Capitally allows you to monitor the current market value of your real estate, along with all related income and expenses, giving you a comprehensive overview of your investment. Please note that market prices are not automated, and you will need to update them manually.

Organizing your real estate portfolio

You can organize properties in several ways:

One account per property - Create a separate account for each property (e.g., "Downtown Apartment", "Beach House"). This approach works well when you want to:

- Track a mortgage alongside the property in the same account

- See the net equity (property value minus mortgage) at a glance

- Keep all property-related transactions together

Single account for all properties - Create one "Real Estate" account containing all your properties as separate assets. This works better when:

- You don't have mortgages to track

- You prefer simpler organization

- You want to quickly compare properties side by side

Using taxonomies - Add tags and categories to categorize properties by ownership (Owner/Me, Owner/Partner), location, or type (Real-estate/Rental, Real-estate/Primary Residence).

Adding a property

Unless you're managing a vast real estate portfolio, you'll likely want to create a custom asset for each unit you own. Depending on how you prefer to obtain the current market price - per square meter or per whole unit - create a Buy transaction with the quantity set either to actual square meters or 1.

1 as quantity for simplicity, or actual square meters if you want to track price per square meter.Tracking rental income

If you're renting out your property, track income using Rent transactions.

Recording monthly rent

- Open the property asset

- Click Add transaction

- Select Rent as the transaction type

- Enter the rent amount in Value

- If tax was withheld, enter it in Tax Paid

- Add Fees for any property management costs deducted from rent

Recurring rent payments

To quickly add multiple rent payments:

- Create one rent transaction

- Select it in the Transactions tab

- Click Edit & Clone

- Set the number of copies and interval (e.g., 12 copies, 1 month apart)

Future income estimation

Capitally can estimate future rental income based on your payment history. See Tracking Dividends - Future income estimation for details.

Tracking Expenses

Track property-related costs using Other transactions.

One-off expenses

For renovations, repairs, or one-time purchases, use negative Value in the Other transaction. It will only affect the ROI and won't be reflected in Fees.

Recurring expenses

For regular costs like property tax, insurance, or maintenance contracts, use Fees, keeping Value field at 0 in the Other transaction. This will affect both ROI and the Fees metrics.

Example: Annual property tax

- Add an

Othertransaction - Set Value to

0 - Set Fees to the tax amount (e.g., 1,200 EUR)

- Add a note: "Annual property tax 2024"

Financing with a mortgage

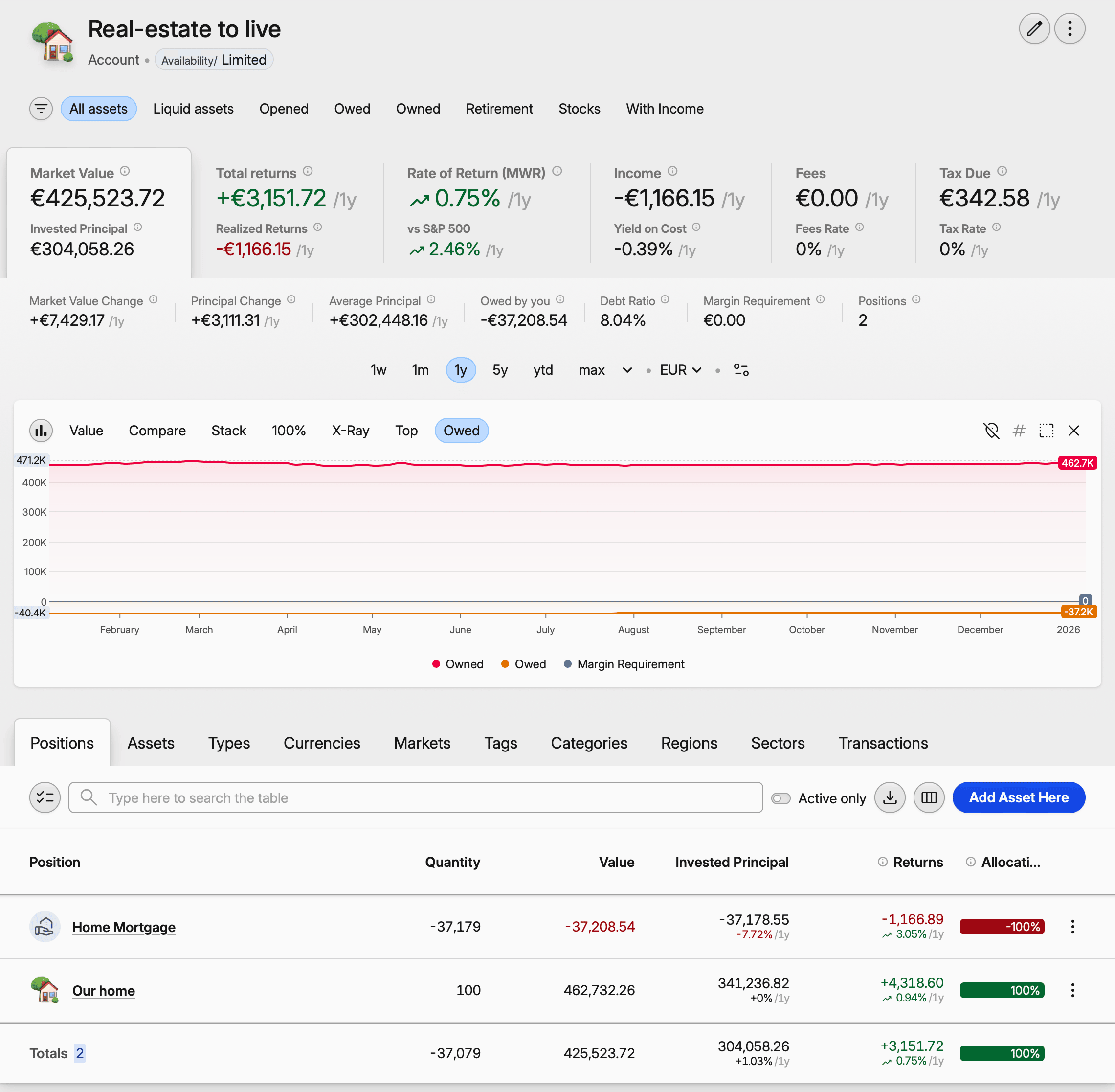

If your property is financed with a mortgage, you can track both together and see your true equity position.

See Tracking Mortgage for:

- Setting up a mortgage with interest calculations

- Connecting the mortgage to your property

- Viewing combined equity (property value minus debt)

Updating Market Price

Periodically, it's advisable to update the current Market Price based on market prices in your area.

If you've been tracking all this data in a spreadsheet, you can create an import template and import everything in one go. If you plan to track the expenses and income in a spreadsheet or app alongside Capitally, remember that you can also create a template for Copying & Pasting the data, saving you the trouble of exporting it.

Exploring Your Real Estate Portfolio

Portfolio section allows you to compare the fixed income of all the assets in your portfolio, including Bonds, Stocks and Real Estate. This gives you a holistic view of the fixed-income potential of all your investments.

To see all your real estate, navigate to Portfolio → Types → Real Estate.

Real Estate are not Liquid Assets

Real Estate is excluded from the Summary and Portfolio when viewing Liquid assets. To see your real estate alongside other investments, select All assets or navigate directly to Portfolio → Types → Real Estate.