeks to download their data and find a replacement.

Are you one of those affected? You might be feeling a bit unsure about which alternative to adopt for your investment tracking needs. I get it. However, as the saying goes, when one door closes, another one opens. This guide aims to provide an objective overview of five alternative investment tracking tools worth considering as you embark on finding a replacement. Each option brings its own unique strengths and limitations to the table. I will analyse them in alphabetical order:

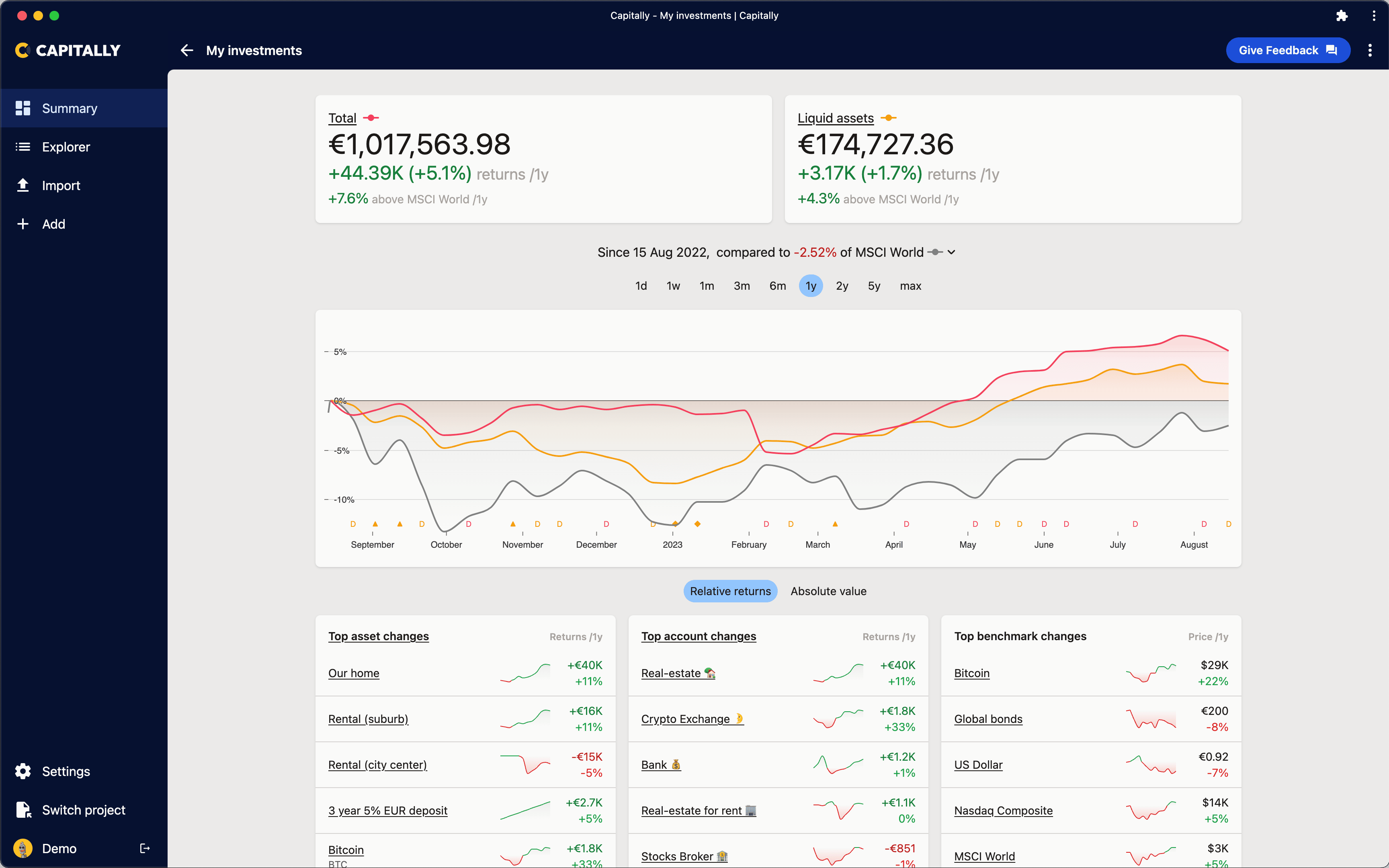

- Capitally shines with ability to cover any portfolio and focus on privacy.

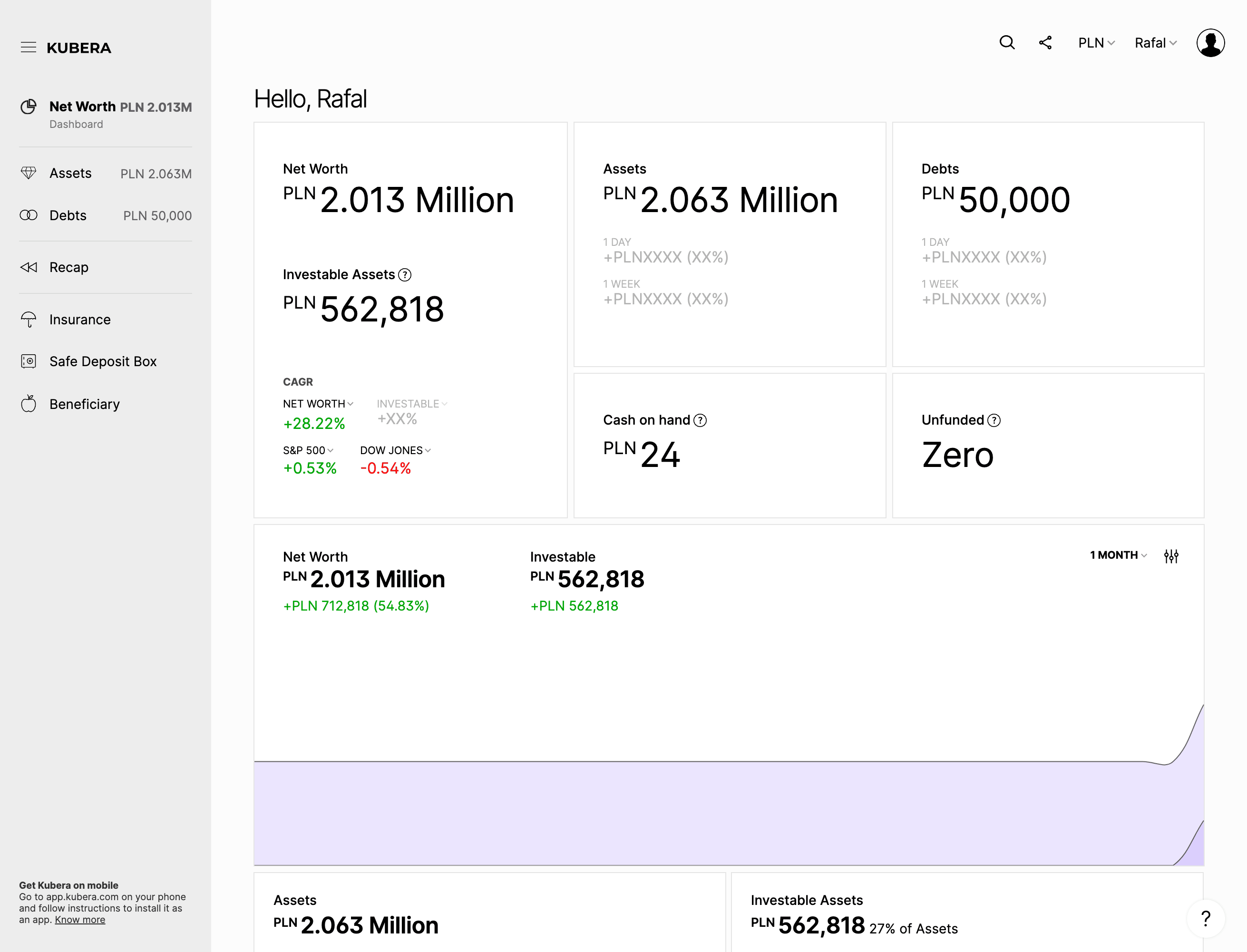

- Kubera offers a refreshingly simple and user-friendly experience.

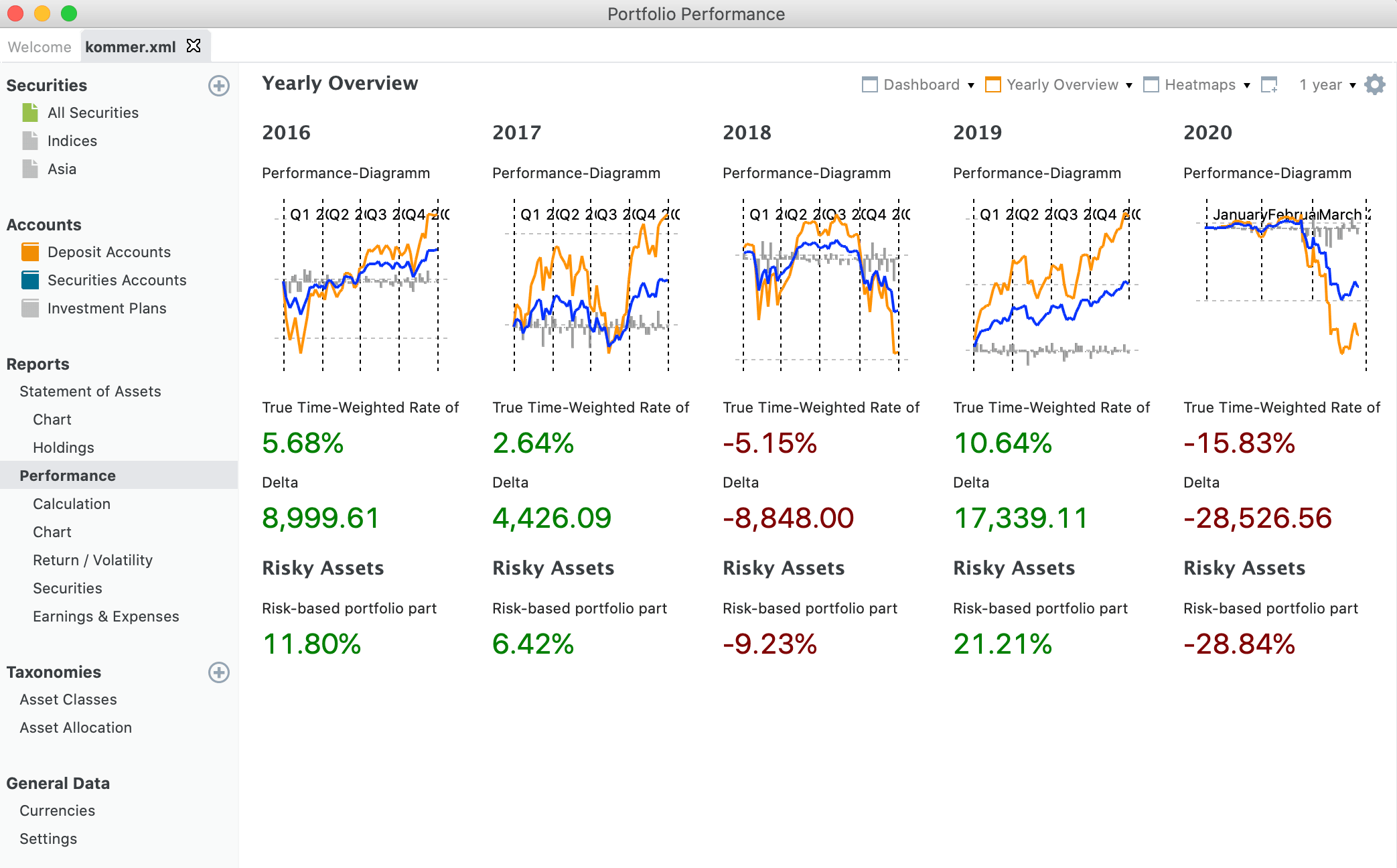

- The open-source Portfolio-performance grants advanced users unmatched control for free.

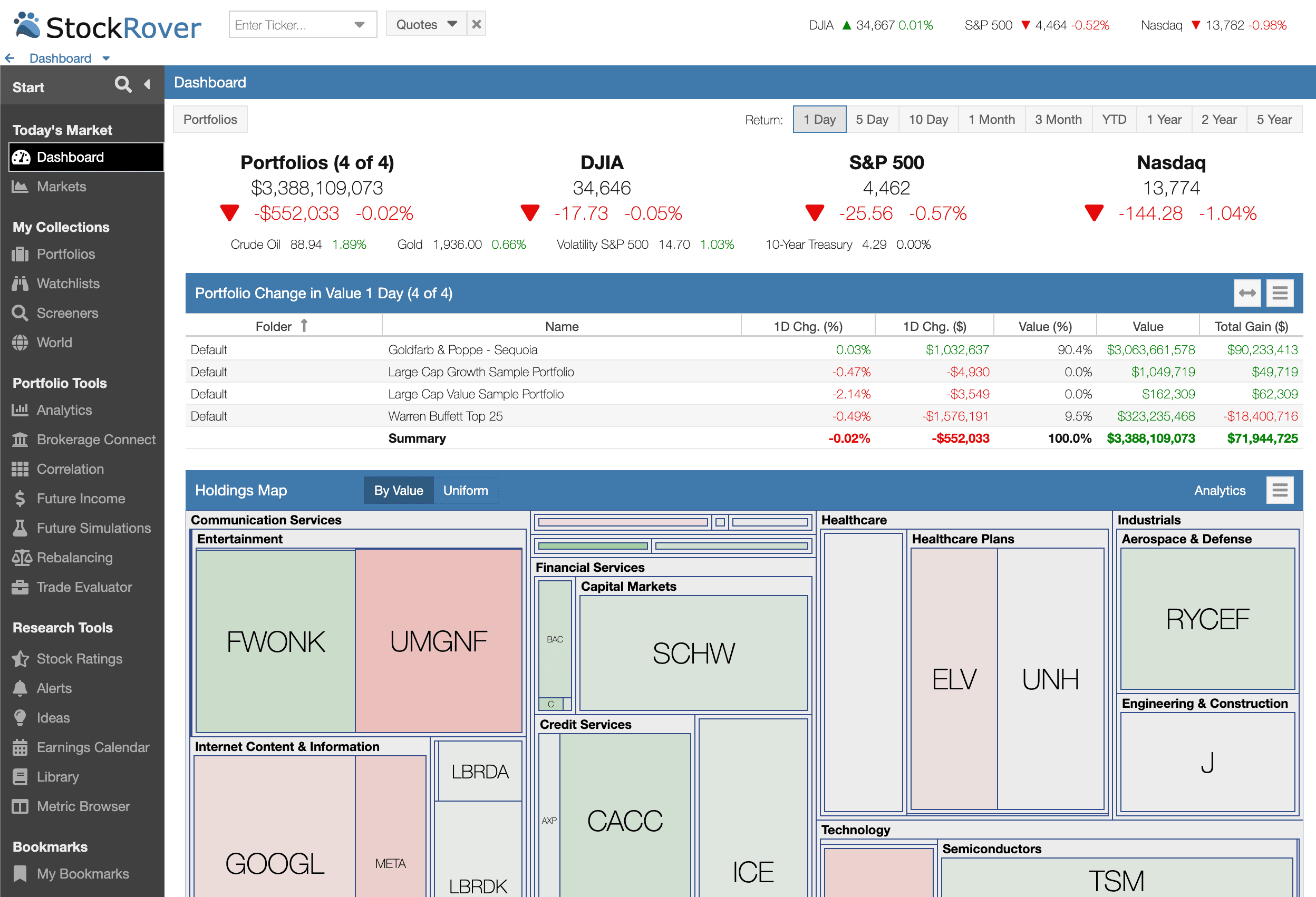

- Stock Rover provides unparalleled access to US stock fundamentals and charts.

- And Sharesight is arguably the leader when it comes to detailed tax reporting.

In the interest of full transparency, I want to note that I am the founder of Capitally, one of the apps featured in this guide. My aim is to analyze all the options in a fair and balanced manner. I believe Capitally brings unique strengths to the table, but I recognize it may not be the ideal fit for everyone.

Table of Contents

Figuring Out Your Portfolio Management Needs

Before we forge ahead, it's essential for you to clearly define what you expect from an investment tracker. This really comes down to the type of investor you are. Do you build your own stock portfolio or passively invest in index funds? Are you a set-it-and-forget-it investor or more hands-on? Are you focused on the US markets or investing globally? How important is privacy and encryption to you? Asking yourself these questions will help zero-in on the investment companion that is the right match for the next step in your financial journey.

There's no one-size-fits-all tool out there, and there probably never will be. That's why it's important to pick and focus on the requirements that truly matter to you, and ignore the ones that don't. Here's the checklist I used to assess all the tools:

- User Interface: This includes both functionality and aesthetic aspects—the overall user experience.

- Historical Transactions Support: Necessary for those seeking precision or intending to do taxes. If you just need a general overview, tracking every single detail might be overkill.

- Stock Market Tracking: Real-time tracking of the stock market, dividends, and splits is crucial.

- Tracking Other Wealth Components: We often own more than a bunch of stocks, like real-estate or retirement funds. If you really want to understand where you stand, you will want to track them as well.

- Multiple Account Tracking: Being able to consolidate and monitor multiple accounts in one place is invaluable for those managing investments across various platforms.

- Account Organisation: Features that allow for the organization of accounts, portfolios and assets help with easy navigation and meaningful comparisons.

- Multi-Currency Support: Necessary for global investors, the ability to handle transactions in different currencies and switch them at any given time.

- User-Friendly Performance Reports: Reports that are detailed, customizable, and user-friendly are key to understanding your performance metrics.

- Benchmarks Support: The ability to compare your performance with a known benchmark helps you contextualize your metrics.

- Tax Handling: If you need to file taxes on your investments each year, or at least be prepared to, having a reliable source of truth is crucial.

- Importing Transactions: There's nothing to track without transactions. An easy-to-use import feature for transactions from a broker, another app, or a spreadsheet is a must.

- Minimal Maintenance Required: We're all busy, and keeping a detailed log of your investments probably isn't at the top of your to-do list.

- Privacy and Data Encryption: Is it important for you that a tool that values your privacy and how it achieves that?

- Portfolio Diversification Reports: These are useful for managing risks and enhancing returns.

- Technical Chart Indicators: Features like SMA, EMA, etc., are important for those who build their own stock portfolios and undertake technical analysis.

- Stock Fundamentals: Access to fundamental stock data and analysis is crucial for those who build their portfolios and invest based on fundamentals.

- Watchlists & Price Alerts: Another key feature for DIY stock portfolio builders who want to keep an eye on specific stocks.

- Pricing: The cost should offer value—features that are proportionate to the pricing plans.

To make it more readable, I've assessed how well they solve the requirement using using an emoji-scale:

- ❌ Not solving

- 🤏 Not ideal - requires additional work or compromises

- ✅ Does the job

- ⭐ Best-in-class (there can only be one per requirement)

Capitally - best for diversified multi-currency portfolios

Capitally is a new-comer, but it's already a pretty robust financial tracking tool with a modern, unique interface that encourages exploration. Its powerful multi-currency support and ability to track almost any kind of asset makes it perfect for international investors and users with diverse portfolios. This comes at a price of requiring more hands-on approach, but it shouldn't be an issue for those who want to be in control and like to poke around. In return, it's probably the only financial tool that offers end-to-end encryption.

Let's see how it solves the requirements:

- ✅ User Interface: Capitally features a modern and unique interface designed for exploration. It's web application works seamlessly on both desktop and mobile, and can be added to the home page like a regular app. Works offline as well.

- ⭐ Historical Transactions Support: Depending on the level of detail required, users can either use full historical transactions or just account balances.

- ✅ Stock Market Tracking: Capitally offers global tracking of stocks, ETFs and cryptocurrencies, along with dividends and splits.

- ⭐ Tracking Other Wealth Components: Users can track anything of value, including real estate, collectibles, or closed funds, similarly to how stocks are tracked. Market prices, fixed income, and any other type of transaction can be monitored.

- ⭐ Multiple Account Tracking: The app supports tracking an unlimited number of accounts, even allowing one asset to be tracked across multiple accounts.

- ⭐ Account Organisation: You can freely organise assets, accounts and even transactions using hierarchical tags.

- ✅ Multi-Currency Support: Capitally offers robust multi-currency support, allowing transactions, market prices, fees, and reports to be used in mixed currencies.

- ⭐ User-Friendly Performance Reports: Predefined performance reports are available for quick exploration, including point-in-time metrics.

- ⭐ Benchmarks Support: Any asset or index, including custom ones, can be used as a benchmark. You can use parts of or a whole portfolio as a benchmark as well.

- ✅ Tax Handling: Capitally has a built-in support for Capital Gains Tax calculation for some countries, but most importantly, it allows you to customize your own tax handling logic.

- ✅ Importing Transactions: Capitally supports importing transactions from any CSV file through a robust column matching interface. It also has built-in support for transactions exported from StockMarketEye (along with other apps and brokers).

- 🤏 Minimal Maintenance Required: Manual updates of transactions and balances are needed whenever you buy or sell, but custom import templates help make the process quick and seamless.

- ✅ Privacy and Data Encryption: Capitally takes privacy seriously with its end-to-end encryption. Your financial data remains accessible only to you and is never routed or touched by a third-party.

- ⭐ Portfolio Diversification Reports: Market-traded assets are automatically categorised according to their regions, sectors and categories. What's pretty unique, is that you can edit any of these categories, and assign them to your own custom assets.

- ❌ Technical Chart Indicators: Not available.

- ❌ Stock Fundamentals: Not available.

- ❌ Watchlists & Price Alerts: Not available.

- ✅ Pricing: Priced at $80 per year, with all features included and a free 14 day trial.

Kubera - best for hands-off wealth management

Kubera stands out with its streamlined, modern interface, offering a user-friendly experience that won't leave you feeling overwhelmed. It's a stellar choice for users who prioritize ease of use and a clean design above all else. Kubera is designed for users who want to track their current account balances and global stocks, ETFs, and cryptocurrencies, rather than delve into historical transactions. Despite its simplicity, Kubera offers user-friendly performance reports and portfolio diversification options, but you will never be able to see data prior to signup.

Let's check how it solves the requirements:

Let's check how it solves the requirements:

- ⭐ User Interface: Kubera offers a simplified, modern, and user-friendly interface with easy data input options. It includes a web application with a read-only mobile version.

- ❌ Historical Transactions Support: Kubera does not support transaction history tracking. It only tracks account balances from the signup point.

- ✅ Stock Market Tracking: It supports global tracking for stocks, ETFs, and cryptocurrency, including dividends and splits.

- 🤏 Tracking Other Wealth Components: You can track other forms of wealth like real estate and collectibles, but it's limited to their value only

- ✅ Multiple Account Tracking: Kubera allows tracking asset balances on separate accounts.

- ✅ Account Organisation: It offers easy and user-friendly categorization of accounts (though it doesn't support nested trees).

- ✅ Multi-Currency Support: Kubera supports tracking and viewing assets in multiple currencies.

- ✅ User-Friendly Performance Reports: It enables building a customizable, user-friendly dashboard of performance reports with optional goals (like for allocation).

- ✅ Benchmarks Support: You can compare your returns to a list of pre-set benchmarks.

- ❌ Tax Handling: Kubera is not suitable for tax reporting as it doesn't provide a full transaction history (though logging of the cost-basis is possible).

- 🤏 Importing Transactions: Users can manually update the current account balance or use a third-party integration to update balances automatically - but this requires sharing your account's login and password. It's simple and hassle-free, but remember that it only tracks account balance from the point of signup and will have gaps if account is unlinked or you don't update it in time.

- ⭐ Minimal Maintenance Required: If you're fine with privacy implications of linking your accounts through Plaid and all your accounts are supported - you can just enable it and get back from time to time just to check the results.

- ❌ Privacy and Data Encryption: Your data can be shared with a third party when using automated imports and is not end-to-end encrypted. App loads third-party trackers.

- ✅ Portfolio Diversification Reports: Yes, Kubera supports portfolio diversification reports.

- ❌ Technical Chart Indicators: Not available.

- ❌ Stock Fundamentals: Not available.

- ❌ Watchlists & Price Alerts: Not available.

- 🤏 Pricing: Kubera costs $150/year with a $1 fee for a 14-day trial.

Portfolio-Performance - best open-source

Portfolio-performance is a free, open-source portfolio tracker which prioritizes privacy as your data never leaves your device. It is a perfect match for advanced users who appreciate a high level of control and customization, along with an extensive range of features. However, due to the requirement of inputting your own data for market tracking, and the overall manual handling, it may not be the perfect fit for beginners or those who prefer a straightforward, simple experience.

Let's take a closer look at what Portfolio-performance offers:

- 🤏 User Interface: The interface may seem outdated and difficult to use, especially for a new user, as many operations need to be handled manually.

- ✅ Historical Transactions Support: Yes, Portfolio-performance supports historical transactions.

- 🤏 Stock Market Tracking: It supports global stock, ETF, and crypto market tracking, including dividends and splits. However, you'll need to provide your own data using free sources like Yahoo or data scraping, or paid data sources like AlphaVantage.

- 🤏 Tracking Other Wealth Components: Although not directly supported, you can track any custom symbol along with prices and transaction history.

- ✅ Multiple Account Tracking: Yes, Portfolio-performance supports tracking multiple accounts.

- ⭐ Account Organisation: You have the freedom to create your own taxonomy.

- ✅ Multi-Currency Support: It allows tracking and viewing transactions in mixed currencies.

- 🤏 User-Friendly Performance Reports: Advanced, albeit complicated, reporting is available. While I personally gave up trying, I've seen dashboards of comprehensive reports.

- ✅ Benchmarks Support: Any asset you've added to your project can be used as a benchmark.

- ✅ Tax Handling: You can record taxes paid on transactions and generate reports to aid with taxation.

- ✅ Importing Transactions: You can import transactions in bulk using a couple of pre-set templates.

- ❌ Minimal Maintenance Required: As with many open-source projects, reading guides and constant tinkering are part of the experience.

- ⭐ Privacy and Data Encryption: Portfolio-performance prioritizes your privacy, ensuring your data never leaves your device.

- ✅ Portfolio Diversification Reports: Yes, if you manually assign assets to your chosen taxonomies. This gives you complete control over the end result.

- ✅ Technical Chart Indicators: Yes, Portfolio-performance supports EMA, SMA, MACD among others.

- ❌ Stock Fundamentals: Not available.

- ❌ Watchlists & Price Alerts: Not available.

- ⭐ Pricing: Portfolio-performance is completely free and open-source.

Stock Rover - best for stock pickers

Stock Rover stands out as a platform for advanced US investors who build their portfolios through stock picking. While the interface may pose challenges for the uninitiated, experienced users will appreciate the range of charts, technical indicators, and extensive fundamental data available. However, Stock Rover supports only USD and US stocks & ETFs, limiting its appeal for international users.

Here's a more detailed breakdown of what Stock Rover offers:

Here's a more detailed breakdown of what Stock Rover offers:

- 🤏 User Interface: The interface might not appeal to everyone, especially beginners. It's geared towards advanced users who know what they're looking for, offering a multitude of options and menus that may make navigation difficult.

- 🤏 Historical Transactions Support: Stock Rover only supports Buy & Sell transactions.

- 🤏 Stock Market Tracking: The platform offers tracking for only US stocks & ETFs, along with dividends and splits.

- ❌ Tracking Other Wealth Components: This feature is not supported.

- 🤏 Multiple Account Tracking: While direct support for multiple accounts is missing, the platform does allow you to have multiple portfolios.

- 🤏 Account Organisation: Organisation is possible only by grouping your investments into portfolios.

- ❌ Multi-Currency Support: Stock Rover supports only USD.

- ✅ User-Friendly Performance Reports: The platform offers robust charts with fundamentals and a multitude of technical indicators. However, you need to be comfortable with navigating complex data.

- ✅ Benchmarks Support: Yes

- ❌ Tax Handling: Stock Rover does not provide options to record taxes paid or generate tax reports.

- 🤏 Importing Transactions: You can only import your current account balances using a predefined CSV template or through third-party integration.

- ✅ Minimal Maintenance Required: The app itself doesn't require you to do much, but it's not a typical wealth tracker - how much work it requires depends mostly on your investing style.

- 🤏 Privacy and Data Encryption: When using automated imports, data is shared with a third party and is not end-to-end encrypted.

- ✅ Portfolio Diversification Reports: Yes.

- ⭐ Technical Chart Indicators: Yes, lots of them.

- ⭐ Stock Fundamentals: The only one here with a full-blown stock screener.

- ⭐ Watchlists & Price Alerts: Yes.

- ✅ Pricing: A limited free plan and paid plans ranging from $79 to $279 per year, with optional add-ons.

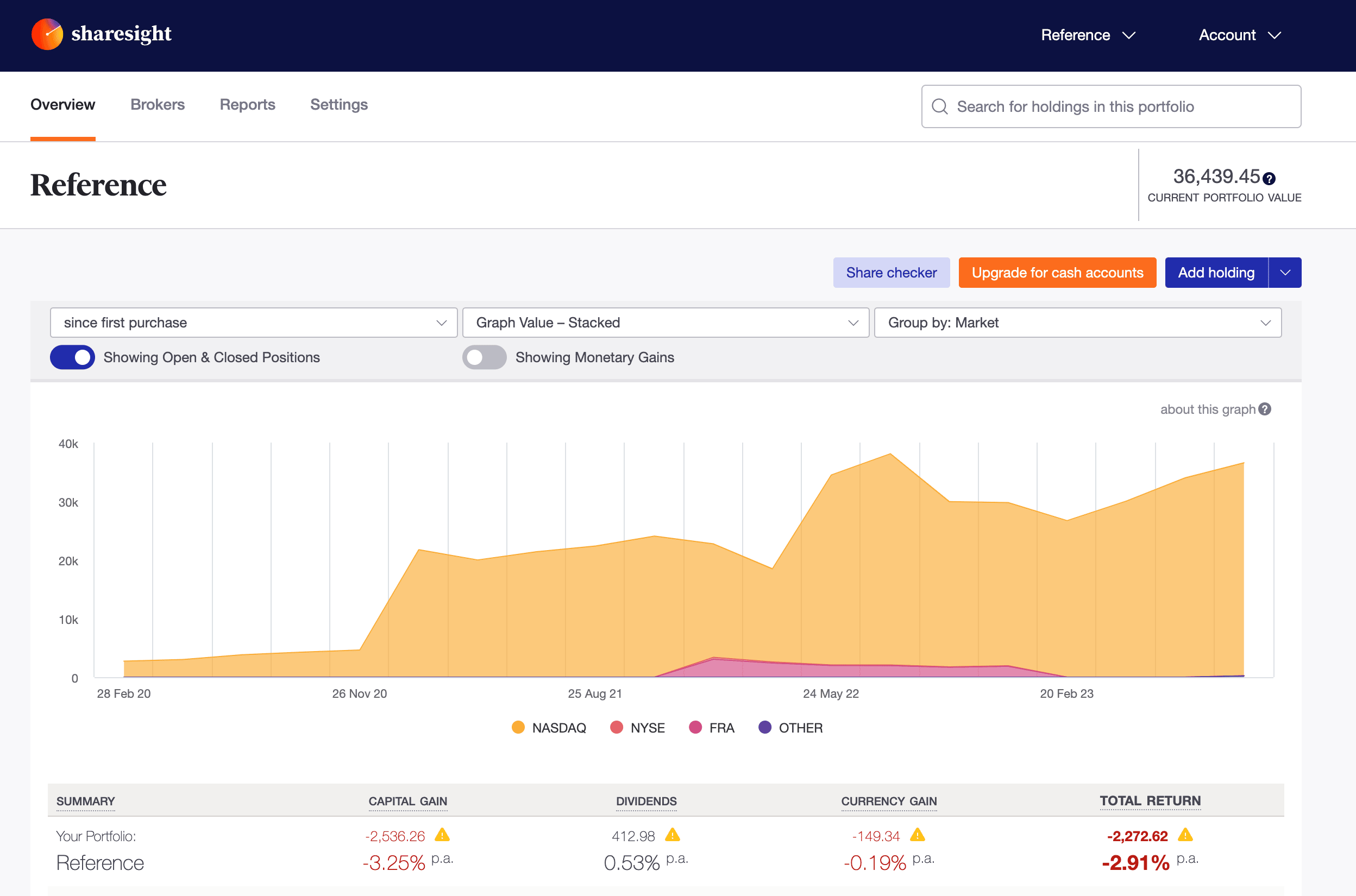

Sharesight - best tax reporting

Sharesight is an advanced tool perfectly suited for individuals looking for detailed tracking and superior tax reporting capabilities. It provides tracking for global stocks, ETFs, and cryptocurrencies, as well as the ability to track custom assets. However, Sharesight truly shines in its tax reporting, offering bespoke reports tailored to an individual user's country of residence - a feature unmatched by most competitors. Nevertheless, there are certain limitations to consider, such as limited account organisation, multi-currency handling, and import options.

Here's a more detailed look at Sharesight's features:

Here's a more detailed look at Sharesight's features:

- 🤏 User Interface: The user interface can feel a bit dated with lots of clicking required, but they have recently begun a brand refresh. It offers a web application with a read-only mobile version.

- ✅ Historical Transactions Support: Sharesight supports full historical transactions.

- ✅ Stock Market Tracking: It offers global tracking for stocks, ETFs, and cryptocurrencies, including dividends and splits.

- ✅ Tracking Other Wealth Components: Users can track custom assets like real estate, collectibles, or closed funds, along with their prices and historical transactions.

- 🤏 Multiple Account Tracking: Sharesight does not separate transactions into accounts. Instead, you can track them in separate portfolios or use custom grouping.

- ✅ Account Organisation: Multiple flat custom groups can be created on paid plans.

- 🤏 Multi-Currency Support: A bit limited, as each portfolio can have only one set currency that cannot be changed. However, transactions can be logged in multiple currencies.

- ✅ User-Friendly Performance Reports: Although reporting might feel a bit clunky, it is fully featured on higher plans.

- ✅ Benchmarks Support: Benchmarks are available on paid plans.

- ⭐ Tax Handling: Sharesight arguably provides the best-in-class tax reporting, tailored to a user's country of residence. However, this also means that you cannot change it.

- ✅ Importing Transactions: Features a limited but functional tabular data import. Some institutions are supported with built-in import, and automated updates can be achieved by redirecting confirmation emails to Sharesight's inbox.

- ✅ Minimal Maintenance Required: It really depends on the brokers you use, as many can be updated automatically. If you have multiple custom assets, prepare for quite a lot of manual work.

- 🤏 Privacy and Data Encryption: While data is not shared with third parties, it's not end-to-end encrypted.

- ✅ Portfolio Diversification Reports: Available only on higher-paid plans.

- ❌ Technical Chart Indicators: Not available.

- ❌ Stock Fundamentals: Not available.

- 🤏 Watchlists & Price Alerts: No watchlists are available, but users can get price alerts and weekly reports.

- 🤏 Pricing: Offers a very limited free plan. Paid plans start at $135/year for a quite restricted version, going up to $279/year for the fully featured version (although still limited to 10 portfolios and 10 custom groups).

Final words

I hope this guide has shed some light on the options available and provided a framework to assess their suitability for your needs. Don't let the StockMarketEye shutdown keep you down. With a little research, you'll surely find an alternative that helps you reclaim control over understanding and optimizing your investments.