Tracking your mortgage in Capitally lets you monitor your debt, interest payments, and see your true net equity when combined with property value.

Capitally can automatically calculate interest accrual and generate payment schedules.

Setting up a mortgage

- Click + Add and select Create custom asset

- Set Type to

Mortgage - Name it (e.g., "Apartment Mortgage" or "123 Main St Mortgage")

- Set the Currency to match your loan currency

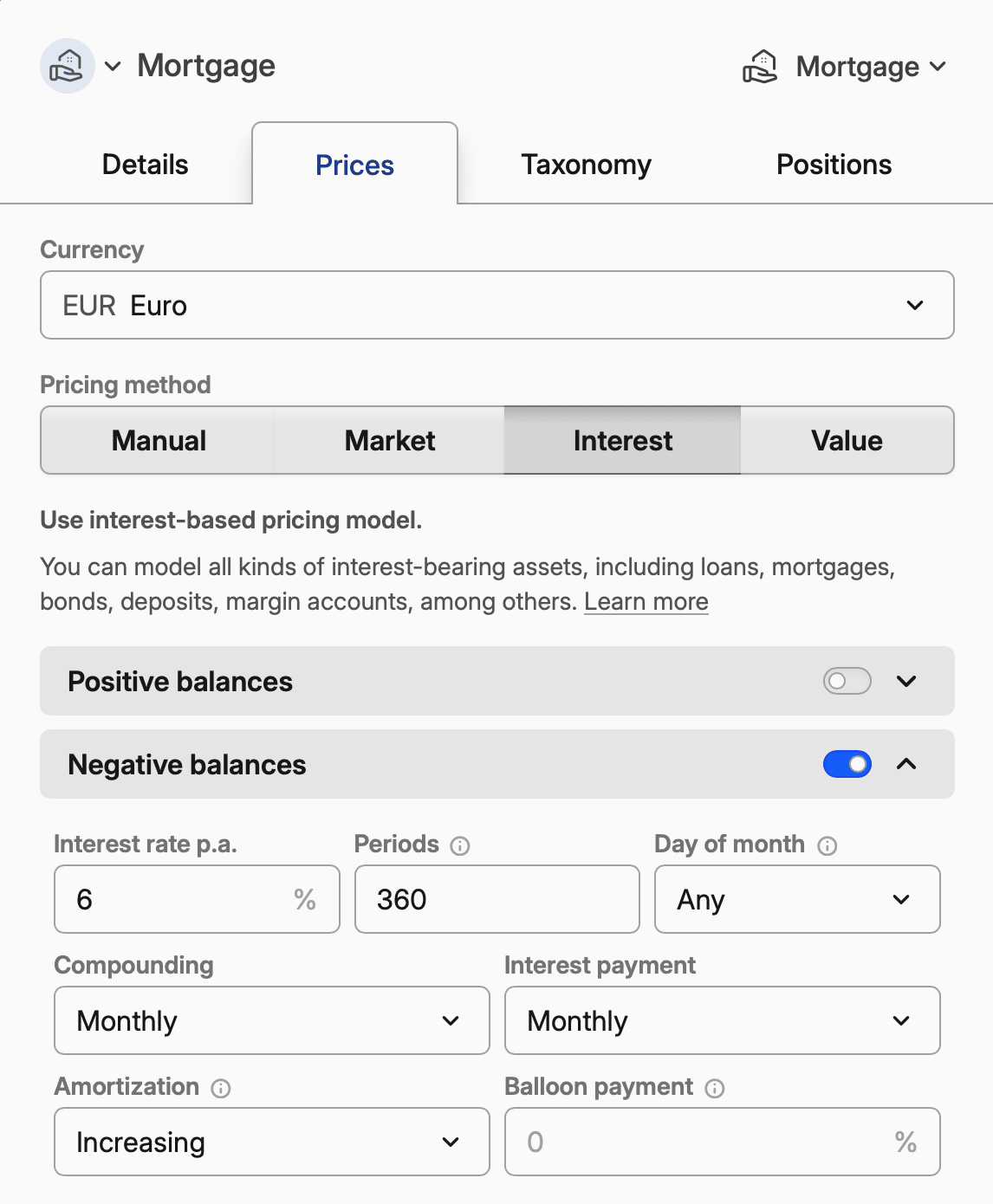

- Open Prices tab

- Enable Interest pricing

- Enable Negative balances (since a mortgage is money you owe)

- Configure the interest settings as below

Example: 30-year fixed-rate mortgage at 6%

Setting | Value |

|---|---|

Interest rate p.a. | 6 |

Compounding | Monthly |

Interest payment | Monthly |

Periods | 360 |

Amortization | Increasing |

Day of month | 1 (or your payment date) |

Example: 5/1 ARM (5-year fixed, then adjustable)

Start with the initial rate, then add overrides for rate adjustments:

Setting | Value |

|---|---|

Interest rate p.a. | 4.5 |

Compounding | Monthly |

Interest payment | Monthly |

Periods | 360 |

Amortization | Increasing |

Then click Add rate to add an override:

- Date: 5 years after loan start

- Interest rate p.a.: 6.25 (or expected rate)

Add additional overrides as rates adjust annually.

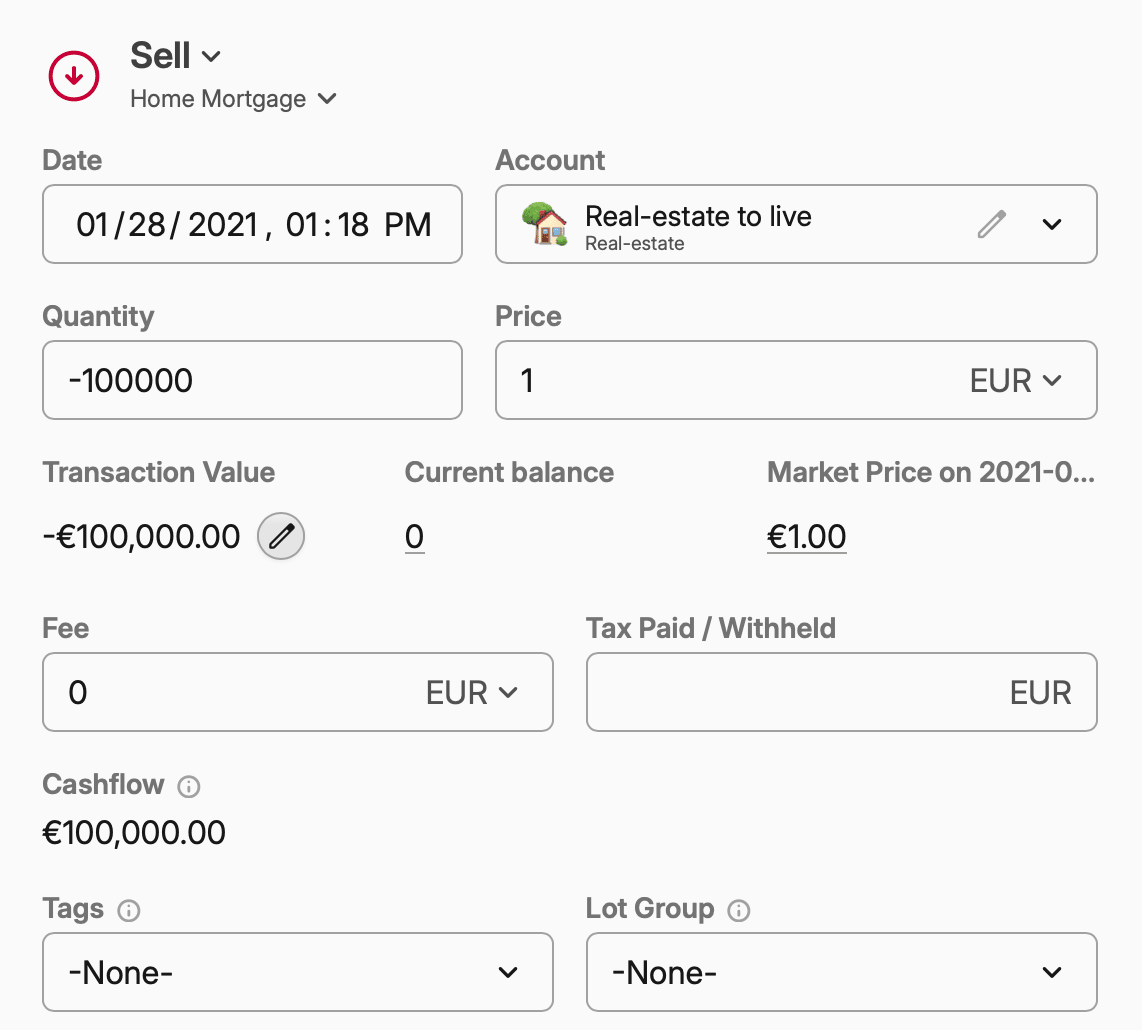

Recording the initial loan

When you receive the mortgage:

- Add a Buy transaction

- Set Quantity to the loan amount as a negative number (e.g., -300,000)

- Set Price to

1 - Set the Account where you want to track this mortgage

Recording out-of-schedule payments

If you configured interest-based pricing right, Capitally will automatically generate estimated interest transactions. You can adjust these to match your actual statements.

You can also add Interest transactions manually, whenever you make out-of-schedule payments or closing the mortgage early.

- Add an Interest transaction

- Set Interest received to the interest paid as a negative number

- Set Principal amortized to the amount you repaid as a negative number

Refinancing:

- Close the old mortgage with a Sell transaction (quantity = remaining balance as negative)

- Create a new mortgage asset with updated terms

- Record the new loan with a Buy transaction

Early payoff:

- Add a Sell transaction for the remaining balance

- The mortgage position closes to zero

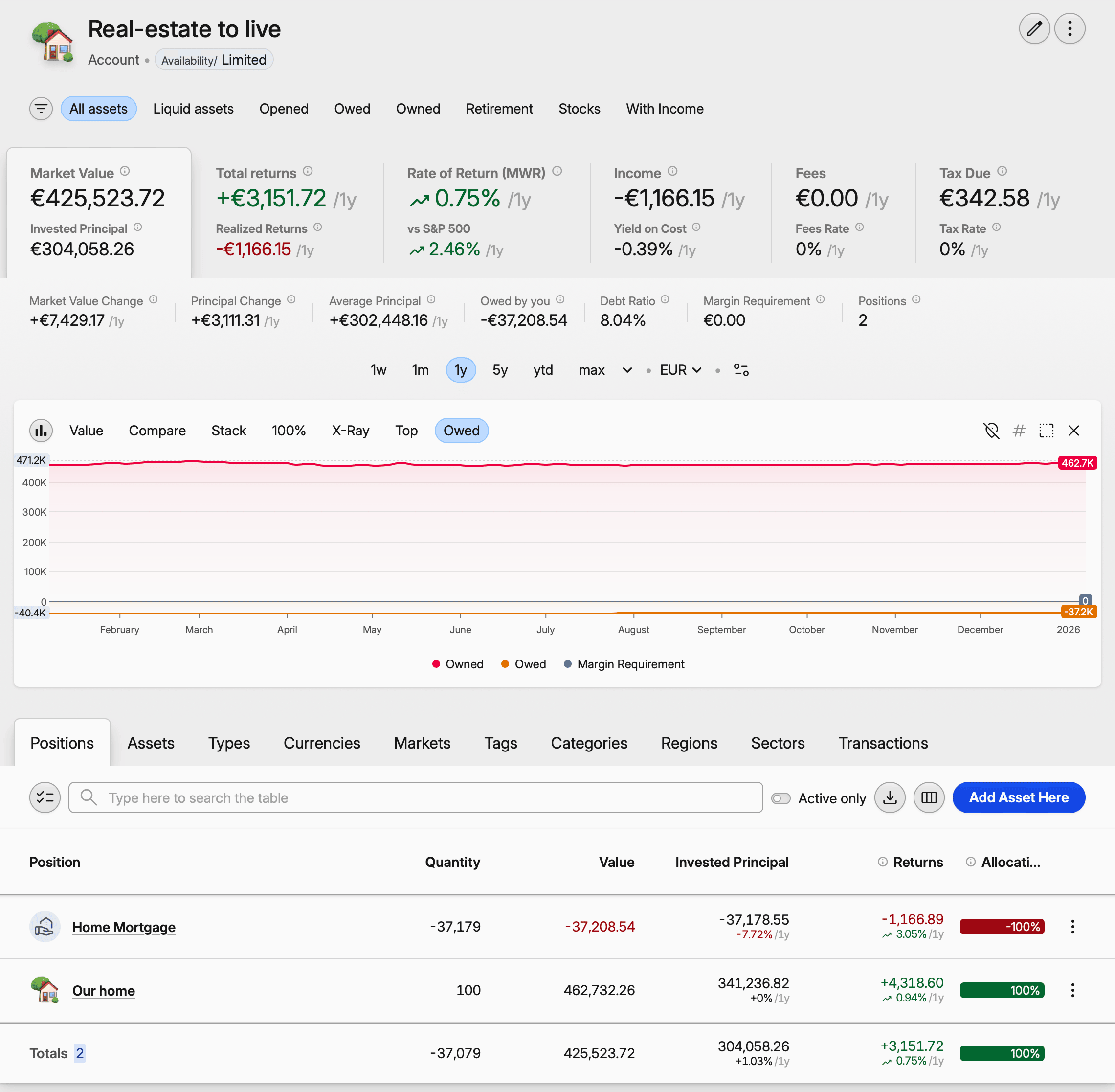

Connecting mortgage to property

Put both the property and mortgage in the same account:

- Create an account (e.g., "Downtown Apartment")

- Add the property asset to this account

- Add the mortgage asset to this account

When you open this account in Portfolio, you'll see:

- Owned: the property value

- Owed: the mortgage balance

- Net value: your equity (property value minus mortgage)

The Owed chart shows both values over time.

Viewing your debt metrics

In Portfolio, the Market Value tab shows:

- Owned: Total value of assets you own

- Owed: Total value of liabilities (mortgage balance)

- Debt Ratio: How leveraged you are (

owed / owned)

The Owed chart visualizes how your equity grows as you pay down the mortgage while property value changes.

Importing mortgage transactions

If you have a spreadsheet with your payment history:

- Go to Import → Import any data

- Load your file

- Map columns to transaction properties

- For interest payments, map to Value (as negative) and Principal amortized (as negative)

See Import from a file for detailed instructions.