Interest-bearing assets like bonds, loans, and mortgages don't just sit there collecting dust in your portfolio. They work for you, generating income through interest payments and principal repayments over time. Instead of manually tracking every payment, Capitally can calculate these cash flows automatically based on the terms you specify.

You can use this feature not only to model assets you currently hold, but also to estimate how future rate changes might affect your portfolio or to compare different loan structures before making financial decisions.

When to use interest-based pricing

Use this pricing method when you hold assets that pay regular interest or when you owe money that accrues interest charges. This includes:

Government and corporate bonds that pay coupon payments on a schedule

Bank loans and mortgages where you're the borrower paying interest

Peer-to-peer loans where you're the lender receiving payments or the borrower

Certificate of deposits that compound interest over time

Credit lines and overdrafts that charge interest on negative balances

The key is that the asset's value changes predictably based on interest calculations rather than market fluctuations.

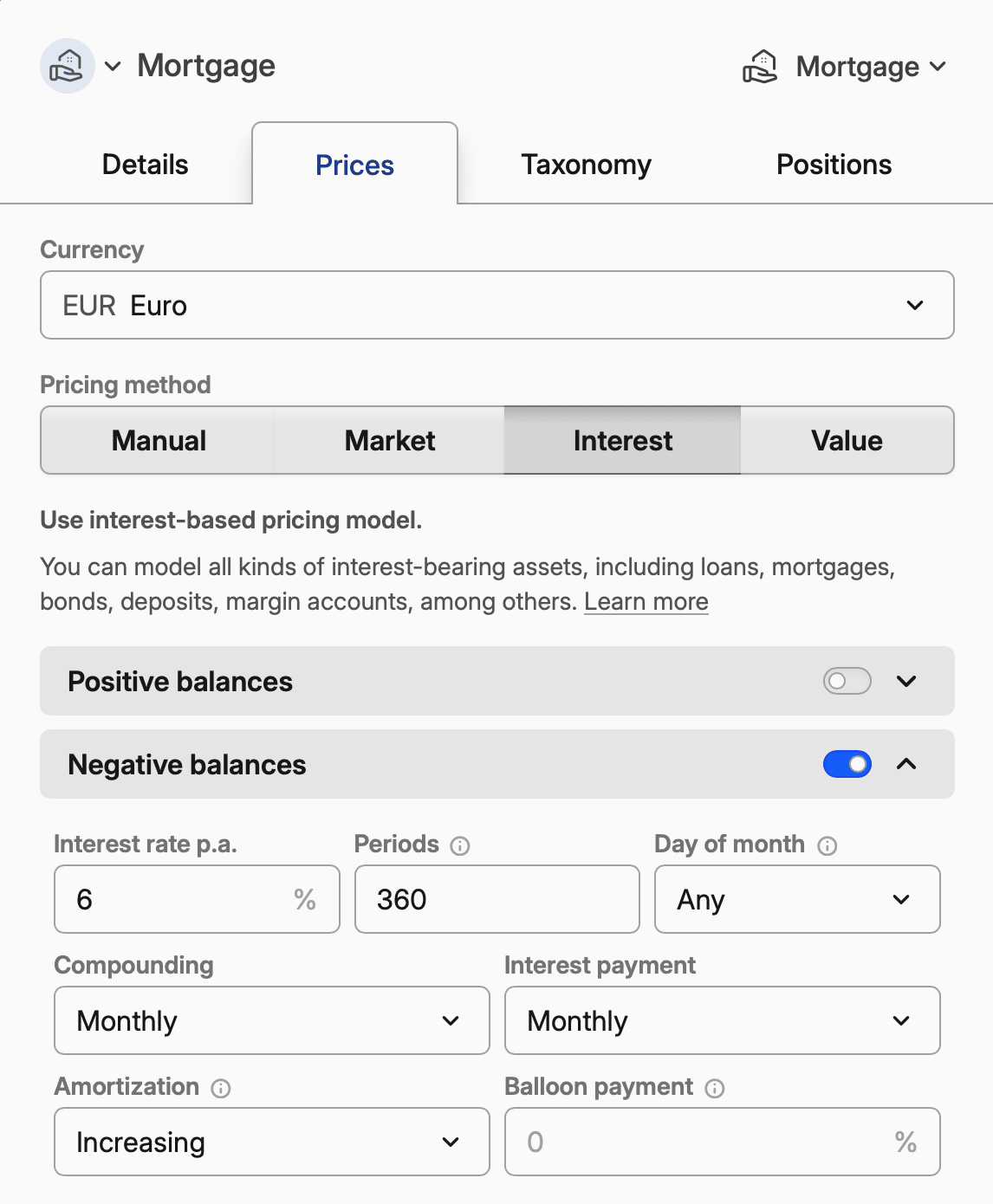

Mortgage example

Here's how to configure a typical 30-year fixed-rate mortgage:

Setting | Value | Notes |

|---|---|---|

Negative balances | Enabled | Mortgages are liabilities |

Interest rate p.a. | 6.0 | Your annual rate |

Compounding | Monthly | Standard for mortgages |

Interest payment | Monthly | When you make payments |

Periods | 360 | 30 years × 12 months |

Amortization | Increasing | Standard mortgage amortization |

Initial price | 1 | Price per unit of currency |

For adjustable-rate mortgages, add rate overrides at each adjustment date. See Tracking Mortgage for complete setup instructions.

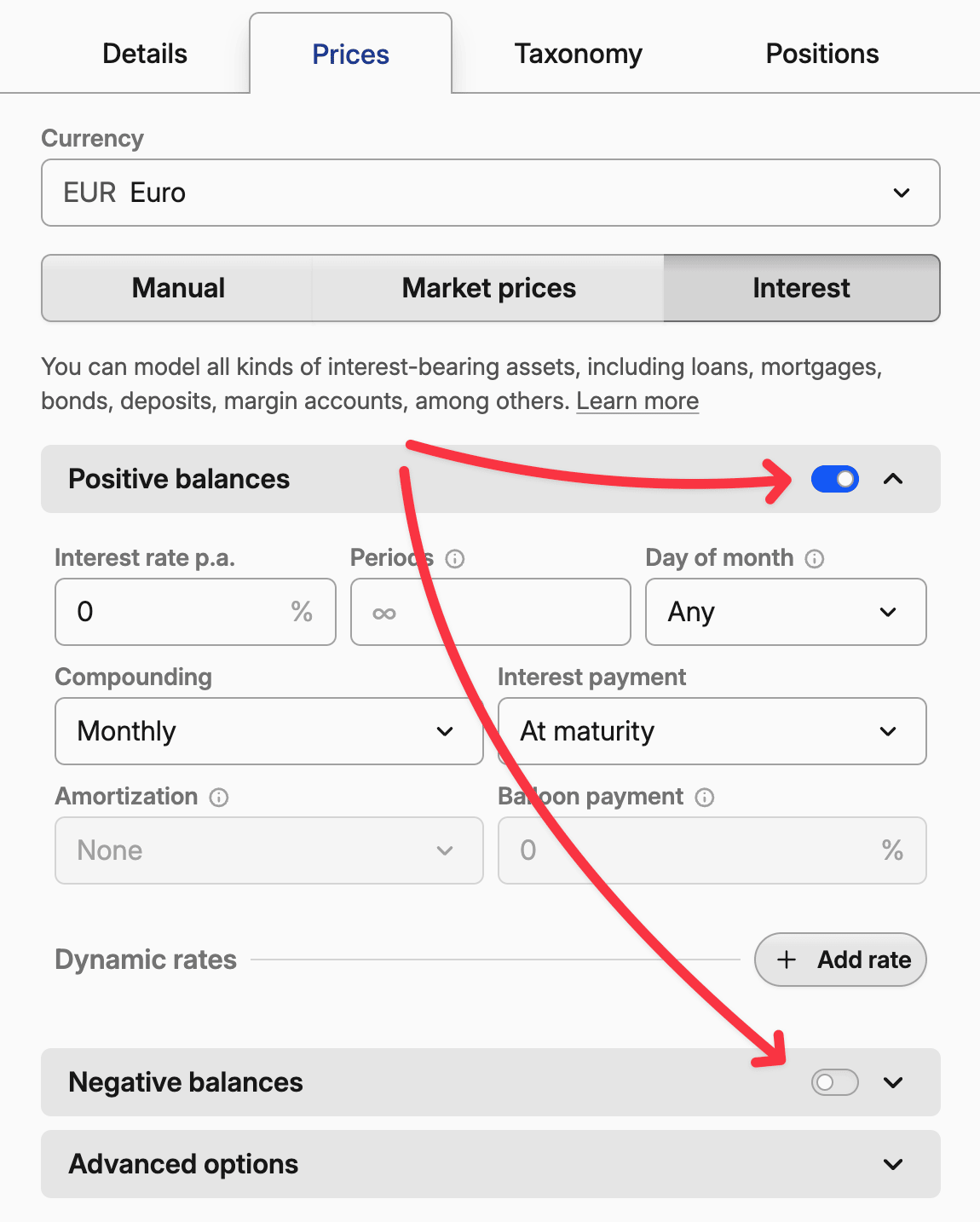

Setting up positive and negative balances

The first decision is whether your asset earns interest (positive balances), costs you interest (negative balances), or both.

For investment assets like bonds, CDs, or savings accounts, enable positive balances. The system will calculate interest income and any principal repayments you receive.

For debt assets like mortgages, personal loans, or credit cards, enable negative balances. The system will track interest charges and principal payments you make.

For hybrid accounts like checking accounts or credit lines, you might enable both. Positive balances earn interest at one rate while negative balances (overdrafts) charge interest at a higher rate.

Each side has independent settings, so your checking account might earn 0.5% annually on positive balances while charging 15% annually on negative balances, with different compounding schedules for each.

To enable a side, toggle the switch next to Positive balances or Negative balances.

Core interest settings

Interest rate p.a. is your annual percentage rate. For a 3.5% bond, enter 3.5. For a mortgage at 6.2%, enter 6.2.

Compounding determines how often interest gets added to your balance. Daily compounding means interest earns interest every day. Monthly compounding waits until month-end. Most bonds compound semi-annually, while savings accounts often compound daily.

Interest payment controls when you actually receive (or pay) the interest. "At maturity" means all interest pays out when the asset matures - common for zero-coupon bonds. Monthly payments are typical for mortgages and many corporate bonds.

Periods limits how long the interest calculations run. A 30-year mortgage has 360 monthly periods. A 10-year bond has 20 semi-annual periods. Leave this empty for perpetual assets like checking accounts.

Day of month chooses a single day of month when interest is compounded and payouts are made. If left empty, dates are calculated based on the opening day.

Amortization and balloon payments

These features apply when you have a limited number of periods and regular interest payments.

Amortization spreads principal repayment across the loan's life. "Even" amortization means equal principal payments each period. "Increasing" means larger principal payments over time.

Note on amortization vs. payments

If your combined interest and amortization payments remain constant throughout the loan term, which is common for mortgages, the amortization component is 'increasing.' In contrast, an 'even' amortization schedule—where the principal payment remains fixed—will cause your total payments to decrease over time.

Balloon payment specifies what percentage of principal gets paid in the final period. A 50% balloon payment means half the principal pays off at maturity, with the rest amortized over the loan's life.

Advanced options

Day count convention affects how interest accrues between payment dates. The choice depends on your specific bond:

- Actual/Actual counts the exact number of days in each period and year. US Treasury bonds use this method.

- Actual/Actual (Equal periods) also counts exact days but assumes all periods within a year are equal length. This works better for bonds with irregular payment schedules.

- 30E/360 treats every month as 30 days and every year as 360 days, regardless of the actual calendar. European bonds commonly use this.

- Actual/360 counts actual days but divides by 360 instead of 365/366.

When in doubt, check your bond's prospectus or offering document for the exact convention used.

Initial price is a price per bond (a.k.a face value), share or unit of currency. For bonds it may be $100, while mortgages, loans or margin accounts should use 1.

Start date overrides when interest calculations begin. Useful for mortgages that have a single start date, but you can increase the borrowed capital by paying out tranches.

Round price per share is primarily used with bonds, which pay interest through coupons at a fixed rate. Your payment is then calculated by multiplying the rounded coupon rate by the number of units you hold.

Secondary market causes interest to be accrued from the Start date, instead of the date when position was opened. This way you can track assets bought on the secondary market, where you receive the full accrued interest at the payout date.

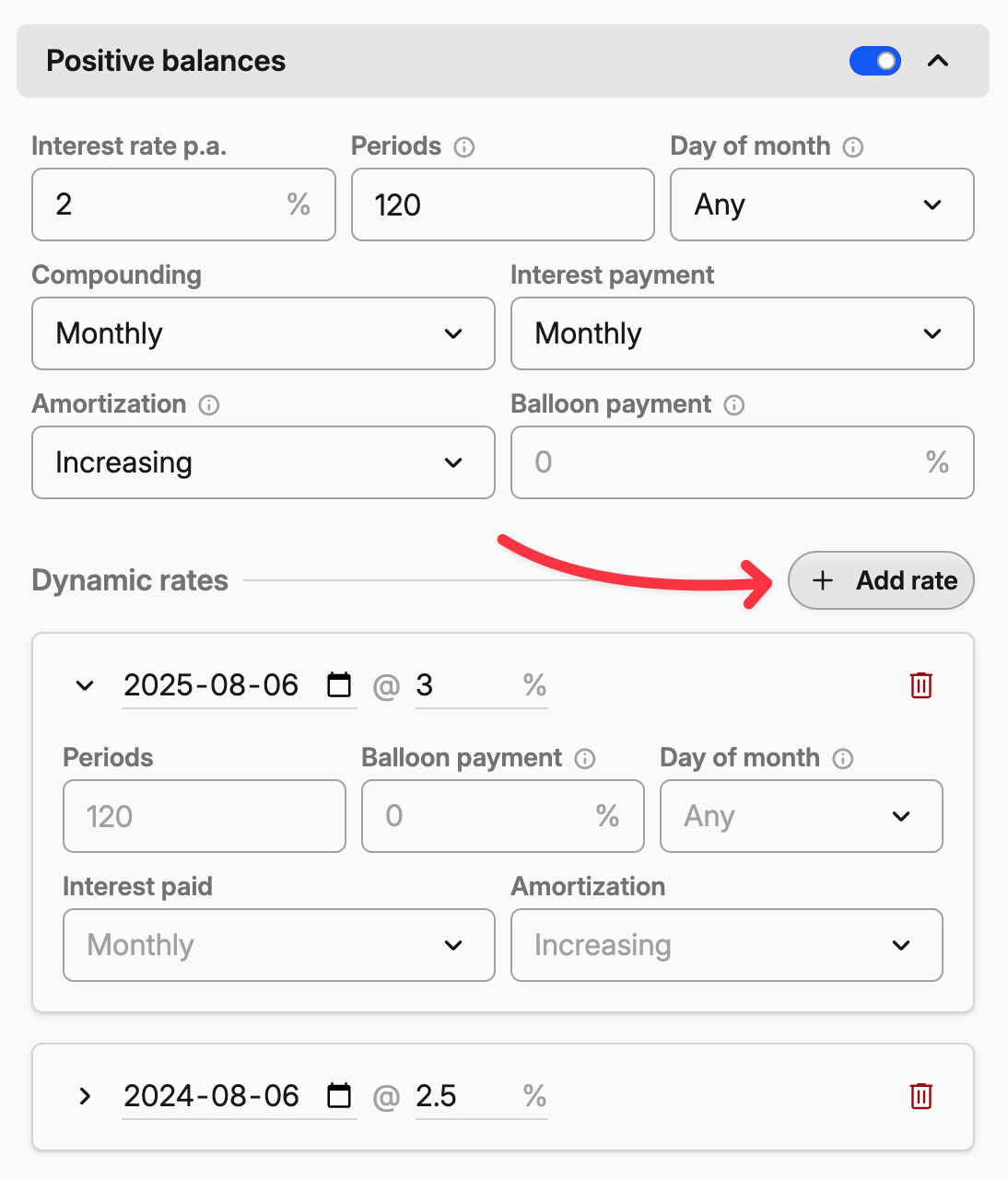

Dynamic rates and overrides

Real-world loans and bonds often don't stay static. Interest rates change, payment schedules shift, and life happens. The override system lets you model these changes precisely.

How overrides work

Click "Add rate" to create an override that takes effect on a specific date. You can override any setting - interest rate, payment frequency, amortization schedule, or even the number of remaining periods.

The system applies overrides in chronological order. If you have a base rate of 4% and add an override changing it to 6% starting January 1st, the rate jumps to 6% on that date and stays there until the next override (or until the asset matures).

Any changes take effect at the next compounding/payment interval!

Modeling rate changes

Adjustable mortgages: Your ARM starts at 3.5% and adjusts annually based on market rates. Add overrides for each adjustment date with your expected rates.

Step-up bonds: Corporate bonds sometimes start at 4% for the first five years, then jump to 6% for the remaining term. Add an override on the step-up date.

Promotional rates: Credit cards often offer 0% introductory rates that jump to 22% after 12 months. Model this with an override at the promotional expiration.

Debt vacation periods

Sometimes you negotiate payment holidays or forbearance periods where you temporarily stop making principal payments but interest keeps accruing.

To model a debt vacation, add an override that changes the amortization to "None" during the forbearance period. Interest will continue compounding, but no principal gets paid down. Add another override when normal payments resume, adjusting the amount of periods if needed.

For example, if you have a 30-year mortgage and take a 6-month payment holiday in year 5, you'd add:

- Override at holiday start: Change amortization to "None"

- Override at holiday end: Change amortization back to "Even", extend periods by 6 months

Changing loan length

Refinancing or loan modifications often change the remaining term. Use overrides to model these changes precisely.

If you refinance your mortgage after 5 years and extend the remaining 25 years to a new 30-year term, add an override on the refinance date that increases the periods from 300 to 360.

Conversely, if you make extra payments to shorten your loan, add an override that reduces the remaining periods when you make the change.

The number of periods always represents thetotal loan duration.

Scenario planning

Interest prices aren't just for modeling reality - they're powerful tools for financial planning:

Rate shock analysis: Add overrides with higher interest rates to see how rising rates would affect your portfolio value.

Prepayment strategies: Model the effect of making extra principal payments by adding Sell transactions, or overrides that reduce the remaining periods.

Refinancing decisions: Compare your current loan against potential refinancing options by setting up different override scenarios.

Getting the details right

Interest calculations are precise but unforgiving. A small mistake in the dynamic rates or compounding frequency can throw off your entire portfolio value.

Start with the asset's official documentation. Bond prospectuses spell out exactly how interest gets calculated. Loan agreements specify payment schedules and rate adjustment mechanisms.

When possible, verify your setup against a known payment. If you know your mortgage payment should be $1,847.33, configure the interest settings and check that Capitally matches that amount.

Reconciling interest transactions

Once you import or add actual interest transactions, Capitally will automatically detect them and skip creating automatic payments for those dates. These imported transactions should serve as your source of truth for tax purposes.

Note: Interest calculations involve complex variables, different calculation conventions, and rounding practices that may cause variations in computed amounts.