Some investments don't give you full visibility into their inner workings. Wealth managers, closed managed funds, private equity, or certain retirement accounts often report only the current net asset value without disclosing the underlying holdings, quantities, or prices. Capitally supports these "black-box" investments through a feature called value-based pricing.

What is a black-box investment?

A black-box investment is any holding where you know:

- How much money you've put in (deposits)

- How much you've taken out (withdrawals)

- The current total value

But you don't know:

- What specific assets are held inside

- The quantity of those assets

- The price per unit

Common examples include managed accounts handled by wealth managers, closed-end funds, certain pension schemes, hedge fund investments, or private equity stakes.

How value-based pricing works

Normally, Capitally calculates your position's value by multiplying quantity × price. But when you don't have this information, value-based pricing lets you track the investment using just cash flows (deposits and withdrawals) and periodic balance updates.

Instead of entering buy/sell transactions with quantities and prices, you simply:

- Record when money goes in or out

- Update the current value whenever you receive a statement

Capitally handles everything else - calculating your returns, comparing performance against benchmarks, and displaying the investment alongside the rest of your portfolio.

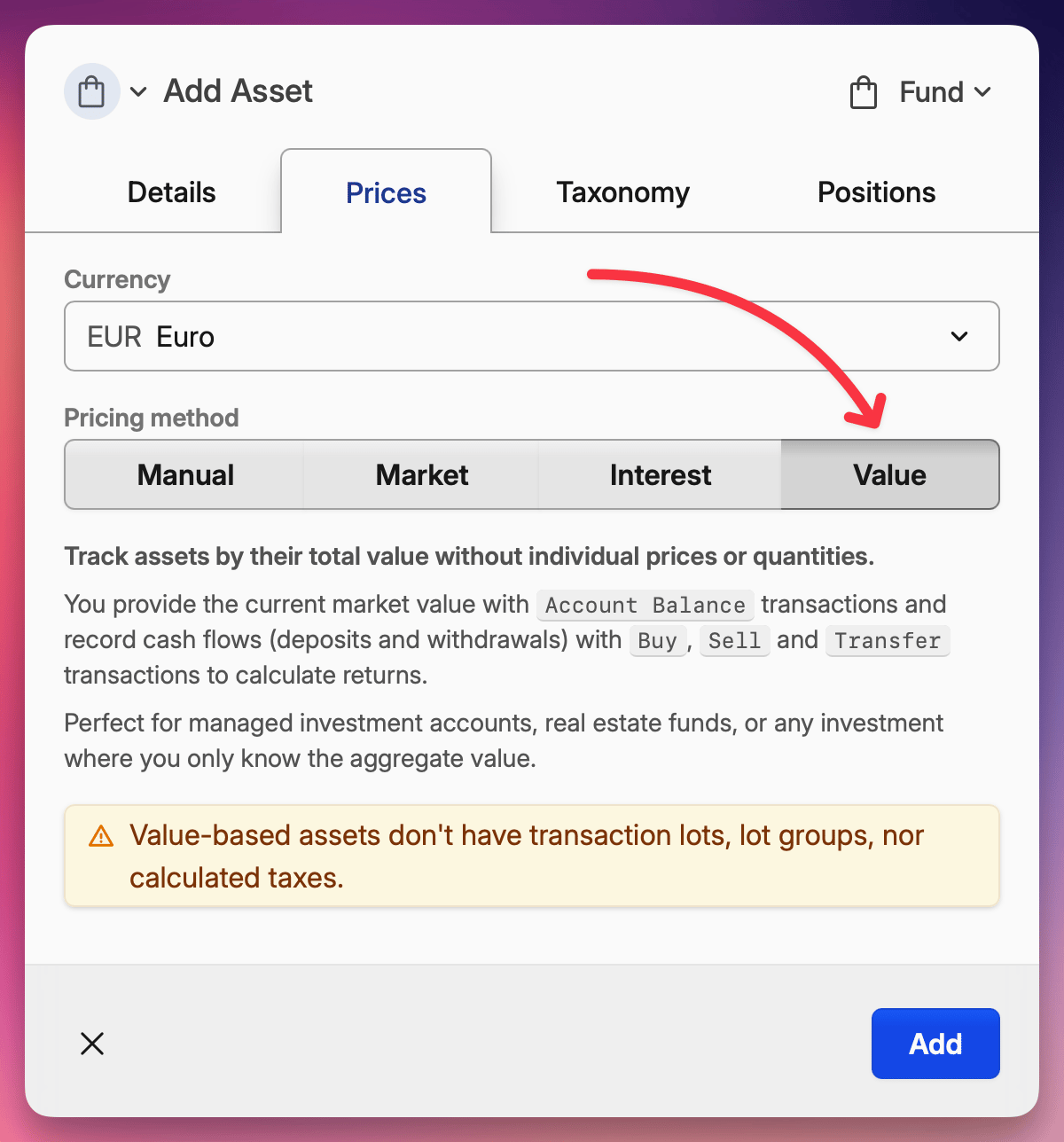

Setting up a value-based asset

- Click + Add and select create a custom asset

- Choose an appropriate asset type (Fund or Other Asset work well for most cases)

- In the asset's Prices tab, change the pricing method to Value

- Save the asset

That's it - your asset is now ready to track using balance updates instead of traditional transactions.

Recording your cash flows

For value-based assets, you need to record deposits and withdrawals. You can do this with:

- Buy transactions - when you deposit money into the investment

- Sell transactions - when you withdraw money from the investment

- Transfer transactions - for moving money in (positive) or out (negative)

Updating the current value

Whenever your wealth manager sends you a statement showing the current value, you have two options:

Option 1: Account Balance transaction

Add an Account Balance transaction with the current value of your investment. This is the cleanest approach for periodic updates.

Option 2: Quick edit

Double-click the position in your portfolio table and enter the new value directly.

Tip: Your first Account Balance transaction automatically creates the initial cash flow for you - no need to add a separate buy transaction first. And when you eventually close the investment, an Account Balance of zero will close out the position.

Importing statements in bulk

If your wealth manager provides statements in a tabular format (spreadsheet, CSV), you can import everything automatically.

Preparing your data

Your file should contain:

- Date column (unless all entries are for today)

- Cash flow column - either a single column with positive/negative values, or two separate columns for deposits and withdrawals

- Current value column - the balance at each statement date

- Account and asset columns (optional) - useful if you're tracking multiple managed accounts

Importing the file

- Go to the Import section and click Import any data

- Load your file and confirm which rows to import

- Select Account cash flows as the data type

- Map your columns to the appropriate properties:

- If your file contains account/asset names, map those columns

- If not, select a fixed account and asset from the dropdown

- Review and import

Custom assets will be created automatically during import if they don't already exist, so you can import statements from multiple investments in one go without setting up each asset beforehand.

What you can do with value-based investments?

Once your data is in Capitally, these investments work just like any other:

- Performance analysis - see your money-weighted return (MWR), time-weighted return (TWR), and ROI

- Benchmarking - compare your managed fund's performance against indexes, ETFs, or other parts of your portfolio

- Taxonomies - categorize by region, sector, investment strategy, or any custom taxonomy

- Portfolio view - see how these investments fit into your overall allocation

Limitations

Value-based assets don't support tax calculations. Since these investments don't track individual lots with cost basis information, Capitally cannot calculate realized gains, losses, or generate tax reports for them. If you need tax reporting, you'll need to rely on the statements from your wealth manager or fund administrator.