It's crucial to set up your tax presets correctly to ensure accurate estimates.

Keep in mind that you are responsible for the correctness of your data, and the output should be used for estimating taxes or as an aid when doing your taxes, not as a definitive source of truth.

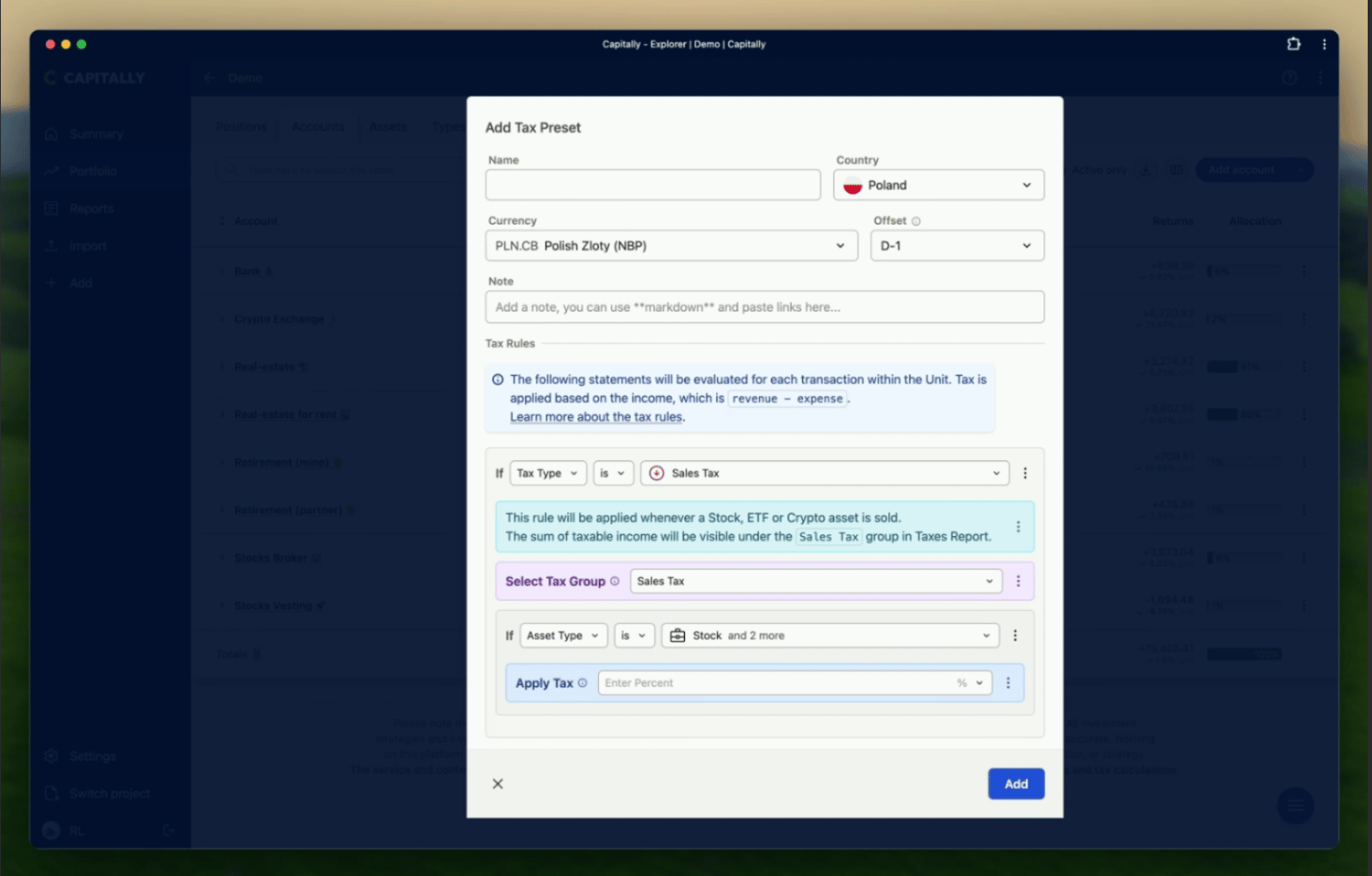

You can edit your Tax Presets by going to Settings -> Taxes.

Found an issue with a built-in preset? Maybe you want to share your own one? Go to our Github repository and create an issue or pull request.

How Tax Presets work

Tax presets are bound to a single country, currency, and currency date offset. Multiple presets can share the same settings, and they will all be accumulated on a single report.

For each transaction on the account that has a tax preset applied, defined tax rules will be evaluated. This includes Buy, Sell, Dividend / Interest / Rent and Others.

Whenever an Apply Tax statement is encountered, the current revenue, expense, and tax are accumulated within a selected Tax Group. You can modify the revenue and expense with the Set statement. The tax is calculated as rate * (revenue - expense).

Revenue and Expense

For Buy transactions, expense is equal to the amount paid to acquire an asset, plus any opening fees.

For Sell transactions, expense is increased by closing fees - so it already includes all expenses paid when opening the transaction. revenue is equal to the amount received for the sale.

Balance and Transfer transactions are not taxed, but the position they opened can be still closed with a Sell, in which case the opening expense will still be includedFor Dividend / Interest / Income transactions, revenue equals the income received, while expense equals the fees.

For Other transactions, revenue equals the value gained, while expense includes any fees.

revenue and expense are swapped.Tax Groups

Tax Group is optional, but you might want to group taxes from stock sales separately from taxes on dividends. They can also be nested similarly to Tags, by using the / symbol - eg. Dividends/US. The great thing is that tax groups are global, so different tax presets can use the same tax group as long as the country, currency, and offset match.

Use separate presets for different types of accounts

It is recommended to create a few separate Tax Presets if the tax situation varies across accounts. For example, you can have a single preset for all your investment accounts and separate presets for various tax-sheltered accounts. However, if the calculation logic is very similar, you can use just a single preset and check for tags to apply different logic.

Average Cost Basis (ACB) Settings

When using Average Cost Basis for tax calculations, you can configure how cost averaging works at the preset level.

ACB Asset Types

Select which asset types should use average cost pooling instead of individual lot tracking.

Assets not in this list will continue to use lot-based tracking (FIFO, LIFO, etc.).

ACB Pooling

Choose how positions are pooled for averaging:

- Asset: All holdings of an asset across all your accounts share one average cost. This is the Canadian approach where your ACB for Apple stock is the same whether held in your TFSA or taxable account.

- Asset + Account: Each account maintains its own average cost per asset. This is the UK and German approach where the same stock can have different cost bases in different accounts.

ACB Variant

Special calculation rules for specific jurisdictions:

- Standard: Normal weighted average cost calculation. When you buy more shares, the new cost is averaged with your existing holdings.

- UK: Section 104 holding rules with same-day and 30-day matching. Sales are first matched against same-day purchases, then purchases within 30 days, then the Section 104 pool.

Editing the preset's rules

Snippets

Use the built-in snippets for a great starting point. For example, to calculate taxes on stock sales, use the "Stock Sales Income" snippet, which will add some pre-made statements for you.

Presets are built using statements. Learn more about the basic set of statements and ways to edit them in the Programmable Presets article.

Notes and comments

Calculations will only be helpful if you understand the numbers. There are a couple of ways that you can inform your future self:

- Preset Note - Every preset can have a richly formatted note that will be displayed in the Taxes Due Report. It's the best place to set the context for the numbers.

- Add Note statement - You can add multiple notes to tax events. They will be displayed in the

Notescolumn of the Taxes Due report for each transaction with tax applied. - Comment statement - You can add richly formatted comments within the rules to better describe the logic.